Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Berserker is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Berserker's population, as of November 2025, is approximately 7,273. This figure represents an increase of 249 people since the 2021 Census, which reported a population of 7,024. The estimated resident population in June 2024 was 7,257, with an additional seven validated new addresses contributing to this growth. This results in a population density ratio of 725 persons per square kilometer, comparable to averages across locations assessed by AreaSearch. Natural growth accounted for approximately 62.3% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, Queensland State Government's SA2 area projections from 2023, based on 2021 data, are adopted. However, these state projections lack age category splits, so AreaSearch applies proportional growth weightings in line with ABS Greater Capital Region projections released in 2023, based on 2022 data. Looking ahead, Berserker's population is expected to increase by approximately 662 persons to 2041, reflecting an overall gain of 8.9% over the seventeen-year period, as per the latest annual ERP population numbers.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Berserker according to AreaSearch's national comparison of local real estate markets

Berserker averaged approximately five new dwelling approvals annually between FY21 and FY25, with 26 homes approved over these years. In FY26 up to June, 22 dwellings have been approved. Each year, an average of eleven new residents arrived per dwelling constructed during this period.

This significant demand outstripping supply typically leads to price growth and increased buyer competition. The average development value for new dwellings was $276,000, below the regional average, suggesting more affordable housing options. In FY26 up to June, commercial approvals totaled $8.5 million, reflecting Berserker's primarily residential nature. Compared to the Rest of Qld, Berserker had 81.0% less development activity per person as of June 2022. This scarcity usually strengthens demand and prices for existing properties, although recent periods have seen increased development activity. Development in Berserker is also below the national average, indicating an established area with potential planning limitations. New developments consist of 50.0% detached dwellings and 50.0% townhouses or apartments, marking a significant shift from the current housing pattern of 81.0% houses.

This change may reflect diminishing developable land availability and evolving lifestyle preferences. As of June 2022, Berserker had an estimated population of 2071 people per dwelling approval. Future projections suggest Berserker will add 646 residents by 2041, potentially straining housing supply at current development rates and heightening buyer competition and price increases.

Frequently Asked Questions - Development

Infrastructure

Berserker has strong levels of nearby infrastructure activity, ranking in the top 40% nationally

Area infrastructure significantly impacts local performance. AreaSearch identified 21 projects potentially affecting the area. Notable ones include 196 Mason Street Residential Subdivision, Large Format Retail Development Moores Creek Road, Mildura Rise Estate, and Former Bunnings Site Redevelopment.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

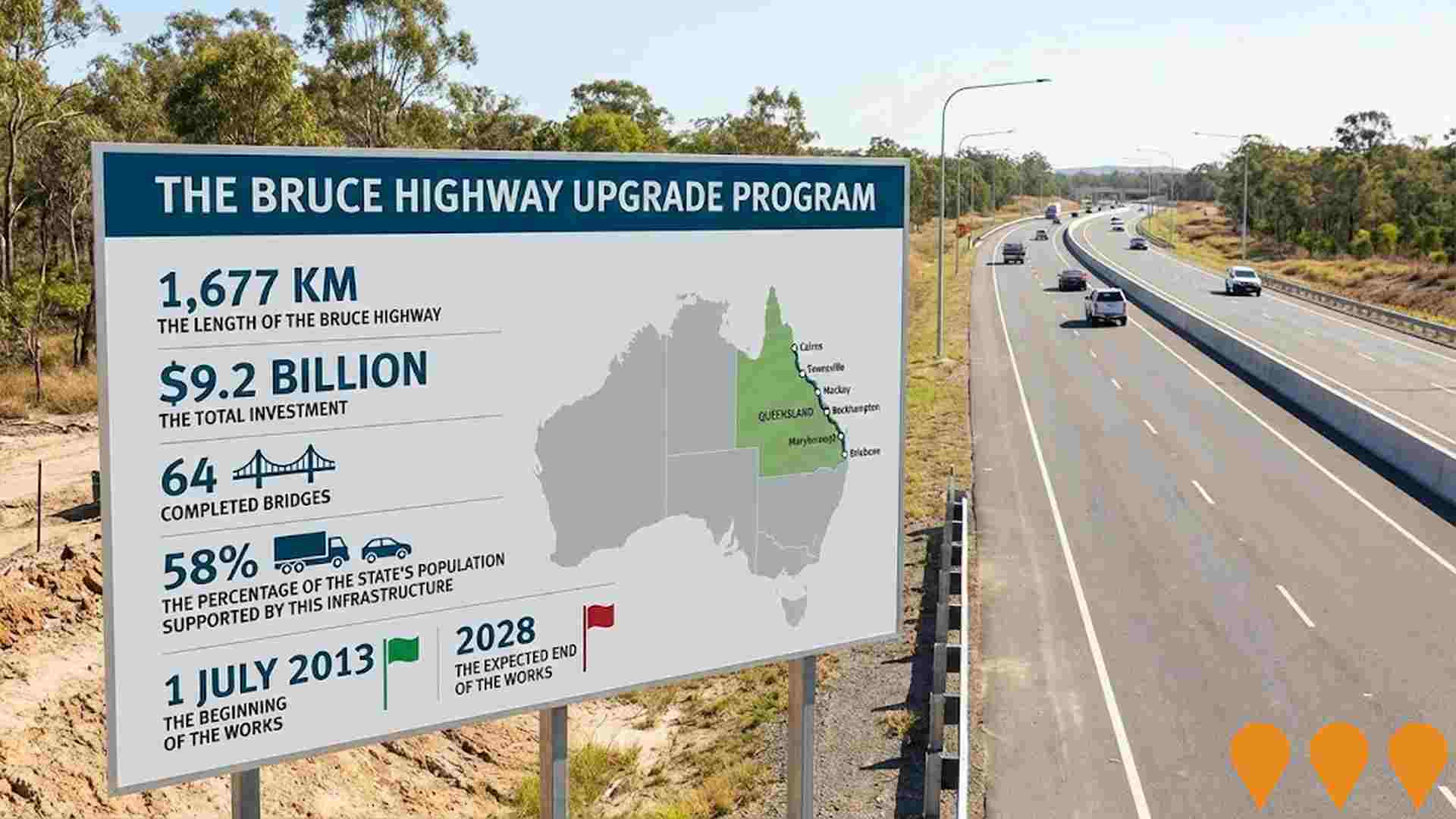

Bruce Highway Upgrade Program

The Bruce Highway Upgrade Program is Queensland's largest road infrastructure initiative, delivering safety, flood resilience, and capacity improvements along the 1,677km corridor from Brisbane to Cairns. The massive investment program includes the $9 billion Targeted Safety Program, major bypass projects (including Gympie, Rockhampton, and Tiaro), bridge replacements, and wide centre line treatments. Jointly funded by the Australian and Queensland governments, works are progressing across multiple sections simultaneously.

Rockhampton Ring Road

A 17 km high-standard four-lane ring road bypassing Rockhampton CBD, connecting Capricorn Highway to Rockhampton-Yeppoon Road with a new 650 m dual-carriageway bridge over the Fitzroy River (Q100 flood immunity). The $1.76 billion project (80% Federal / 20% Queensland funded) will remove heavy vehicles from the CBD, bypass 19 traffic lights, improve freight efficiency on the Bruce Highway corridor, and enhance regional flood resilience. Construction started November 2023; project remains on track for completion by late 2027.

ALDI at Stockland Rockhampton

New 1,186 sqm freestanding ALDI supermarket opened January 29, 2025, at Stockland Rockhampton shopping centre. This is the second ALDI in Rockhampton and the first serving the northern suburbs, creating a triple supermarket hub. The development included construction of a freestanding building in the car park at the Kmart side of the centre, with modern interior design, self-checkouts, and 118 dedicated parking spaces. Additional improvements include shade sails, a new garden plaza, and covered pedestrian walkway connecting to the main shopping centre.

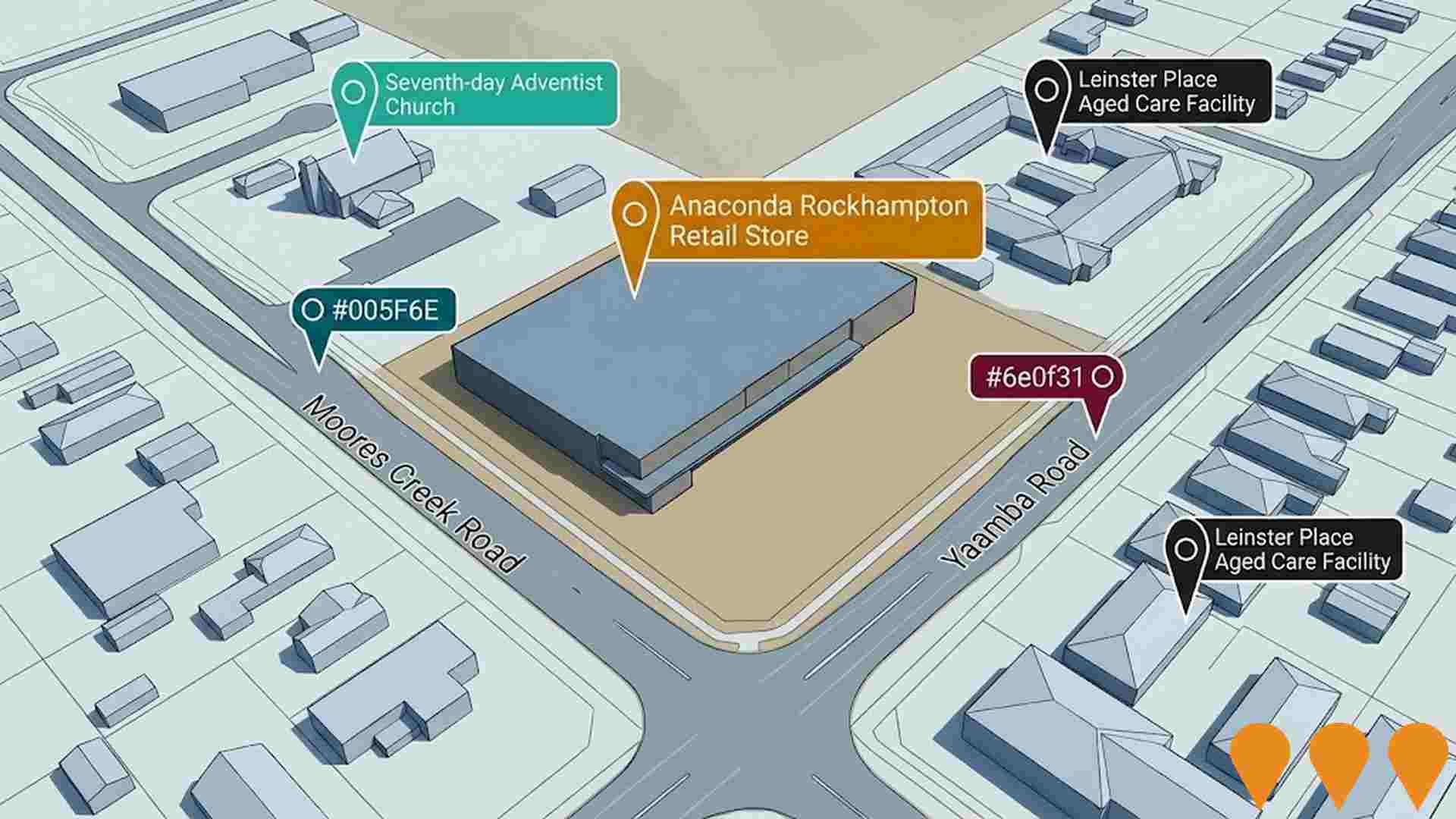

Large Format Retail Development Moores Creek Road

Mixed-use commercial development featuring Anaconda as anchor tenant in 2,500 sqm showroom space, plus four single-storey retail buildings (300-605 sqm each), service station with 223 sqm building operating 24/7, and 258 car parking spaces. Development includes pedestrian connection to existing Spotlight store. Project originally approved in 2017, revised plans lodged with Rockhampton Regional Council in December 2022.

Mildura Rise Estate

A 392-lot sustainable housing development providing around 400 new housing lots with diverse lot sizes ranging from 1013m2 to 8719m2 with an average of 2078m2. The development includes new roads, water and sewer connections, direct Bruce Highway access, and a future community park. Features larger rural-style lots compared to urban developments.

Former Bunnings Site Redevelopment

Multi-staged mixed-use redevelopment of the former Bunnings Warehouse site (2.66 ha) at 452-488 Yaamba Road, Norman Gardens, into a shopping centre and residential precinct. Features a full-line Coles supermarket, Liquorland, specialty retail stores, outdoor dining, showroom space, and twelve four-bedroom townhouses at the rear accessed via Potts Street. The existing 8,000 sqm warehouse will be demolished. The development is expected to create approximately 100 jobs during operation.

Anaconda Rockhampton Retail Store

Large format outdoor and sporting goods retail store operated by Anaconda, part of the Spotlight Group. The store opened in December 2016 in the former Webbers Retravision location within Stockland Rockhampton shopping center. Anaconda specializes in camping, fishing, hiking, 4WD equipment, outdoor clothing and footwear, water sports equipment, and cycling gear. The store serves the Rockhampton region providing outdoor adventure and sporting equipment to the community.

Rockhampton Museum of Art

Three storey regional art museum built by Rockhampton Regional Council on Quay Street, opened in 2022. Around 4,700 sqm GFA with multiple exhibition spaces, learning studios, shop and a cafe, positioned on the Fitzroy River waterfront (Tunuba).

Employment

AreaSearch assessment indicates Berserker faces employment challenges relative to the majority of Australian markets

Berserker's workforce is balanced across white and blue collar jobs, with essential services well represented. As of September 2025, the unemployment rate was 9.6%.

Over the past year, employment has remained relatively stable. There are 3,541 employed residents, with an unemployment rate of 5.6%, which is 1.5 percentage points higher than Rest of Qld's rate of 4.1%. Workforce participation stands at 57.1%, compared to Rest of Qld's 59.1%. Leading employment industries include health care & social assistance, retail trade, and education & training.

Retail trade is particularly notable, with employment levels at 1.2 times the regional average. Conversely, agriculture, forestry & fishing shows lower representation at 0.5% compared to the regional average of 4.5%. Many residents commute elsewhere for work, as indicated by the Census working population count. Over a 12-month period ending September 2025, Berserker's labour force increased by 1.1%, while employment declined by 0.2%. This resulted in an unemployment rate rise of 1.2 percentage points. In contrast, Rest of Qld saw employment rise by 1.7% and the labour force grow by 2.1%, with unemployment rising by 0.3 percentage points over the same period. State-level data to November 25 shows Queensland's employment contracted by 0.01%, losing 1,210 jobs, with an unemployment rate of 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia's national employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years nationally. Applying these projections to Berserker's employment mix suggests local employment should increase by 6.1% over five years and 13.0% over ten years, assuming constant population projections for illustrative purposes.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

The Berserker SA2's median income among taxpayers was $46,562 and average income stood at $54,956 in the financial year 2022. These figures compare to Rest of Qld's median income of $50,780 and average income of $64,844 respectively. Based on Wage Price Index growth of 13.99% since financial year 2022, estimated median income is approximately $53,076 and average income is around $62,644 as of September 2025. According to the 2021 Census, incomes in Berserker fall between the 11th and 23rd percentiles nationally for households, families, and individuals. The predominant income cohort spans 29.5% of locals (2,145 people) with incomes ranging from $1,500 to $2,999, similar to the broader area where 31.7% fall within this bracket. Housing affordability pressures are severe in Berserker, with only 83.5% of income remaining after housing costs, ranking at the 12th percentile nationally.

Frequently Asked Questions - Income

Housing

Berserker is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

Berserker's dwelling structure, as per the latest Census, consisted of 80.8% houses and 19.1% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro Qld had 88.5% houses and 11.5% other dwellings. Home ownership in Berserker stood at 25.3%, with mortgaged dwellings at 31.4% and rented ones at 43.3%. The median monthly mortgage repayment was $1,116, lower than Non-Metro Qld's average of $1,517. The median weekly rent in Berserker was $260, compared to Non-Metro Qld's $300. Nationally, Berserker's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Berserker features high concentrations of lone person households and group households, with a lower-than-average median household size

Family households constitute 60.5% of all households, including 21.8% couples with children, 20.5% couples without children, and 16.4% single parent families. Non-family households account for the remaining 39.5%, with lone person households at 35.0% and group households comprising 4.4% of the total. The median household size is 2.3 people, which is smaller than the Rest of Qld average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Berserker faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 11.6%, significantly lower than the Australian average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are most common at 8.5%, followed by postgraduate qualifications (1.7%) and graduate diplomas (1.4%). Vocational credentials are prominent, with 39.8% of residents aged 15+ holding them - advanced diplomas account for 7.2% and certificates for 32.6%.

Educational participation is high, with 30.7% of residents currently enrolled in formal education. This includes 12.3% in primary education, 9.3% in secondary education, and 3.6% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Berserker is well below average with a range of health conditions having marked impacts on both younger and older age cohorts

Berserker faces significant health challenges, as indicated by health data. A variety of health conditions affect both younger and older age groups. The rate of private health cover is low at approximately 47% (~3,432 people), compared to 53.2% in the rest of Queensland and a national average of 55.3%.

Mental health issues are the most common condition, affecting 10.7% of residents, followed by arthritis at 9.9%. Sixty-one point one percent of residents report no medical ailments, compared to 64.7% in the rest of Queensland. Fifteen point four percent of residents are aged 65 and over (1,117 people), lower than the 18.5% in the rest of Queensland. Health outcomes among seniors present some challenges, broadly in line with the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

Berserker is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Berserker's population showed low cultural diversity, with 86.2% being citizens, 89.7% born in Australia, and 93.3% speaking English only at home. Christianity was the predominant religion in Berserker, accounting for 50.4%, compared to 56.3% across the Rest of Qld. The top three ancestral groups were Australian (30.3%), English (29.6%), and Australian Aboriginal (7.8%).

Notably, German ancestry was overrepresented at 4.2% in Berserker versus 4.9% regionally, while Vietnamese was 0.7% compared to 0.2%, and Filipino was 1.4% compared to 1.0%.

Frequently Asked Questions - Diversity

Age

Berserker's population is younger than the national pattern

The median age in Berserker is 34 years, which is lower than the average for Rest of Qld at 41 years and also substantially lower than the Australian median of 38 years. Compared to Rest of Qld, Berserker has a higher percentage of residents aged 25-34 (18.1%) but fewer residents aged 65-74 (8.1%). According to the 2021 Census, the population aged 25 to 34 has increased from 15.3% to 18.1%, while the percentage of those aged 5 to 14 has decreased from 13.8% to 12.1%. The group aged 55 to 64 has also seen a decline, from 11.4% to 10.3%. By the year 2041, Berserker's age composition is expected to change significantly. The 25 to 34 age group is projected to grow by 29%, increasing from 1,314 people to 1,689. Conversely, both the 45 to 54 and 5 to 14 age groups are expected to decrease in number.