Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Norman Gardens are slightly above average based on AreaSearch's ranking of recent, and medium term trends

Based on AreaSearch's analysis, Norman Gardens' population is around 11,279 as of Nov 2025. This reflects an increase of 570 people, or 5.3%, since the 2021 Census which reported a population of 10,709 people. The change is inferred from the estimated resident population of 11,204 from the ABS as of June 2024 and an additional 127 validated new addresses since the Census date. This level of population equates to a density ratio of 313 persons per square kilometer. Over the past decade, Norman Gardens has demonstrated resilient growth patterns with a compound annual growth rate of 1.1%, outpacing the SA3 area. Population growth for the area was primarily driven by natural growth contributing approximately 45.5% of overall population gains during recent periods, although all drivers including overseas migration and interstate migration were positive factors.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, as released in 2024 with 2022 as the base year. For any SA2 areas not covered by this data, and for years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 and based on 2021 data. Considering the projected demographic shifts, a population increase just below the median of non-metropolitan areas nationally is expected, with the area expected to increase by 1,136 persons to 2041 based on the latest annual ERP population numbers, reflecting an increase of 9.4% in total over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within Norman Gardens when compared nationally

Norman Gardens has recorded approximately 26 residential properties granted approval each year. Over the past five financial years, from FY-21 to FY-25131 homes were approved, with an additional 32 approved so far in FY-26. On average, for every home built over these years, Norman Gardens has seen 4.1 new residents per year.

This supply lagging demand indicates heightened buyer competition and pricing pressures. The average construction value of new properties is $257,000, reflecting more affordable housing options compared to regional norms. In FY-26, $38.9 million in commercial development approvals have been recorded, demonstrating high levels of local commercial activity. Compared to the Rest of Qld, Norman Gardens shows approximately 62% of the construction activity per person and places among the 38th percentile nationally, suggesting limited choices for buyers and supporting demand for existing dwellings.

This activity is below average nationally, indicating the area's maturity and possible planning constraints. New development consists of 83.0% standalone homes and 17.0% attached dwellings, maintaining Norman Gardens' traditional low density character with a focus on family homes. The estimated count of 525 people in the area per dwelling approval reflects its quiet, low activity development environment. Future projections show Norman Gardens adding 1,061 residents by 2041, according to the latest AreaSearch quarterly estimate. Building activity is keeping pace with growth projections, though buyers may experience heightened competition as the population grows.

Frequently Asked Questions - Development

Infrastructure

Norman Gardens has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified 35 projects that could affect the region. Notable projects include Capricorn Square Essential Service Centre, The Gardens Estate Norman Gardens, Central Queensland University Norman Gardens Campus, and Central Queensland University (CQU) Rockhampton Priority Development Area (PDA). Below is a list of projects likely to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Capricorn Square Essential Service Centre

Capricorn Square is a neighbourhood essential service centre in Norman Gardens, Rockhampton, featuring approximately 3,123 sqm of specialty retail tenancies (food & liquor, medical, health & fitness, convenience fuel) across four low-rise buildings plus a 1,014 sqm childcare centre for 130 children. The centre offers 169 retail car spaces and 33 dedicated childcare spaces on a high-exposure corner site with over 11,500 vehicles passing daily.

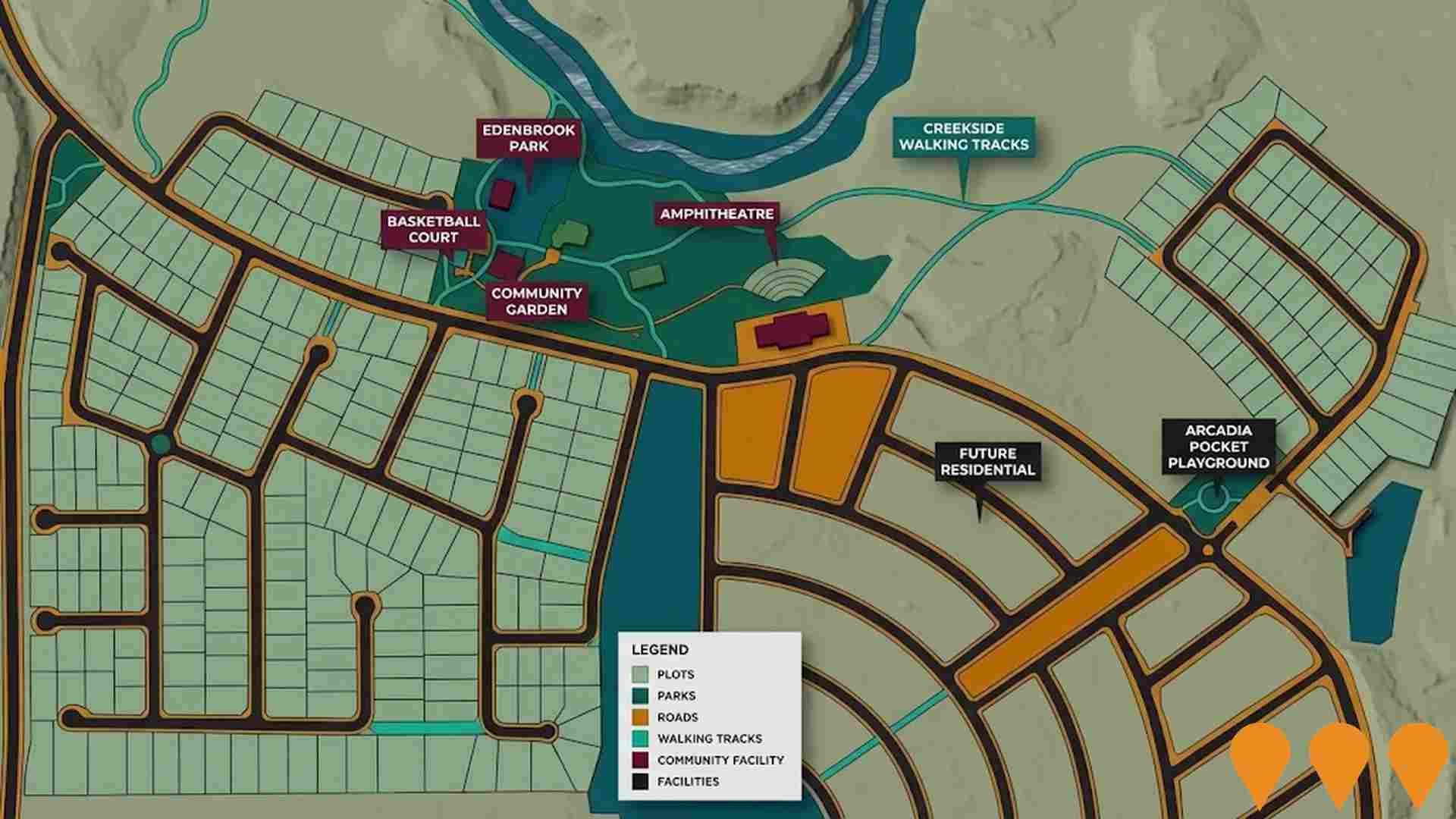

Ellida Estate

Rockhampton's newest masterplanned community spanning 279 hectares with plans for 2,200+ homes across multiple stages. The development includes expansive greenspace with 28 hectares of open space and reserves, recreational parklands, medium density residential, and a neighbourhood commercial precinct. Located with Bruce Highway frontage in a high-demand growth corridor, Ellida Estate represents the largest residential zoned land in the Rockhampton Regional Council jurisdiction. The estate officially launched in February 2025 with Stages 5 and 6 now selling, following approval of the first six stages totaling approximately 263 lots.

Mildura Rise Estate

A 392-lot sustainable housing development providing around 400 new housing lots with diverse lot sizes ranging from 1013m2 to 8719m2 with an average of 2078m2. The development includes new roads, water and sewer connections, direct Bruce Highway access, and a future community park. Features larger rural-style lots compared to urban developments.

Large Format Retail Development Moores Creek Road

Mixed-use commercial development featuring Anaconda as anchor tenant in 2,500 sqm showroom space, plus four single-storey retail buildings (300-605 sqm each), service station with 223 sqm building operating 24/7, and 258 car parking spaces. Development includes pedestrian connection to existing Spotlight store. Project originally approved in 2017, revised plans lodged with Rockhampton Regional Council in December 2022.

Former Bunnings Site Redevelopment

Multi-staged mixed-use redevelopment of the former Bunnings Warehouse site (2.66 ha) at 452-488 Yaamba Road, Norman Gardens, into a shopping centre and residential precinct. Features a full-line Coles supermarket, Liquorland, specialty retail stores, outdoor dining, showroom space, and twelve four-bedroom townhouses at the rear accessed via Potts Street. The existing 8,000 sqm warehouse will be demolished. The development is expected to create approximately 100 jobs during operation.

Central Queensland University Norman Gardens Campus

The main campus of Central Queensland University featuring modern teaching facilities, research centers, student accommodation, and recreational facilities. The campus serves as the administrative and academic hub for the university system.

Living Gems Rockhampton

A $360 million over-50s lifestyle resort spanning 27 hectares featuring 505 low-maintenance homes and over $23 million in resort-style amenities. The development includes an architect-designed Country Club, Summer House, heated pools, bowling alley, yoga studio, golf simulator, tennis and pickleball courts, undercover bowls green, workshop, and extensive recreational facilities. Operating under a land lease model where homeowners own their homes and lease the land with no stamp duty, entry or exit fees.

Ninja-Themed Playground Springfield Drive

A unique ninja-themed playground featuring a timed obstacle course with climbing net, balance pommels, curved climbing bars, mini rock-climbing wall, timber balance beams, ramp with rope pull, and slide. Includes all-abilities inclusive play unit, bird's nest swing, junior balance beams, shaded seating, and picnic facilities. Designed for children aged 3-12 years with varying skill levels.

Employment

Employment performance in Norman Gardens exceeds national averages across key labour market indicators

Norman Gardens has a skilled workforce with well-represented essential services sectors. Its unemployment rate is 3.4%, with an estimated employment growth of 0.6% over the past year.

As of September 2025, 6,241 residents are employed, with an unemployment rate of 0.7% lower than Rest of Qld's rate of 4.1%. Workforce participation is at 63.4%, compared to Rest of Qld's 59.1%. Employment is concentrated in health care & social assistance, education & training, and retail trade, with a notable concentration in health care & social assistance at 1.2 times the regional average. However, construction is under-represented, with only 6.2% of Norman Gardens' workforce compared to Rest of Qld's 10.1%.

The area offers limited local employment opportunities, as indicated by Census data. Over a 12-month period ending September 2025, employment increased by 0.6%, while the labour force grew by 1.4%, causing the unemployment rate to rise by 0.7 percentage points. In contrast, Rest of Qld experienced employment growth of 1.7% and labour force growth of 2.1%, with a 0.3 percentage point rise in unemployment. As of 25-Nov-25, Queensland's employment contracted by 0.01% (losing 1,210 jobs), with the state unemployment rate at 4.2%. National employment forecasts from May-25 suggest national employment will expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Norman Gardens' employment mix suggests local employment should increase by 6.4% over five years and 13.7% over ten years, based on a simple weighting extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Norman Gardens SA2 had a median income among taxpayers of $57,652 and an average of $68,044. This is higher than the national average. Rest of Qld had a median income of $50,780 and an average of $64,844 in the same period. Based on Wage Price Index growth of 13.99% since financial year 2022, current estimates for Norman Gardens would be approximately $65,718 (median) and $77,563 (average) as of September 2025. According to the 2021 Census, incomes in Norman Gardens cluster around the 53rd percentile nationally. In terms of income distribution, 33.9% of residents earn between $1,500 and $2,999 (3,823 individuals), similar to the surrounding region where this cohort represents 31.7%. After housing costs, residents retain 87.2% of their income, indicating strong purchasing power. The area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Norman Gardens is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Norman Gardens, as per the latest Census evaluation, 87.1% of dwellings were houses, with 12.8% being other types such as semi-detached homes, apartments, or 'other' dwellings. This is compared to Non-Metro Qld's 88.5% houses and 11.5% other dwellings. Home ownership in Norman Gardens was at 33.5%, similar to Non-Metro Qld's level. Mortgaged dwellings constituted 37.7%, while rented dwellings made up 28.8%. The median monthly mortgage repayment in the area was $1,625, higher than Non-Metro Qld's average of $1,517. The median weekly rent figure stood at $300, matching Non-Metro Qld's figure. Nationally, Norman Gardens' mortgage repayments were lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Norman Gardens has a typical household mix, with a higher-than-average median household size

Family households comprise 74.5% of all households, including 33.0% couples with children, 28.4% couples without children, and 11.9% single parent families. Non-family households account for the remaining 25.5%, with lone person households at 22.9% and group households comprising 2.6%. The median household size is 2.6 people, larger than the Rest of Qld average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Norman Gardens fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

Norman Gardens' residents aged 15 and above have lower university degree holders (22.4%) compared to the national average of 30.4%. Bachelor degrees are most common (15.6%), followed by postgraduate qualifications (4.6%) and graduate diplomas (2.2%). Vocational credentials are prominent, with 35.5% holding them, including advanced diplomas (8.7%) and certificates (26.8%). Educational participation is high at 31.4%, with 11.3% in primary education, 9.3% in secondary education, and 6.0% pursuing tertiary education.

Educational participation is notably high, with 31.4% of residents currently enrolled in formal education. This includes 11.3% in primary education, 9.3% in secondary education, and 6.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Norman Gardens is lower than average with common health conditions somewhat prevalent across the board, though to a considerably higher degree among older age cohorts

Norman Gardens faces significant health challenges, with common health conditions prevalent across all age groups but more so among older cohorts.

Approximately 53% (~6,022 people) of the total population have private health cover. The most common medical conditions are mental health issues (9.0%) and arthritis (7.6%), while 67.8% of residents report no medical ailments compared to 64.7% in Rest of Qld. There are 17.4% (1,961 people) of residents aged 65 and over, which is lower than the 18.5% in Rest of Qld. Health outcomes among seniors require more attention due to presenting challenges.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Norman Gardens records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Norman Gardens, when compared to the broader region, showed cultural diversity levels roughly in line with averages. Its population composition was 87.5% citizens, 83.3% born in Australia, and 85.6% speaking English only at home. Christianity dominated Norman Gardens' religious landscape, with 59.5%, slightly higher than the Rest of Qld's 56.3%.

The top three ancestry groups were Australian (29.8%), English (28.2%), and Other (7.5%). Notable differences existed in the representation of certain ethnicities: Australian Aboriginal was overrepresented at 4.9% versus regional 5.1%, Filipino at 2.2% compared to regional 1.0%, and German at 4.7% versus regional 4.9%.

Frequently Asked Questions - Diversity

Age

Norman Gardens's population is slightly younger than the national pattern

Norman Gardens has a median age of 37 years, which is lower than the Rest of Qld average of 41 and closely aligns with Australia's median age of 38. Compared to the Rest of Qld average, Norman Gardens has an over-representation of the 15-24 cohort at 13.8% and an under-representation of the 55-64 year-olds at 10.8%. Post the 2021 Census, the 15 to 24 age group grew from 12.6% to 13.8%, while the 65 to 74 cohort increased from 8.5% to 9.6%. Conversely, the 5 to 14 cohort decreased from 14.5% to 12.3%. By 2041, demographic modeling indicates significant changes in Norman Gardens' age profile. The 25 to 34 cohort is projected to grow by 29%, adding 469 residents to reach a total of 2,062. Meanwhile, both the 55 to 64 and the 5 to 14 age groups are expected to decrease in numbers.