Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Northern Highlands has shown very soft population growth performance across periods assessed by AreaSearch

Northern Highlands' population was around 3,203 as of November 2025. This reflected an increase of 108 people since the 2021 Census, which reported a population of 3,095. The change was inferred from ABS's estimated resident population of 3,196 in June 2024 and additional validated new addresses since the Census date. This resulted in a density ratio of approximately 0 persons per square kilometer. Northern Highlands' growth rate of 3.5% since the 2021 census exceeded the SA3 area's growth rate of 2.6%. Natural growth contributed approximately 77.8% of overall population gains during recent periods.

AreaSearch adopted ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections were used, released in 2023 based on 2021 data. These state projections did not provide age category splits, so proportional growth weightings from ABS Greater Capital Region projections were applied for each age cohort. From 2025 to 2041, the population was projected to decline by 472 persons according to this methodology. However, specific age cohorts such as those aged 85 and over were expected to grow, with a projected increase of 16 people in that group.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Northern Highlands according to AreaSearch's national comparison of local real estate markets

Northern Highlands has averaged approximately five new dwelling approvals each year over the past five financial years, totalling 25 homes. As of FY-26 so far, zero approvals have been recorded. On average, 3.5 new residents per year are associated with every home built between FY-21 and FY-25, indicating a significant demand exceeding supply, which typically leads to price growth and increased buyer competition. The average expected construction cost value for new dwellings in the area is $368,000.

In this financial year, $4.9 million in commercial development approvals have been recorded, suggesting the area's residential character. Compared to the rest of Queensland, Northern Highlands has slightly more development activity, with 43.0% above the regional average per person over the five-year period, providing reasonable buyer options while sustaining existing property demand. However, this level is lower than the national average, reflecting market maturity and possible development constraints. All recent building activity consists of detached dwellings, maintaining the area's traditional low-density character with a focus on family homes appealing to those seeking space.

The estimated population per dwelling approval in the area is 626 people, indicating its quiet, low-activity development environment. With population expected to remain stable or decline, Northern Highlands should see reduced pressure on housing, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

Infrastructure

Northern Highlands has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

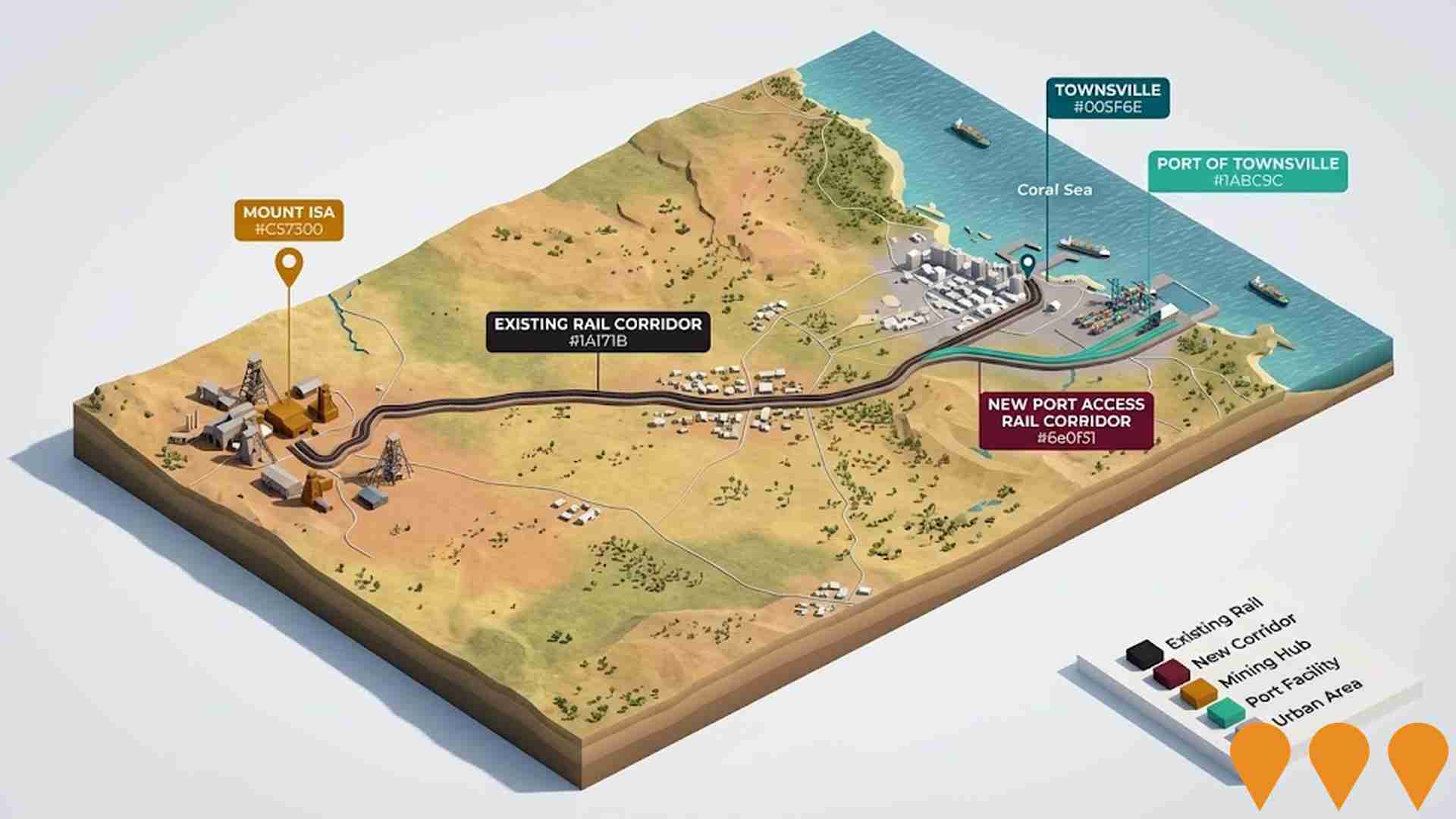

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified 22 projects that could impact this area. Notable ones include CopperString 2032, Mount Isa-Townsville Rail Corridor Upgrade, and Wongalee Wind Energy Project. The following list details those likely most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

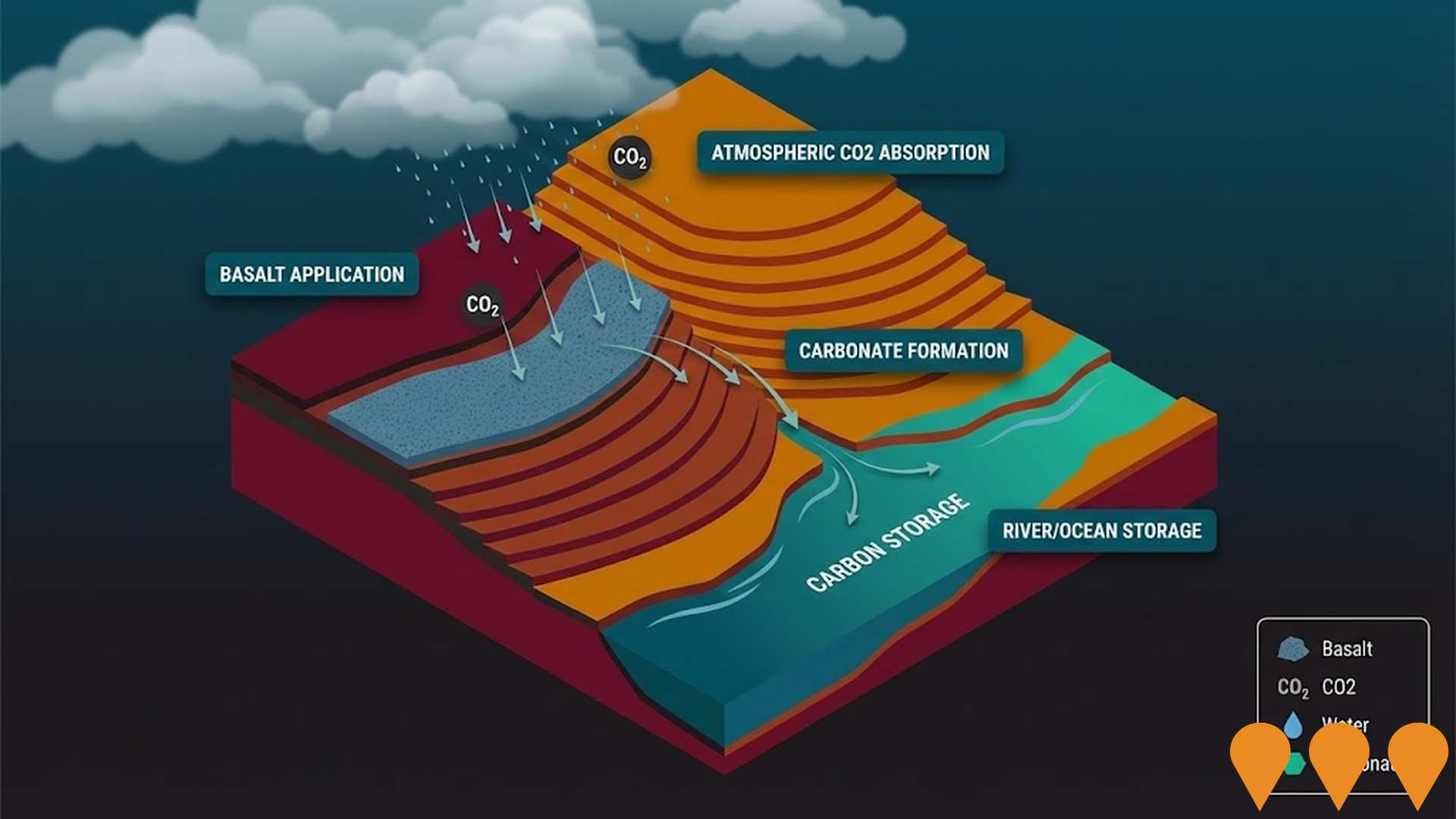

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

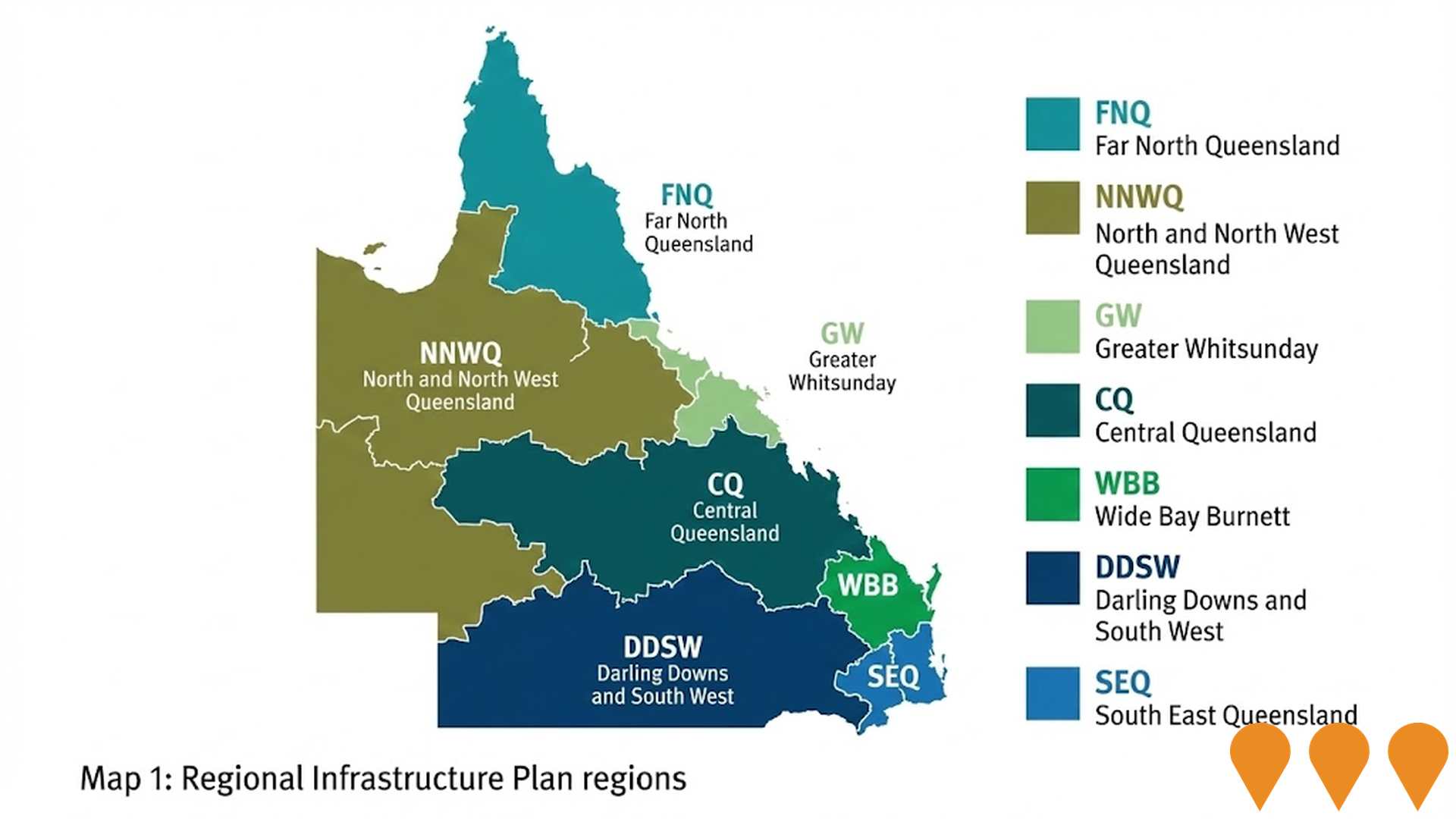

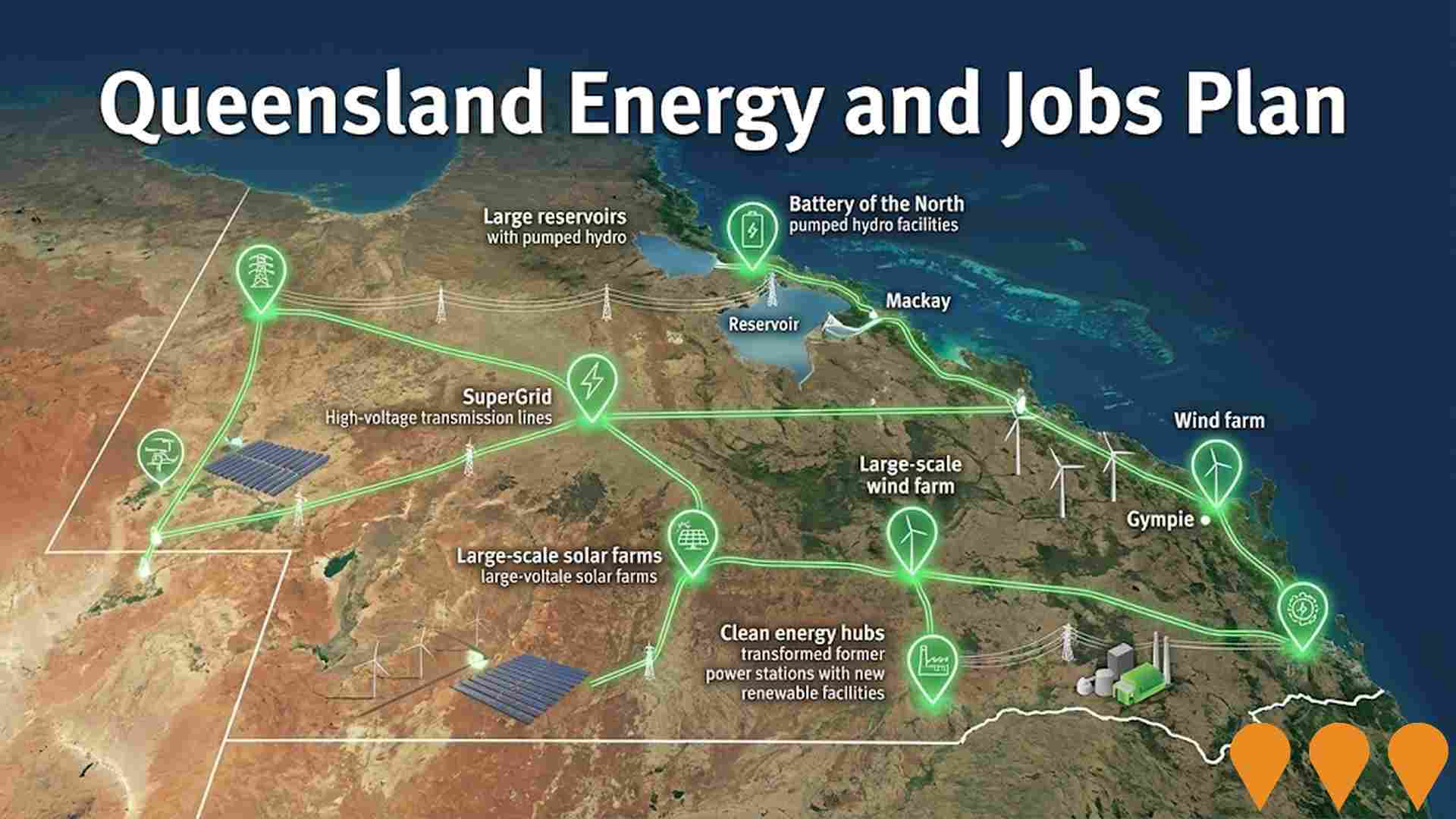

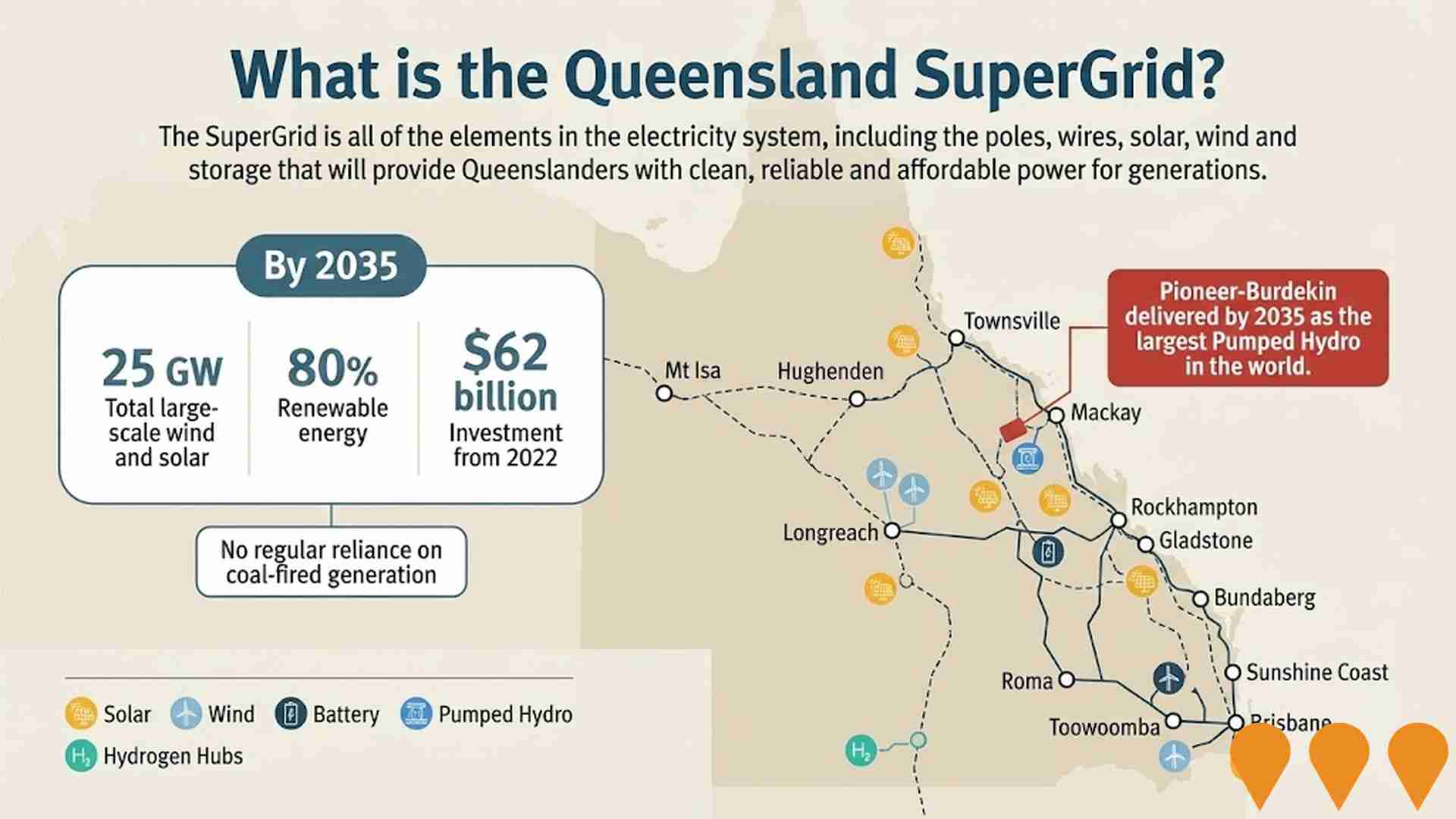

Queensland Energy and Jobs Plan

State-wide renewable energy transformation program delivering large-scale wind, solar, pumped hydro, battery storage and transmission infrastructure. Aims for 70% renewable energy by 2032 and 80% by 2035, supporting 100,000 jobs by 2040 across regional Queensland. Largest clean energy investment program in Australia.

Queensland Energy and Jobs Plan - Northern Queensland SuperGrid (CopperString 2032 & Northern REZ)

Flagship component of the Queensland Energy and Jobs Plan delivering the 1,100 km CopperString 2032 high-voltage transmission project, establishment of the Northern Renewable Energy Zone, and supporting SuperGrid infrastructure to unlock large-scale renewable energy and critical minerals processing in North and North-West Queensland.

Queensland Energy and Jobs Plan

The Queensland Energy and Jobs Plan is a $62 billion+ statewide program to deliver publicly owned renewable energy generation, large-scale battery and pumped hydro storage, and the Queensland SuperGrid transmission backbone. Targets: 50% renewables by 2030, 70% by 2032, 80% by 2035. Multiple projects are now under construction including CopperString 2032, Pioneer-Burdekin Pumped Hydro, and numerous Renewable Energy Zones.

Queensland Energy and Jobs Plan SuperGrid

The Queensland Energy and Jobs Plan is delivering the Queensland SuperGrid and 22 GW of new renewable energy capacity through Renewable Energy Zones (REZs) across the state. Legislated targets are 50% renewables by 2030, 70% by 2032 and 80% by 2035. Key delivery mechanisms include the Energy (Renewable Transformation and Jobs) Act 2024, the SuperGrid Infrastructure Blueprint, the Queensland REZ Roadmap and the Priority Transmission Investments (PTI) framework. Multiple transmission projects are now in construction including CopperString 2032, Gladstone PTI (Central Queensland SuperGrid), Southern Queensland SuperGrid reinforcements, and numerous grid-scale batteries and pumped hydro projects under active development.

CopperString 2032

CopperString 2032 is a 1,100 km high-voltage transmission project (including spurs) connecting the North West Minerals Province to the National Electricity Market for the first time. The 500 kV line runs from just south of Townsville to Mount Isa, with construction underway since mid-2024. Fully funded with Queensland Government ownership, it will unlock large-scale renewable generation and critical minerals projects in north-west Queensland. Expected energisation by late 2029.

CopperString 2032

The CopperString 2032 project involves constructing approximately 840 km of high-voltage electricity transmission lines to connect Queensland's North West Minerals Province to the National Electricity Market. It includes a 500 kV line from Townsville to Hughenden, a 330 kV line from Hughenden to Cloncurry, a 220 kV line from Cloncurry to Mount Isa, along with substations and supporting facilities. The project is prioritizing the Eastern Link with private investment sought for the Western Link.

Wongalee Wind Energy Project

Windlab's Wongalee Wind Energy Project is part of the North Queensland Super Hub. The project is planned for up to 175 turbines with up to 1.4 GW capacity near Prairie in Flinders Shire. In May 2025 the project received State Development approval from the Queensland Government and is advancing detailed design and delivery planning, with Federal EPBC assessment still to follow.

Residential Activation Fund - Central Queensland Allocation

Part of the $2 billion Residential Activation Fund with at least 50% allocated outside SEQ. Potential infrastructure to support residential housing developments in regional areas including trunk infrastructure, water, sewerage, and roads.

Employment

Employment conditions in Northern Highlands rank among the top 10% of areas assessed nationally

Northern Highlands has a balanced workforce with representation across various sectors. As of September 2025, it has an unemployment rate of 1.4%.

The area's employment rate is 2.6% lower than the Rest of Queensland's rate of 4.1%, and its participation rate is higher at 64.9% compared to Rest of Queensland's 59.1%. Key sectors include agriculture, forestry & fishing, public administration & safety, and construction. Notably, employment in agriculture, forestry & fishing is 8.5 times the regional average. Conversely, health care & social assistance is under-represented at 4.9% compared to Rest of Queensland's 16.1%.

The worker-to-resident ratio is substantial at 0.9. Over the year to September 2025, labour force levels decreased by 0.7%, and employment declined by 0.6%, lowering the unemployment rate by 0.1 percentage points. Meanwhile, Rest of Queensland saw employment growth of 1.7% and labour force growth of 2.1%. State-level data to 25-Nov-25 shows Queensland's employment contracted by 0.01%, with an unemployment rate of 4.2%, closely aligned with the national rate of 4.3%. National employment forecasts from May-25 project a 6.6% increase over five years and 13.7% over ten years, but local growth rates vary significantly by sector. Applying these projections to Northern Highlands' employment mix suggests local employment should grow by 4.4% over five years and 10.1% over ten years.

Frequently Asked Questions - Employment

Income

The area's income profile falls below national averages based on AreaSearch analysis

In AreaSearch's aggregation of postcode level ATO data released for financial year 2022, Northern Highlands SA2 had a median taxpayer income of $51,866 and an average income of $66,549. This is slightly above the national average, compared to Rest of Qld's figures of $50,780 and $64,844 respectively. As of September 2025, estimated median and average incomes would be approximately $59,122 and $75,859, based on a 13.99% Wage Price Index growth since financial year 2022. Census data shows personal income ranks at the 69th percentile ($914 weekly) and household income at the 36th percentile. Income analysis reveals 33.3% of the population falls within the $1,500 - $2,999 range, consistent with metropolitan trends (31.7%). Housing costs are manageable, with 94.3% retained, but disposable income is below average at the 47th percentile. The area's SEIFA income ranking places it in the 5th decile.

Frequently Asked Questions - Income

Housing

Northern Highlands is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Northern Highlands, as per the latest Census evaluation, 89.2% of dwellings were houses with the remaining 10.8% being semi-detached homes, apartments, and other types. This contrasts with Non-Metro Qld's composition of 77.3% houses and 22.7% other dwellings. Home ownership in Northern Highlands stood at 45.3%, with mortgaged dwellings at 21.5% and rented ones at 33.2%. The median monthly mortgage repayment was $715, lower than Non-Metro Qld's average of $1,500. Weekly rent in Northern Highlands was recorded at $150, compared to Non-Metro Qld's $220. Nationally, Northern Highlands' mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Northern Highlands features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 64.4% of all households, including 26.9% couples with children, 29.4% couples without children, and 7.5% single parent families. Non-family households account for 35.6%, with lone person households at 32.7% and group households comprising 2.7%. The median household size is 2.4 people, smaller than the Rest of Qld average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Northern Highlands faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 14.5%, significantly lower than Australia's average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 11.6%, followed by postgraduate qualifications (1.7%) and graduate diplomas (1.2%). Trade and technical skills are prominent, with 41.2% of residents aged 15+ holding vocational credentials - advanced diplomas (8.8%) and certificates (32.4%).

Educational participation is high, with 31.6% of residents currently enrolled in formal education, including 16.8% in primary education, 4.3% in secondary education, and 2.7% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Northern Highlands's residents are healthier than average in comparison to broader Australia with prevalence of common health conditions quite low across both younger and older age cohorts

Health data shows Northern Highlands residents have relatively positive health outcomes. Prevalence of common conditions is low across both younger and older age groups.

Private health cover rate is approximately 52%, slightly higher than the SA2 area average (1,678 people). This compares to a 57.6% rate in Rest of Qld. The most prevalent medical conditions are asthma and arthritis, affecting 8.5 and 7.4% of residents respectively. 70.4% of residents report no medical ailments, compared to 76.2% in Rest of Qld. In Northern Highlands, 17.7% of residents are aged 65 and over (568 people), higher than the 10.0% in Rest of Qld. Health outcomes among seniors are above average, mirroring the general population's health profile.

Frequently Asked Questions - Health

Cultural Diversity

The latest Census data sees Northern Highlands placing among the least culturally diverse areas in the country when compared across a range of language and cultural background related metrics

Northern Highlands showed lower cultural diversity, with 82.0% citizens, 94.1% born in Australia, and 98.0% speaking English only at home. Christianity was the predominant religion at 65.5%, compared to 52.2% regionally. Ancestry-wise, Australian (33.4%) and English (30.1%) groups were significantly higher than regional averages of 25.4% and 21.6% respectively.

Irish ancestry stood at 9.8%. Notable disparities existed for Australian Aboriginal (6.2% vs 20.0%), Scottish (8.6% vs 5.5%), and German (4.0% vs 3.2%) groups.

Frequently Asked Questions - Diversity

Age

Northern Highlands's population is slightly younger than the national pattern

Northern Highlands has a median age of 37 years, which is significantly lower than the Rest of Queensland average of 41 years but closely aligned with Australia's median age of 38 years. The 25-34 age cohort is notably over-represented in Northern Highlands at 16.8%, compared to the Rest of Queensland average, while the 45-54 year-olds are under-represented at 10.0%. According to the 2021 Census, the population aged 65 to 74 years has grown from 10.0% to 11.3%, and the 35 to 44 age group has increased from 10.9% to 12.1%. Conversely, the 45 to 54 cohort has decreased from 12.0% to 10.0%, and the 55 to 64 age group has dropped from 14.4% to 12.8%. Demographic modeling indicates that Northern Highlands' age profile will change significantly by 2041, with the strongest projected growth in the 85+ cohort at 23%, adding 11 residents to reach a total of 62. This demographic aging trend is expected to continue as residents aged 65 and older contribute entirely to population growth. Conversely, population declines are projected for the 0 to 4 and 25 to 34 age cohorts.