Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Riverhills reveals an overall ranking slightly below national averages considering recent, and medium term trends

Riverhills' population is approximately 4,265 as of November 2025. This figure represents an increase of 144 people, a growth rate of 3.5%, since the 2021 Census which recorded a population of 4,121. This change is inferred from the estimated resident population of 4,265 reported by the ABS in June 2024 and an additional one validated new address since the Census date. The population density stands at 1,956 persons per square kilometer, exceeding the national average assessed by AreaSearch. Riverhills' growth rate of 3.5% since the 2021 census outpaces the SA3 area's growth rate of 2.9%, positioning it as a region leader in population increase. Natural growth contributed approximately 67.7% to overall population gains during recent periods.

AreaSearch employs ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections from 2023, based on 2021 data, are used. However, these state projections lack age category splits; thus, AreaSearch applies proportional growth weightings aligned with ABS Greater Capital Region projections released in 2023 and based on 2022 data for each age cohort. Future population trends anticipate lower quartile growth across statistical areas nationally, with Riverhills expected to expand by 106 persons to 2041, reflecting a total increase of 2.5% over the 17-year period as per the latest annual ERP population numbers.

Frequently Asked Questions - Population

Development

The level of residential development activity in Riverhills is very low in comparison to the average area assessed nationally by AreaSearch

Riverhills averaged approximately two new dwelling approvals per year between FY-21 and FY-25, with a total of 12 homes approved during this period. In FY-26 up to May, 2 dwellings have been approved.

The average population growth associated with these approvals is around 0.3 people per year over the past five financial years. This suggests that new supply has kept pace with or exceeded demand, providing ample buyer choice and capacity for population growth beyond current forecasts. The average construction value of new homes in Riverhills is $384,000, which is moderately above regional levels, indicating an emphasis on quality construction. Compared to Greater Brisbane, Riverhills has around two-thirds the rate of new dwelling approvals per person.

Nationally, it places among the 10th percentile of areas assessed for new dwellings, suggesting somewhat limited buyer options while strengthening demand for established properties. This activity is lower than the national average, reflecting market maturity and possible development constraints. Recent development in Riverhills has been entirely comprised of standalone homes, maintaining the area's traditional suburban character with a focus on family homes appealing to those seeking space. The location has approximately 1768 people per dwelling approval, demonstrating an established market. Looking ahead, Riverhills is expected to grow by 106 residents through to 2041, according to the latest AreaSearch quarterly estimate. If current development rates continue, housing supply may not keep pace with population growth, potentially increasing competition among buyers and supporting stronger price growth in the future.

Frequently Asked Questions - Development

Infrastructure

Riverhills has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

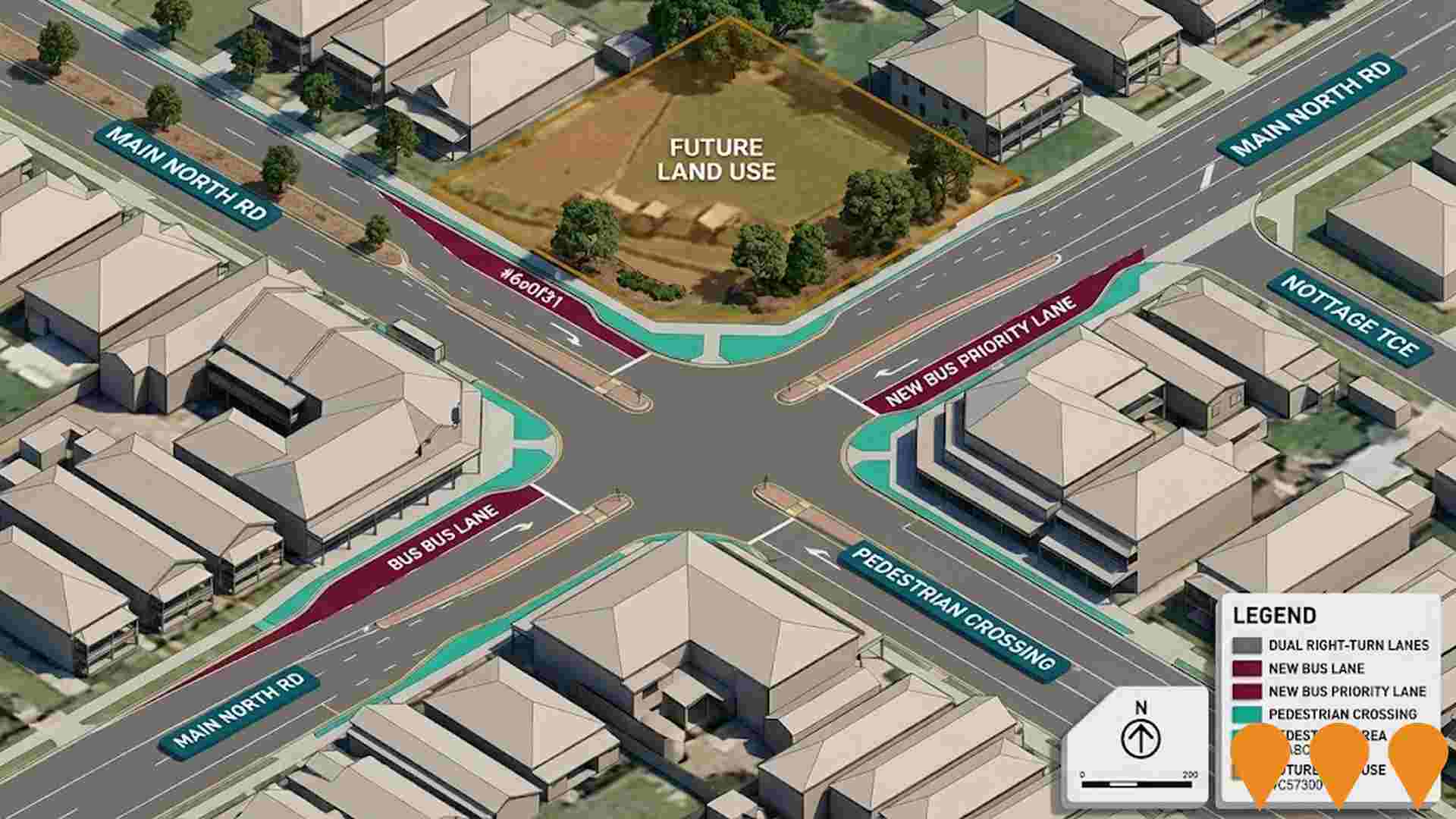

Changes to local infrastructure significantly impact an area's performance. AreaSearch identified three projects likely affecting the region: Middle Park Intersection Upgrade (Eumong Street/Riverhills Road), Centenary Motorway Upgrade Planning, Metro Middle Park Mixed-Use Redevelopment, and McLeod Country Golf Club Retirement Village. Key details are listed below.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Greater Springfield Master Planned Community

Australia's largest master-planned community spanning 2,860 hectares in South-East Queensland. Currently home to over 55,000 residents (2025), the $88+ billion privately funded city is projected to reach 138,000 residents and 105,000 jobs by 2045. Key pillars include health, education, technology, and connectivity, with more than $20 billion invested to date. Ongoing construction across multiple residential, commercial, education, health and retail precincts.

Building Future Hospitals Program

Queensland's flagship hospital infrastructure program delivering over 2,600 new and refurbished public hospital beds by 2031-32. Includes major expansions at Ipswich Hospital (Stage 2), Logan Hospital, Princess Alexandra Hospital, Townsville University Hospital, Gold Coast University Hospital and multiple new satellite hospitals and community health centres.

South East Queensland Infrastructure Plan and Supplement (SEQIP & SEQIS)

The South East Queensland Infrastructure Plan (SEQIP) and its accompanying Infrastructure Supplement (SEQIS) provide the strategic framework for infrastructure coordination across the SEQ region to 2046. The SEQIS specifically identifies priority infrastructure initiatives to support housing supply, economic growth and the delivery of the Brisbane 2032 Olympic and Paralympic Games, including transport, social infrastructure, and catalytic development projects.

Ipswich to Springfield Central Public Transport Corridor (I2S)

The Ipswich to Springfield Central Public Transport Corridor (I2S) is a proposed 25 km dedicated mass transit corridor linking Ipswich Central and Springfield Central via Ripley and Redbank Plains. The project includes nine new stations and will support future growth in one of South East Queenslands fastest-growing regions. The Options Analysis was completed in late 2024. A Detailed Business Case, jointly funded by the Australian Government, Queensland Government and Ipswich City Council under the South East Queensland City Deal, is scheduled to commence in 2026. Delivery mode (heavy rail, trackless tram or other) and final alignment are still under investigation.

Centenary Motorway Upgrade Planning

The Queensland Department of Transport and Main Roads is developing a long-term corridor masterplan for the upgrade of the Centenary Motorway between Darra and Toowong. Two shortlisted options: Option 1 - a tunnel with targeted surface upgrades; Option 2 - widening of the existing motorway plus a new arterial road. The motorway serves high daily traffic volumes with significant forecasted growth. Masterplan finalisation expected in 2025, with community consultation on options in early-mid 2025. Upgrades to be delivered in stages subject to future funding. Separate to the ongoing Centenary Bridge Upgrade at Jindalee. Planning funded by $10 million from the Australian Government.

Logan West Upgrade

Major upgrade to the western section of the Logan Motorway in partnership with Transurban Queensland and the Queensland Government. Adds one additional lane in each direction along approximately 10-13km between the Centenary Highway and Mt Lindesay Highway, plus an extra westbound lane between Boundary Road and Formation Street. Includes upgrading the Formation Street interchange, installing smart motorway technologies, and increasing vehicle height capacity for over-dimensional vehicles. Expected to reduce peak travel times by up to 20 minutes, improve freight productivity on a route handling 210,000 daily trips, enhance safety, and support preparations for the 2032 Brisbane Olympics. Community consultation completed in 2024; construction targeted for completion before 2032.

Queensland Schools Infrastructure Program

Ongoing $1.9 billion investment in state school infrastructure including new schools, expansions, and modernization across Queensland. Multiple projects planned for Southeast Brisbane to accommodate growing populations.

Wacol Logistics Hub

18.2 hectare industrial complex with six warehouses acquired by JD Property for $153M. Major employment hub with proximity to transport networks and Richlands corridor.

Employment

The labour market in Riverhills shows considerable strength compared to most other Australian regions

Riverhills has an educated workforce with significant representation in essential services sectors. As of September 2025, the unemployment rate is 2.9%.

Residents' employment rate is 1.1% lower than Greater Brisbane's at 4.0%, and participation rate is higher at 72.2% compared to Greater Brisbane's 64.5%. Key employment sectors include health care & social assistance, education & training, and retail trade. Notably, education & training has a share of employment 1.4 times the regional level. Conversely, accommodation & food shows lower representation at 5.2% versus the regional average of 6.7%.

The area appears to have limited local employment opportunities, with Census data indicating more residents work elsewhere than locally. Between September 2024 and September 2025, labour force decreased by 3.9%, employment by 1.9%, leading to a 2.0 percentage point drop in unemployment rate. In contrast, Greater Brisbane saw employment grow by 3.8% and labour force by 3.3%, with a 0.5 percentage point drop in unemployment rate. Statewide, Queensland's employment contracted by 0.01% (losing 1,210 jobs) as of 25-Nov-25, with an unemployment rate of 4.2%, closely aligned with the national rate of 4.3%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years. Applying these projections to Riverhills' employment mix suggests local employment should increase by 6.5% over five years and 13.5% over ten years, though this is a simple extrapolation for illustrative purposes only.

Frequently Asked Questions - Employment

Income

Income metrics indicate excellent economic conditions, with the area achieving higher performance than 75% of national locations assessed by AreaSearch

The Riverhills SA2 had a median taxpayer income of $61,478 and an average income of $77,205 in the financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This is among the highest in Australia, contrasting with Greater Brisbane's median income of $55,645 and average income of $70,520 during the same period. Based on Wage Price Index growth of 13.99% since financial year 2022, current estimates would be approximately $70,079 (median) and $88,006 (average) as of September 2025. According to the 2021 Census figures, household, family and personal incomes in Riverhills cluster around the 72nd percentile nationally. In terms of income distribution, the largest segment comprises 39.8% earning $1,500 - 2,999 weekly (1,697 residents), aligning with the region where this cohort likewise represents 33.3%. High housing costs consume 15.1% of income, though strong earnings still place disposable income at the 71st percentile and the area's SEIFA income ranking places it in the 7th decile.

Frequently Asked Questions - Income

Housing

Riverhills is characterized by a predominantly suburban housing profile, with a higher proportion of rental properties than the broader region

The dwelling structure in Riverhills, as per the latest Census, consisted of 87.1% houses and 12.9% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Brisbane metro had 91.4% houses and 8.6% other dwellings. Home ownership in Riverhills stood at 25.2%, with the rest of dwellings either mortgaged (49.4%) or rented (25.4%). The median monthly mortgage repayment was $1,820, lower than Brisbane metro's average of $2,000 and national average of $1,863. The median weekly rent in Riverhills was $410, higher than Brisbane metro's figure of $450 but lower than the national average of $375.

Frequently Asked Questions - Housing

Household Composition

Riverhills features high concentrations of family households, with a lower-than-average median household size

Family households account for 77.2% of all households, including 37.5% couples with children, 25.7% couples without children, and 12.6% single parent families. Non-family households make up the remaining 22.8%, consisting of 19.7% lone person households and 3.2% group households. The median household size is 2.7 people, which is smaller than the Greater Brisbane average of 2.8.

Frequently Asked Questions - Households

Local Schools & Education

The educational profile of Riverhills exceeds national averages, with above-average qualification levels and academic performance metrics

The area's university qualification rate is 34.3%, significantly lower than the SA4 region average of 47.4%. Bachelor degrees are the most common at 23.2%, followed by postgraduate qualifications (8.0%) and graduate diplomas (3.1%). Vocational credentials are prevalent, with 35.1% of residents aged 15+ holding them, including advanced diplomas (12.2%) and certificates (22.9%). Educational participation is high, with 31.0% of residents currently enrolled in formal education.

This includes 11.0% in primary education, 8.2% in secondary education, and 6.0% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is moderate compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Riverhills has nine active public transport stops, all serving buses. These stops are covered by five different routes, collectively offering 596 weekly passenger trips. The accessibility of these services is rated as good, with residents typically living within 235 meters of the nearest stop.

On average, there are 85 trips per day across all routes, which equates to approximately 66 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Riverhills's residents are extremely healthy with both young and old age cohorts seeing low prevalence of common health conditions

Analysis shows Riverhills had low prevalence of common health conditions across all age groups.

Around 58% (~2,465 people) had private health cover. Mental health issues and asthma were most prevalent at 8.3 and 7.4%, respectively. 72.5% reported no medical ailments, close to Greater Brisbane's 71.2%. 15.7% of residents were aged 65 and over (668 people), lower than Greater Brisbane's 20.4%. Seniors' health outcomes align with the general population's profile.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in Riverhills was found to be above average when compared nationally for a number of language and cultural background related metrics

Riverhills was found to be more culturally diverse than most local markets, with 19.1% of its population speaking a language other than English at home and 31.0% born overseas. Christianity is the main religion in Riverhills, making up 45.5% of people there. Buddhism is overrepresented compared to Greater Brisbane, comprising 2.6% versus 3.4%.

The top three ancestry groups are English (26.4%), Australian (21.5%), and Other (11.2%). Notably, New Zealanders are overrepresented at 1.2%, South Africans at 1.1%, and Samoans at 0.9% compared to regional averages of 1.0%, 0.9%, and 0.4% respectively.

Frequently Asked Questions - Diversity

Age

Riverhills's population is slightly younger than the national pattern

Riverhills' median age is 36 years, equal to Greater Brisbane's but younger than the national average of 38 years. The 35-44 age group comprises 17.4% of Riverhills' population, higher than Greater Brisbane's percentage, while the 25-34 cohort makes up 11.3%. Between 2021 and present, the 75-84 age group grew from 3.7% to 5.5%, and the 15-24 cohort increased from 11.1% to 12.7%. Conversely, the 25-34 cohort decreased from 13.9% to 11.3%, and the 5-14 group fell from 15.0% to 13.7%. By 2041, Riverhills' population is projected to experience significant demographic shifts. The 75-84 age cohort is expected to rise by 150 people (64%), from 236 to 387. Notably, the combined 65+ age groups will account for 63% of total population growth, reflecting Riverhills' aging demographic profile. In contrast, both the 65-74 and 15-24 age groups are projected to decrease in number.