Chart Color Schemes

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

George Town is positioned among the lower quartile of areas assessed nationally for population growth based on AreaSearch's assessment of recent, and medium term trends

George Town's population, as of November 2025, is approximately 7,861 people. This figure represents an increase of 743 individuals, a 10.4% rise from the 2021 Census count of 7,118 people. The change is inferred from the estimated resident population of 7,432 in June 2024 and an additional 272 validated new addresses since the Census date. This results in a population density of 10.5 persons per square kilometer. George Town's growth rate surpassed both the state average (4.8%) and the SA4 region, positioning it as a growth leader. Interstate migration contributed approximately 67.3% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and to estimate growth by age group post-2032, Tasmania State Government's Regional/LGA projections are adopted, released in 2022 with a base year of 2021, adjusted using a method of weighted aggregation from LGA to SA2 levels. Looking ahead, demographic trends indicate an overall population decline, with the area's population projected to decrease by 30 persons by 2041. However, specific age cohorts are expected to grow, notably the 75-84 age group, which is projected to increase by 390 people.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within George Town when compared nationally

George Town has seen approximately 67 new homes approved annually over the past five financial years, totalling 338 homes. As of FY-26, 18 approvals have been recorded. On average, one new resident per year per dwelling constructed has been observed between FY-21 and FY-25. This suggests that new construction is meeting or exceeding demand, providing more options for buyers and potentially driving population growth.

The average expected construction cost value of new dwellings is $258,000. In terms of commercial development, $2.5 million in approvals have been recorded this financial year. Compared to the Rest of Tas., George Town has seen elevated construction activity, with a 26.0% increase per person over the five-year period.

This balances buyer choice while supporting current property values, although building activity has slowed recently. Ninety-six percent of new developments consist of standalone homes, with only 4.0% being townhouses or apartments, preserving George Town's low-density nature and attracting space-seeking buyers. With around 139 people per approval, George Town reflects a developing area. However, population projections indicate stability or decline, which should reduce housing demand pressures and benefit potential buyers in the future.

Frequently Asked Questions - Development

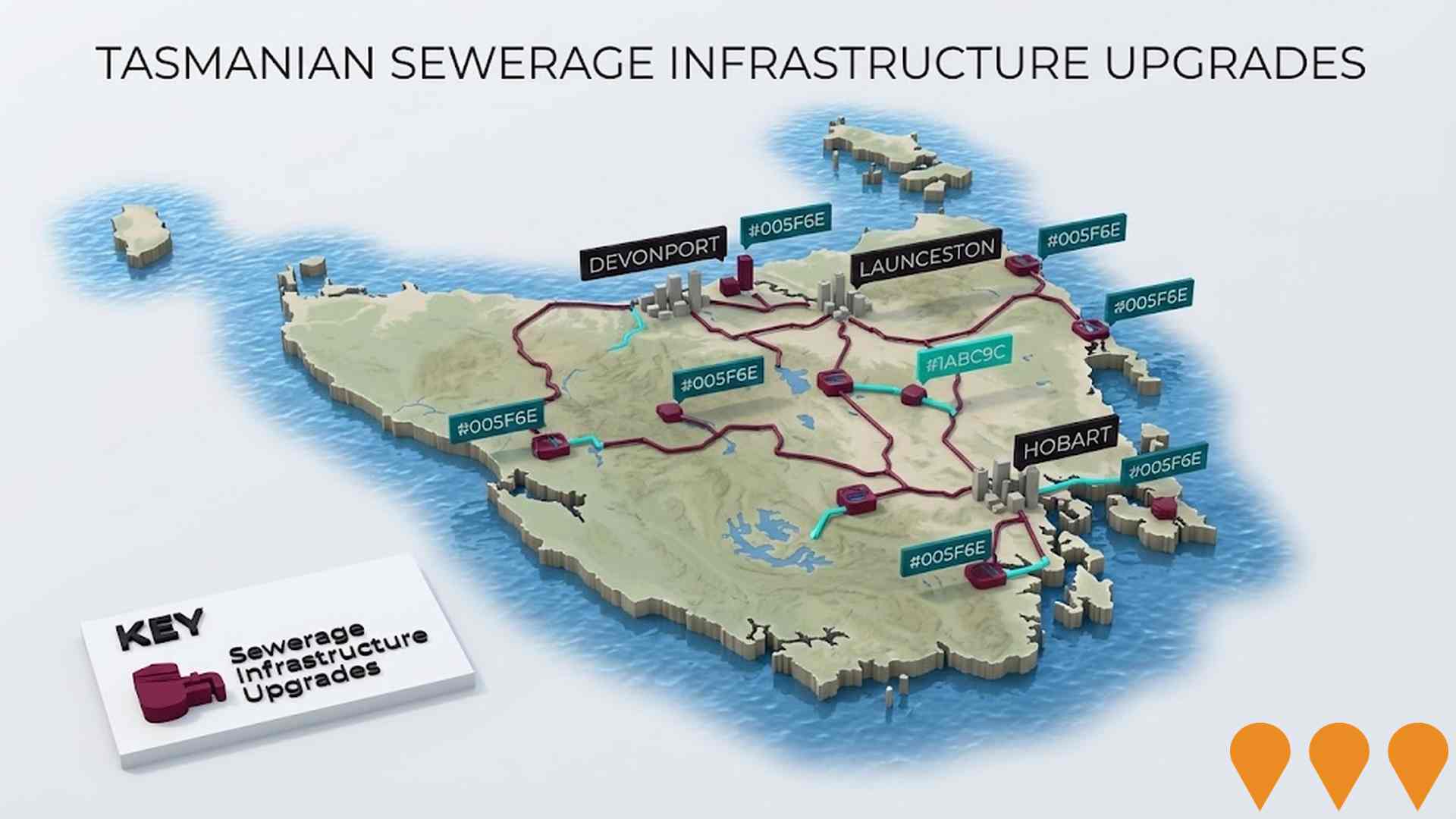

Infrastructure

George Town has limited levels of nearby infrastructure activity, ranking in the 13thth percentile nationally

Changes in local infrastructure significantly impact an area's performance. AreaSearch has identified eight projects that may affect this particular region. Notable projects include Bell Bay Powerfuels Project, H2TAS Renewable Hydrogen and Ammonia Facility, George Town 4-Townhouse Development, and South George Town Primary School Redevelopment. The following list details those likely to have the most relevance.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

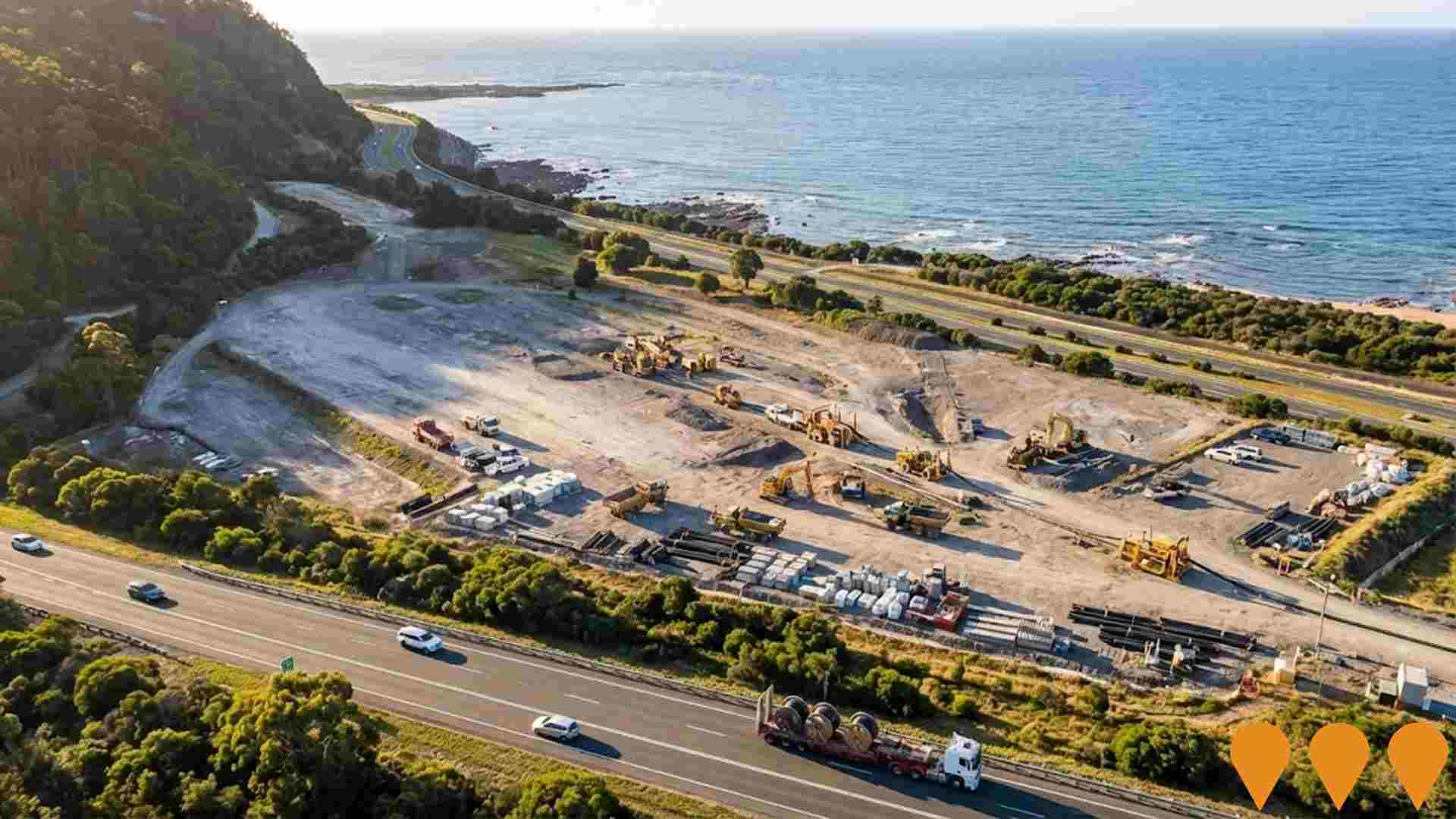

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Marinus Link

Marinus Link is a 1,500 MW (2 x 750 MW) high-voltage direct current (HVDC) electricity and telecommunications interconnector between north-west Tasmania and the Latrobe Valley in Victoria. Stage 1 (750 MW) comprises approximately 255 km of subsea HVDC cable across Bass Strait and 90 km of underground HVDC cable in Gippsland, with converter stations at Heybridge (TAS) and Hazelwood (VIC). Early works and major procurement contracts are in place, with main construction now underway for a target energisation in 2030.

Marinus Link Stage 1

Marinus Link Stage 1 is a proposed 750 MW high-voltage direct current (HVDC) electricity interconnector between North West Tasmania and Victoria. It comprises approximately 255 km of undersea HVDC cable across Bass Strait and 90 km of underground HVDC cable in Gippsland, Victoria. The project received Australian Government approval in September 2025 and is targeting Final Investment Decision in late 2025, with construction expected to commence in 2026-2027 and commissioning by 2030.

H2TAS Renewable Hydrogen and Ammonia Facility

Woodside Energy proposed a renewable hydrogen and ammonia production facility at Long Reach (Bell Bay), Tasmania, with plans for up to 750 MW of electrolysis across phases and production of up to ~800,000 tpa ammonia at full build-out. The project advanced through land arrangements and early studies (2020-2021) but Woodside withdrew its Tasmanian environmental applications in August 2024 and the EPA records the earlier 10 MW pilot as withdrawn in 2021. As of 2025, the proponent has effectively halted progression and the project remains uncommitted.

Bell Bay Powerfuels Project

Iberdrola Australia and ABEL Energy are jointly developing a large-scale renewable hydrogen and green methanol production facility in Bell Bay, Tasmania. The project includes a 300 MW electrolysis plant to produce approximately 129 tonnes of hydrogen per day and 360,000 tonnes of green methanol annually, utilizing biomass gasification, water electrolysis, and renewable energy sources including hydro and new wind power.

George Town 4-Townhouse Development

Construction of four townhouses in George Town, funded by CrowdProperty and developed by Michael Ta. The project is expected to be completed approximately 15 months from the first drawdown (around mid-2024).

South George Town Primary School Redevelopment

A $15.1 million redevelopment of South George Town Primary School to provide contemporary learning environments, associated support spaces and amenities, as part of the Tasmanian Government's School Building Blitz Program. Construction is expected to commence in 2026 and be completed in 2028.

Palmerston to George Town High Voltage Transmission Lines

An 85-kilometre high voltage transmission line upgrade project completed in March 2014 by John Holland for Transend Networks. It involved 243 tower structures and three substations, significantly upgrading NW Tasmania's power grid.

Bell Bay Wind Farm

Proposed 224-megawatt (MW) wind farm and 100-MW / 400-megawatt hour battery, located approximately 6km north east of George Town. It will include up to 28 wind turbines, a battery energy storage system (BESS), a substation, and other facilities. Declared a Major Project, currently undergoing environmental impact assessment.

Employment

Employment conditions in George Town face significant challenges, ranking among the bottom 10% of areas assessed nationally

George Town's workforce is balanced across white and blue-collar jobs, with prominent manufacturing and industrial sectors. The unemployment rate as of June 2025 was 6.4%.

In that month, 2,932 residents were employed while the unemployment rate was 2.5% higher than Rest of Tas.'s rate of 3.9%. Workforce participation in George Town was significantly lower at 46.9%, compared to Rest of Tas.'s 55.7%. Employment is concentrated in manufacturing, health care & social assistance, and retail trade. Manufacturing stands out with an employment share 2.4 times the regional level, while agriculture, forestry & fishing has a lower representation at 5.4% versus the regional average of 8.4%.

Many residents commute elsewhere for work, indicated by Census data on working population compared to local population. Over the year to June 2025, labour force levels decreased by 1.4%, with employment down by 0.8%, leading to a 0.6 percentage point drop in unemployment rate. In contrast, Rest of Tas. saw an employment decline of 0.5% and labour force decline of 0.6%. Jobs and Skills Australia's national employment forecasts from May 2025 project national growth of 6.6% over five years and 13.7% over ten years. Applying these projections to George Town's employment mix suggests local growth of approximately 5.2% over five years and 11.9% over ten years, though this is a simplified extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

George Town's median taxpayer income was $44,878 and average was $55,268 in financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This is lower than the national average, contrasting with Rest of Tas.'s median income of $47,358 and average income of $57,384. Based on Wage Price Index growth of 13.83% since financial year 2022, estimated incomes as of September 2025 would be approximately $51,085 (median) and $62,912 (average). Census 2021 income data shows household, family and personal incomes in George Town all fall between the 3rd and 5th percentiles nationally. Income analysis reveals that the largest segment comprises 29.9% earning $400 - $799 weekly (2,350 residents), differing from patterns across regional levels where $1,500 - $2,999 dominates with 28.5%. With 40.4% earning under $800 per week, George Town faces considerable income constraints affecting local spending patterns. While housing costs are modest with 86.7% of income retained, the total disposable income ranks at just the 6th percentile nationally.

Frequently Asked Questions - Income

Housing

George Town is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

In George Town, as per the latest Census evaluation, 89.6% of dwellings were houses, with the remaining 10.3% comprising semi-detached units, apartments, and other types. This contrasts with Non-Metro Tas., where 92.6% of dwellings were houses and 7.4% were other types. Home ownership in George Town stood at 43.1%, with mortgaged properties accounting for 28.6% and rented dwellings making up 28.3%. The median monthly mortgage repayment in the area was $1,083, lower than Non-Metro Tas.'s average of $1,198. Weekly rent in George Town was recorded at $220, compared to $230 in Non-Metro Tas. Nationally, George Town's median monthly mortgage repayments were significantly lower at $1,083 compared to the Australian average of $1,863, and weekly rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

George Town features high concentrations of lone person households, with a lower-than-average median household size

Family households account for 66.4% of all households, including 20.2% couples with children, 33.1% couples without children, and 12.4% single parent families. Non-family households make up the remaining 33.6%, with lone person households at 31.4% and group households comprising 2.2%. The median household size is 2.2 people, which is smaller than the Rest of Tas. average of 2.3.

Frequently Asked Questions - Households

Local Schools & Education

George Town faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area faces educational challenges, with university qualification rates at 12.4%, significantly below the Australian average of 30.4%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most prevalent at 8.9%, followed by postgraduate qualifications at 2.2% and graduate diplomas at 1.3%. Trade and technical skills are prominent, with 39.3% of residents aged 15+ holding vocational credentials - advanced diplomas at 8.1% and certificates at 31.2%.

Educational participation is notably high, with 25.0% of residents currently enrolled in formal education. This includes 10.4% in primary education, 7.7% in secondary education, and 2.0% pursuing tertiary education. George Town's 4 schools have a combined enrollment reaching 797 students as of the latest data available. The area demonstrates varied educational conditions across George Town, with an educational mix that includes 1 primary school, 1 secondary school, and 2 K-12 schools. Note: where schools show 'n/a' for enrolments, please refer to parent campus information.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in George Town is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

George Town faces significant health challenges with various conditions affecting both younger and older age groups. Approximately 48% (~3,741 people) have private health cover, lower than the national average of 55.3%.

The most prevalent medical conditions are arthritis (13.6%) and mental health issues (10.7%), while 56.1% report having no medical ailments compared to 60.6% in the rest of Tasmania. The area has a senior population of 27.2% (~2,142 people), with health outcomes among seniors performing better than those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

George Town is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

George Town's cultural diversity was found to be below average. Its population composition included 87.6% born in Australia, 90.7% citizens, and 97.4% speaking English only at home. Christianity dominated as the main religion, with 43.3%.

Hinduism, however, had an overrepresentation of 0.5%, compared to the Rest of Tas.'s 0.3%. The top three ancestry groups were English (35.7%), Australian (33.9%), and Scottish (7.7%). Notably, certain ethnic groups diverged in representation: Australian Aboriginal was at 3.3% (vs regional 3.0%), Dutch at 1.3% (vs 1.5%), and Samoan at 0.1% (vs 0.0%).

Frequently Asked Questions - Diversity

Age

George Town hosts an older demographic, ranking in the top quartile nationwide

George Town has a median age of 48, which is higher than the Rest of Tasmania's figure of 45 and above the national average of 38. The 65-74 age group makes up 15.6% of George Town's population, compared to 12.9% in the Rest of Tasmania and 9.4% nationally. Meanwhile, the 25-34 age cohort is less prevalent at 9.9%. Following the 2021 Census, the 75 to 84 age group has increased from 7.5% to 8.9%, while the 45 to 54 age group has decreased from 12.3% to 11.1%. By 2041, demographic modeling suggests significant changes in George Town's age profile. The 75 to 84 age cohort is projected to grow by 332 people (47%), from 700 to 1,033. Notably, the combined 65+ age groups will account for all of George Town's population growth. Conversely, population declines are projected for the 45 to 54 and 65 to 74 age cohorts.