Chart Color Schemes

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Northern Midlands is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

Northern Midlands' population is approximately 4,044 as of November 2025. This figure represents an increase of 344 people since the 2021 Census, which reported a population of 3,700. The growth was inferred from ABS's estimated resident population of 3,879 in June 2024 and an additional 131 validated new addresses post-Census date. This results in a density ratio of 0.80 persons per square kilometer. Northern Midlands' growth of 9.3% since the 2021 Census exceeded the state's average of 4.8%, positioning it as a growth leader in its SA4 region. Interstate migration contributed approximately 64.1% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data, Tasmania State Government's Regional/LGA projections are adopted, released in 2022 with a base year of 2021 and adjusted using weighted aggregation from LGA to SA2 levels. Looking ahead, projections indicate an overall population decline by 108 persons by 2041. However, specific age cohorts like the 75-84 group are expected to grow, projected to increase by 150 people over this period.

Frequently Asked Questions - Population

Development

AreaSearch analysis of residential development drivers sees Northern Midlands recording a relatively average level of approval activity when compared to local markets analysed countrywide

Northern Midlands has received approximately 22 dwelling approvals per year. Over the past five financial years, from FY-21 to FY-25, around 114 homes were approved, with another seven approved so far in FY-26. On average, each new dwelling constructed over these five years brought in about 1.1 new residents annually.

This balance between supply and demand has maintained stable market conditions. The average construction value of new properties is $255,000. In the current financial year, commercial approvals totaling $9.5 million have been registered, indicating steady commercial investment activity.

Comparatively, Northern Midlands shows 18.0% lower construction activity per person relative to the Rest of Tas., while it ranks at the 76th percentile nationally among assessed areas. Recent development has consisted solely of detached houses, preserving the area's traditional low-density character and appealing to those seeking family homes with space. With approximately 227 people per dwelling approval, there is room for growth in Northern Midlands. Population projections indicate stability or decline, which should reduce housing demand pressures, potentially benefiting buyers.

Frequently Asked Questions - Development

Infrastructure

Northern Midlands has emerging levels of nearby infrastructure activity, ranking in the 22ndth percentile nationally

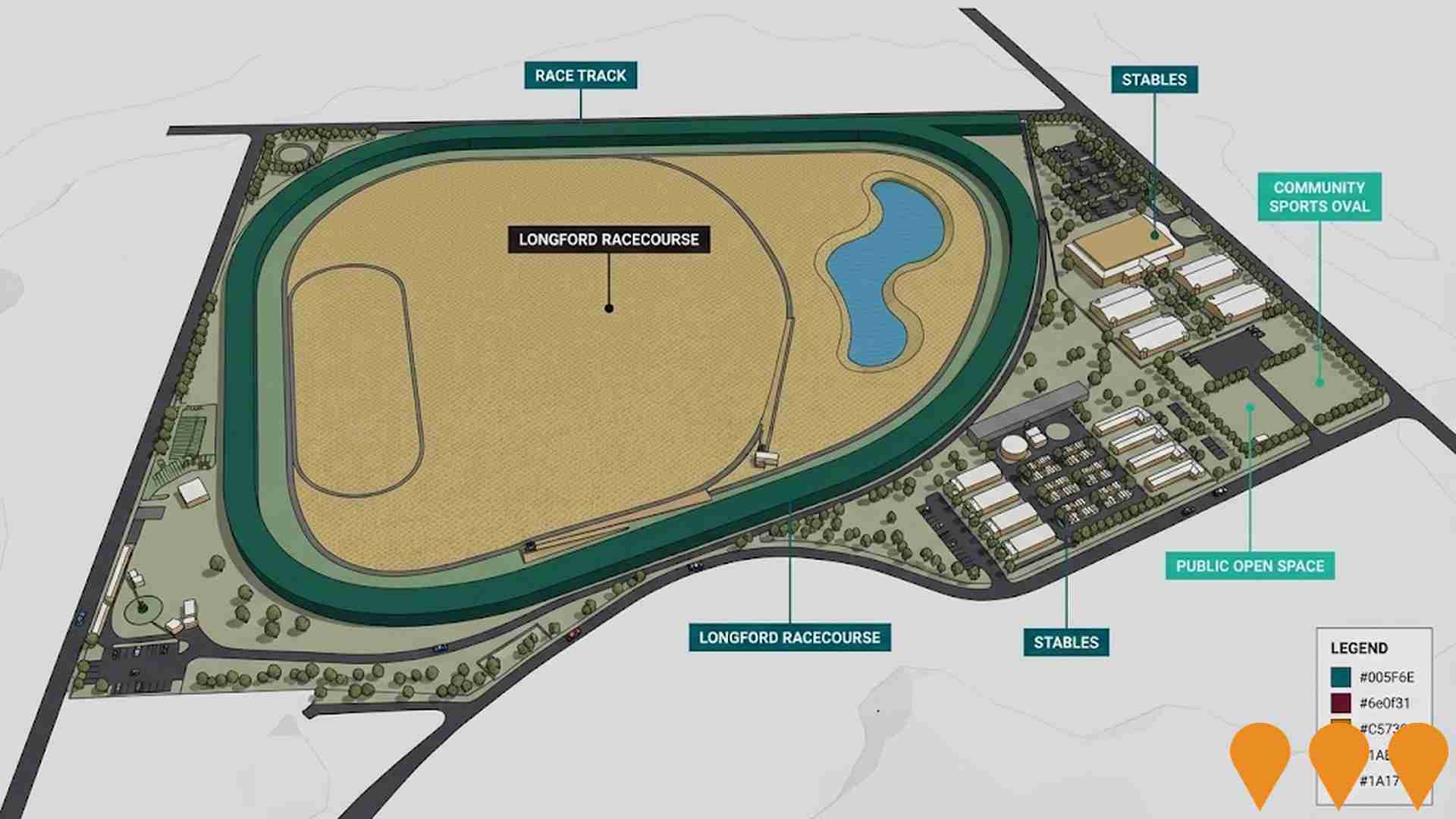

Changes to local infrastructure significantly affect an area's performance. AreaSearch has identified 35 projects that could impact the region. Notable initiatives include Northern Midlands Solar Farm, Retail Development at 92 Main Street, Cressy, Cressy Development Plan, and St Patricks Plains Wind Farm. The following list details those most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

South Perth Outline Development Plan

Outline development plan for a 60-hectare greenfield site to accommodate residential growth. It is designated as an emerging residential area in the Perth Structure Plan (2017) and is intended for 250-280 lots, including medium to high-density housing, a potential retail centre, community uses, open spaces, and integrated road and path networks. The Outline Development Plan (ODP) forms a critical part of the overall strategy for future growth in Perth, Tasmania. The land is identified in the Perth Structure Plan for future residential development, and the next step involves the necessary planning scheme amendments (rezoning) under the Tasmanian Planning Scheme - Northern Midlands Local Provisions Schedule to guide the development of the ODP.

Longford Ambulance Station

New two-bay ambulance station with volunteer training room and modern infection control facilities to replace the existing Smith Street station. DA approved (subject to conditions) in Aug 2025; principal contractor tender open with construction targeted to start late 2025 and complete late 2026.

Longford Child and Family Learning Centre

Tasmanian Government project to deliver a new Child and Family Learning Centre in Longford. Project initiation and planning commenced in 2025, with the preferred site to be confirmed following consultation in 2026. Master plan and design are targeted for completion by 2028, construction from 2029, and opening in 2030. State Government has allocated $32m for four new CFLCs (including Longford).

Perth Sports Precinct Master Plan

Development of a greenfield site, subject to land purchase and community need, into a regional sports facility. The draft master plan proposes a combined AFL and cricket oval, multi-purpose community centre, netball and tennis courts, adventure playground, skatepark, and potential aquatic centre. The project is a key recommendation in the Northern Tasmania Sports Facility Plan 2023.

West Perth Stormwater Upgrades (Stages 1-3)

Comprehensive upgrades to stormwater drainage infrastructure in West Perth to address flooding issues. The project is planned over three stages and includes culvert replacements under Drummond Street, the rail line, Youl Road, Edwards Street, and Phillip Street. The total estimated cost for the three stages is $3.7 million, with an expected completion in a two-year timeframe, targeting June 30, 2025. This includes a tender awarded for the TasRail Culvert at Youl Road.

Skyeview Estate

A residential subdivision in Perth, offering various stages of lots (Stages 1, 2, and 3 sold; Stage 4 available) with a total of 130 dwellings anticipated. The development is situated 15 minutes from Launceston and includes construction of a new public park on Napoleon Street with play equipment, BBQ, and toilet facilities.

Perth Main Street Streetscape Development

Redevelopment of Perth's Main Street to revitalise the town centre following the Midland Highway bypass. The project, part of the Perth Structure Plan, includes upgrading footpaths, adding new street furniture, landscaping, interpretive signage, and enhancing pedestrian crossings for better accessibility. Stage 1 (between Fairtlough Street and Scone Street) is complete, with Stage 2 starting soon.

Perth South Esk River Parklands

Master plan to improve public open space connectivity along the South Esk River at Perth, including upgrading and installing new picnic facilities, extending the William Street concrete walking path to connect with the proposed George Street Park via a new bridge structure spanning the gully, and landscaping using endemic plant species to reinstate native flora and fauna. The project is part of a broader set of proposed Perth Combined Projects driven by population growth and community demand for sports and recreation facilities in the area.

Employment

While Northern Midlands retains a healthy unemployment rate of 3.7%, recent employment declines have impacted its national performance ranking

Northern Midlands has a balanced workforce with both white and blue collar jobs, diverse industry representation, and an unemployment rate of 3.7%. As of June 2025, 1,855 residents are employed while the unemployment rate is 0.3% lower than Rest of Tas.'s rate of 3.9%.

Workforce participation is similar to Rest of Tas.'s figure of 55.7%. Key industries include agriculture, forestry & fishing, health care & social assistance, and retail trade. Agriculture, forestry & fishing has a notable concentration with employment levels at 4.0 times the regional average. Health care & social assistance has limited presence with 9.8% employment compared to 16.5% regionally.

Many residents commute elsewhere for work based on Census data. Between June 2024 and June 2025, Northern Midlands' labour force decreased by 1.4%, alongside a 1.7% decline in employment, leading to an unemployment rate rise of 0.3 percentage points. Rest of Tas. recorded a 0.5% employment decline and a 0.6% labour force decline during the same period. Jobs and Skills Australia's national employment forecasts from May 2025 suggest that Northern Midlands' employment could grow by approximately 4.7% over five years and 10.7% over ten years, based on industry-specific projections applied to its current employment mix.

Frequently Asked Questions - Employment

Income

The area's income levels rank in the lower 15% nationally based on AreaSearch comparative data

Northern Midlands' income level is below the national average according to latest ATO data aggregated by AreaSearch for financial year 2022. Northern Midlands' median income among taxpayers is $46,949 and average income stands at $58,283. These figures compare to Rest of Tas.'s median income of $47,358 and average income of $57,384 respectively. Based on Wage Price Index growth of 13.83% since financial year 2022, current estimates would be approximately $53,442 (median) and $66,344 (average) as of September 2025. According to 2021 Census figures, household, family and personal incomes in Northern Midlands all fall between the 5th and 13th percentiles nationally. Income brackets indicate largest segment comprises 29.0% earning $400 - $799 weekly (1,172 residents), contrasting with surrounding region where $1,500 - $2,999 bracket leads at 28.5%. While housing costs are modest with 88.9% of income retained, total disposable income ranks at just the 9th percentile nationally.

Frequently Asked Questions - Income

Housing

Northern Midlands is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Northern Midlands, as per the latest Census evaluation, 95.0% of dwellings were houses, with the remaining 5.0% comprising semi-detached properties, apartments, and other dwelling types. This is in comparison to Non-Metro Tas., which had 92.6% houses and 7.4% other dwellings. The home ownership rate in Northern Midlands was 47.2%, with mortgaged dwellings at 28.5% and rented ones at 24.3%. The median monthly mortgage repayment in the area was $1,023, significantly lower than Non-Metro Tas.'s average of $1,198. The median weekly rent figure for Northern Midlands was recorded at $200, compared to Non-Metro Tas.'s $230. Nationally, Northern Midlands's mortgage repayments were notably lower than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Northern Midlands features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 65.0% of all households, including 21.9% couples with children, 32.5% couples without children, and 9.6% single parent families. Non-family households constitute the remaining 35.0%, with lone person households at 32.3% and group households comprising 2.5%. The median household size is 2.2 people, which is smaller than the Rest of Tas. average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

Northern Midlands faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area has university qualification rates at 15.2%, significantly lower than Australia's average of 30.4%. Bachelor degrees are the most common at 11.3%, followed by postgraduate qualifications (2.4%) and graduate diplomas (1.5%). Vocational credentials are prominent, with 35.5% of residents aged 15+ holding them - advanced diplomas at 8.9% and certificates at 26.6%. Educational participation is high, with 25.3% of residents currently enrolled in formal education.

This includes 10.9% in primary, 7.7% in secondary, and 2.4% in tertiary education. The area has two schools, Campbell Town District High School and Cressy District High School, serving a total of 619 students. Both schools offer integrated K-12 education for academic continuity. As an education hub with 15.4 school places per 100 residents, the area attracts students from nearby communities, exceeding the regional average of 9.6.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Northern Midlands is well below average with prevalence of common health conditions notable across both younger and older age cohorts

Northern Midlands faces significant health challenges, with common conditions prevalent among both younger and older age groups. Private health cover stands at approximately 49%, covering around 1,977 people, compared to the national average of 55.3%.

The most frequent medical issues are arthritis (affecting 11.5% of residents) and mental health problems (8.5%), with 63.4% reporting no medical ailments, slightly higher than the Rest of Tas. figure of 60.6%. The area has a lower proportion of residents aged 65 and over at 25.8%, or 1,044 people, compared to Rest of Tas.'s 27.6%.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Northern Midlands placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Northern Midlands had a lower cultural diversity compared to averages, with 89.4% citizens, 90.5% born in Australia, and 97.7% speaking English only at home. Christianity was the predominant religion, at 47.8%, slightly higher than the Rest of Tas's 45.1%. Ancestry-wise, Australian (37.1%), English (36.5%), and Scottish (7.9%) were top groups.

Notably, Australian Aboriginal (2.9% vs regional 3.0%) and South African (0.3% vs 0.1%) groups had higher representation in Northern Midlands compared to regional averages.

Frequently Asked Questions - Diversity

Age

Northern Midlands hosts an older demographic, ranking in the top quartile nationwide

Northern Midlands has a median age of 47, which is higher than the Rest of Tas. figure of 45 and Australia's national average of 38 years. Compared to the Rest of Tas., the 65-74 cohort is notably over-represented in Northern Midlands at 15.4%, while the 25-34 age group is under-represented at 10.2%. This concentration of the 65-74 age group is well above the national average of 9.4%. Between 2021 and present, the 75 to 84 age group has grown from 6.2% to 8.4% of the population. Conversely, the 45 to 54 cohort has declined from 14.2% to 13.1%, and the 55 to 64 age group has dropped from 15.6% to 14.6%. Looking ahead to 2041, demographic projections show significant shifts in Northern Midlands' age structure. The 75 to 84 age cohort is projected to grow by 115 people (34%), increasing from 338 to 454. Senior residents aged 65 and above will drive 82% of population growth, highlighting demographic aging trends. In contrast, population declines are projected for the 15 to 24 and 35 to 44 age cohorts.