Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Population growth drivers in Redhead are slightly above average based on AreaSearch's ranking of recent, and medium term trends

Redhead's population was approximately 3,833 as of November 2025. This figure represents an increase of 48 people from the 2021 Census count of 3,785. The change is inferred from ABS data showing an estimated resident population of 3,788 in June 2024 and an additional 289 validated new addresses since the Census date. This results in a population density ratio of 1,041 persons per square kilometer, comparable to averages seen across other areas assessed by AreaSearch. Redhead's growth rate of 1.3% since the census is within 1.6 percentage points of the SA3 area average (2.9%), indicating competitive growth fundamentals. Interstate migration contributed approximately 51.9% of overall population gains in recent periods.

For projections, AreaSearch uses ABS/Geoscience Australia data for each SA2 area released in 2024 with a base year of 2022, and NSW State Government's SA2 level projections for areas not covered by this data, released in 2022 with a base year of 2021. Growth rates by age group are applied to all areas from 2032 to 2041. Based on these projections, the area is expected to expand by 655 persons to 2041, reflecting an increase of 14.8% in total over the 17-year period.

Frequently Asked Questions - Population

Development

Residential development activity is lower than average in Redhead according to AreaSearch's national comparison of local real estate markets

Redhead has averaged approximately 20 new dwelling approvals annually. Over the past five financial years, from FY-21 to FY-25, a total of 101 homes were approved, with an additional one approved so far in FY-26. On average, 0.4 people have moved to the area each year for every dwelling built during this period, indicating that new supply has kept pace with or exceeded demand, providing ample buyer choice and capacity for population growth beyond current forecasts.

The average construction value of these properties is $511,000, suggesting a focus on the premium market with high-end developments. This financial year, $1.9 million in commercial development approvals have been recorded, predominantly reflecting residential focus. Compared to the rest of NSW, Redhead exhibits moderately higher construction activity, 28.0% above the regional average per person over the five-year period, preserving reasonable buyer options while sustaining existing property demand, although recent construction activity has eased somewhat.

New developments consist of 94.0% detached houses and 6.0% medium to high-density housing, maintaining the area's suburban nature with an emphasis on detached housing attracting space-seeking buyers. With around 268 people per approval, Redhead reflects a low-density area. According to AreaSearch's latest quarterly estimate, Redhead is projected to gain 568 residents by 2041. Existing development levels appear aligned with future requirements, maintaining stable market conditions without significant price pressures.

Frequently Asked Questions - Development

Infrastructure

Redhead has moderate levels of nearby infrastructure activity, ranking in the top 50% nationally

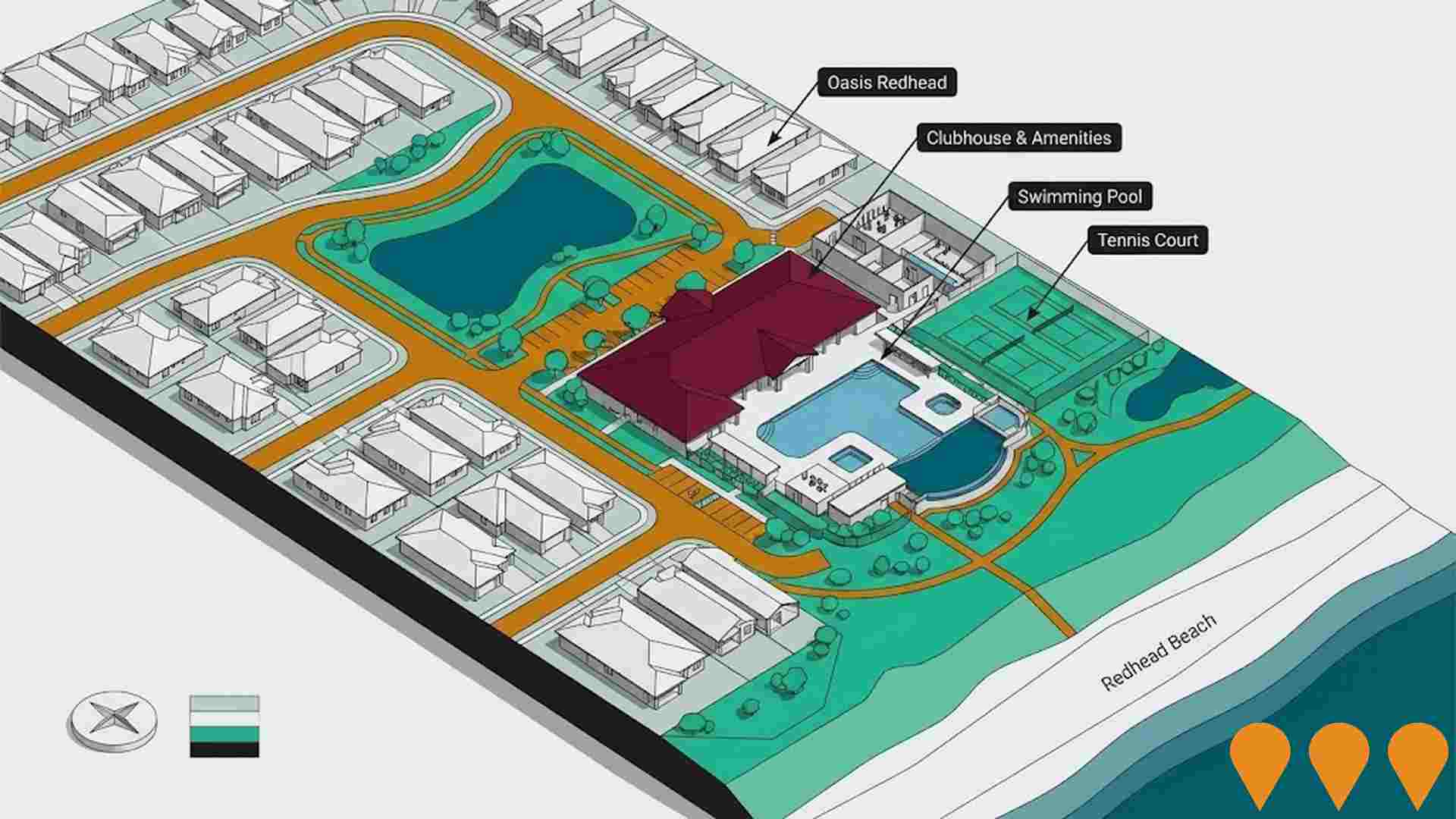

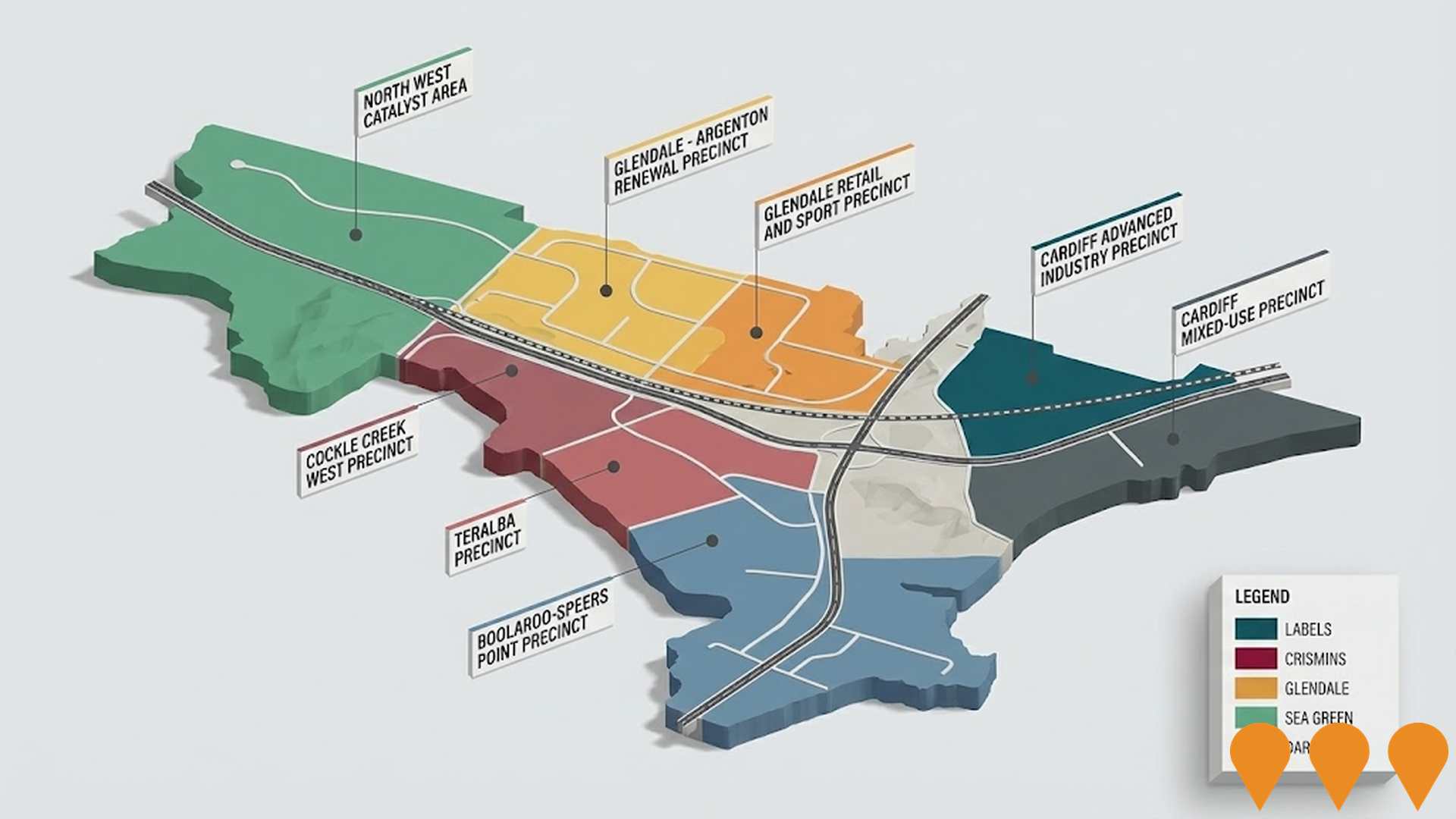

Changes to local infrastructure significantly influence an area's performance. AreaSearch has identified four projects likely impacting this region: Oasis Redhead, Redhead Business Park, First Creek Realignment Project, and Redhead Pump Track. Below are details of these key projects.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Tingira Hills Care Community

A 120-128 bed residential aged care facility (formerly Opal Hillside) that offers residential aged care and assisted living. The facility features a cafe, hairdressing salon, commercial kitchens, laundries, communal areas, and extensive gardens. It was designed to accommodate variable founding conditions and ground movement due to mine subsidence.

Lake Macquarie Private Hospital Expansion

Major expansion of Lake Macquarie Private Hospital by Ramsay Health Care, featuring a new nine-storey health services facility adding 114 patient beds (total ~300 beds), five new operating theatres, three day surgery units, ten consulting suites, six emergency department bays, six day oncology chairs, expanded critical care/ICU, enhanced radiology and oncology services, new main entrance on Casey Street, and basement parking with 56 additional spaces. Approved by the NSW Independent Planning Commission in May 2025 (with 6- or 9-storey options); Ramsay elected the 9-storey version. Construction underway, completion expected 2027.

High Speed Rail - Newcastle to Sydney (Stage 1)

The first stage of the proposed National High Speed Rail network aims to connect Newcastle to Sydney via the Central Coast, reducing travel time to approximately one hour with trains reaching speeds up to 320 km/h. The project is focused on the development phase, which includes design refinement, securing planning approvals, and corridor preservation. It is being advanced by the Australian Government's High Speed Rail Authority (HSRA). Stations are planned for Broadmeadow, Lake Macquarie, Central Coast, and Central Sydney. The long-term vision is a national network connecting Brisbane, Sydney, Canberra, and Melbourne.

Mount Hutton Precinct Area Plan

A planning framework adopted by Lake Macquarie City Council to guide the future infrastructure, built environment, and conservation of the Mount Hutton area. It supports medium density housing, improved connectivity, and ecological rehabilitation, and is part of the Lake Macquarie Development Control Plan 2014.

Lake Macquarie Square

A sub-regional shopping centre located in Mount Hutton, 14km from Newcastle's CBD. The project, originally a $60 million redevelopment completed in 2019 by Charter Hall, consolidated Lake Macquarie Fair and Mount Hutton Plaza into a single, modern retail destination with approximately 24,000 m2 of prime retail space. The centre is anchored by BIG W, Coles, and Woolworths, with over 70 specialty stores, a medical precinct, childcare, and a 24-hour gym. Revelop acquired the asset in February 2025 for $122.5 million.

Swansea Channel Permanent Dredging Solution

A permanent dredging solution for Swansea Channel, the entrance to Lake Macquarie, involving a Beaver 30 dredge vessel and sand transfer system to maintain safe navigation for vessels, with sand pumped to Blacksmiths Beach. The project includes upgrades to the Blacksmiths boat ramp and aims to address ongoing sand accumulation issues.

First Creek Realignment Project

Realignment of First Creek further south at Redhead Beach to reduce scouring of dunes and infrastructure, create a safer flow path, improve emergency and public beach access, and prevent erosion of coastal dunes. The works were undertaken by Lake Macquarie City Council in July 2023 and were expected to take one week to complete.

Newcastle 2040

City of Newcastle's Community Strategic Plan (CSP) setting the shared vision and priorities for the next 10+ years. Originally adopted in 2022 and revised in 2024/25, the updated CSP was endorsed by Council on 15 April 2025. It guides policies, strategies and actions across the LGA and is implemented through the Delivery Program and Operational Plan known as Delivering Newcastle 2040.

Employment

AreaSearch analysis reveals Redhead significantly outperforming the majority of regions assessed nationwide

Redhead has an educated workforce with significant representation in essential services sectors. The unemployment rate was 1.6% as of September 2025, lower than the Rest of NSW's rate of 3.8%.

Employment grew by 3.3% over the past year. As of that date, 1,929 residents were employed while workforce participation was 54.4%, slightly below Rest of NSW's 56.4%. Leading employment industries among residents include health care & social assistance, construction, and education & training.

Conversely, agriculture, forestry & fishing had lower representation at 0.0% compared to the regional average of 5.3%. Employment opportunities locally may be limited as indicated by the count of Census working population vs resident population. Over a 12-month period ending in September 2025, employment increased by 3.3% while labour force increased by 3.5%, causing the unemployment rate to rise by 0.2 percentage points. In comparison, Rest of NSW saw employment decline by 0.5%, labour force decline by 0.1%, with unemployment rising by 0.4 percentage points. State-level data from 25-Nov shows NSW employment contracted by 0.03% (losing 2,260 jobs), with the state unemployment rate at 3.9%. National employment forecasts from May-25 project national employment growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Redhead's employment mix suggests local employment should increase by 7.0% over five years and 14.4% over ten years, though this is a simple weighting extrapolation for illustrative purposes and does not account for localised population projections.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows Redhead SA2 had a median income of $55,166 and an average of $74,186. Nationally, these figures are high compared to the Rest of NSW's median of $49,459 and average of $62,998. Based on Wage Price Index growth of 12.61% since financial year 2022, estimates for September 2025 would be approximately $62,122 (median) and $83,541 (average). Census data reveals household, family and personal incomes rank modestly in Redhead, between the 41st and 42nd percentiles. Income analysis shows the $400 - 799 earnings band captures 26.2% of the community, with 1,004 individuals, differing from the region where the $1,500 - 2,999 category is predominant at 29.9%. The community displays economic stratification, with 32.8% in modest circumstances and 30.7% in high-earning categories. Housing costs are manageable with 86.7% retained, but disposable income sits below average at the 45th percentile, placing the area's SEIFA income ranking in the 6th decile.

Frequently Asked Questions - Income

Housing

Redhead is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Redhead, as per the latest Census evaluation, 93.3% of dwellings were houses with the remaining 6.7% comprising semi-detached homes, apartments, and other types. Compared to Non-Metro NSW's dwelling structure of 82.4% houses and 17.6% other dwellings, Redhead had a higher proportion of houses. Home ownership in Redhead stood at 57.2%, with mortgaged properties at 29.4% and rented dwellings at 13.4%. The median monthly mortgage repayment was $2,300, exceeding Non-Metro NSW's average of $2,000. The median weekly rent in Redhead was $420, higher than Non-Metro NSW's figure of $370. Nationally, Redhead's mortgage repayments were significantly higher than the Australian average of $1,863, and rents were substantially above the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Redhead features high concentrations of lone person households, with a lower-than-average median household size

Family households constitute 65.3% of all households, including 32.2% couples with children, 24.9% couples without children, and 7.8% single parent families. Non-family households account for the remaining 34.7%, with lone person households at 32.7% and group households comprising 1.7% of the total. The median household size is 2.4 people, smaller than the Rest of NSW average of 2.5.

Frequently Asked Questions - Households

Local Schools & Education

Redhead shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

The area's educational profile is notable regionally, with university qualification rates of 29.2% among residents aged 15+, surpassing the Rest of NSW average of 21.3% and the SA3 area rate of 23.5%. Bachelor degrees are most prevalent at 19.6%, followed by postgraduate qualifications (6.1%) and graduate diplomas (3.5%). Vocational credentials are also prominent, with 37.5% of residents aged 15+ holding such qualifications – advanced diplomas account for 11.6% while certificates make up 25.9%.

Educational participation is high, with 30.0% of residents currently enrolled in formal education. This includes 10.8% in primary education, 9.2% in secondary education, and 4.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is low compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

Transport analysis indicates 37 active transport stops operating within Redhead, consisting of buses. These stops are served by 9 unique routes, offering a total of 116 weekly passenger trips. Transport accessibility is rated excellent, with residents typically situated 149 meters from the nearest transport stop.

Service frequency averages 16 trips per day across all routes, translating to approximately 3 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Redhead is well below average with a range of health conditions having marked impacts on both younger and older age cohorts

Redhead faces significant health challenges, with various conditions affecting both younger and older residents. Private health cover is high at approximately 56%, or about 2,165 people, compared to 54.2% across the rest of NSW.

The most prevalent medical conditions are arthritis (9.9%) and mental health issues (8.9%). However, 62% of residents report no medical ailments, similar to the 62.6% in the rest of NSW. Redhead has a higher proportion of seniors aged 65 and over at 29.2%, or 1,120 people, compared to 21.4% in the rest of NSW. Health outcomes among seniors are broadly similar to those of the general population.

Frequently Asked Questions - Health

Cultural Diversity

Redhead is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Redhead's cultural diversity was found to be below average, with 89.5% of its population born in Australia, 93.3% being citizens, and 95.7% speaking English only at home. Christianity is the main religion in Redhead, comprising 55.6% of people, compared to 52.5% across Rest of NSW. The top three ancestry groups are English (33.1%), Australian (32.3%), and Scottish (9.6%).

Notably, Welsh (0.9%) is overrepresented in Redhead compared to the regional average of 0.8%, as are Macedonian (0.6% vs 0.4%) and Russian (0.4% vs 0.2%).

Frequently Asked Questions - Diversity

Age

Redhead hosts an older demographic, ranking in the top quartile nationwide

Redhead's median age of 48 years is notably older than Rest of NSW's 43 and significantly higher than Australia's median of 38. The age profile indicates that those aged 65-74 are particularly prominent, making up 15.0%, while the 25-34 group is comparatively smaller at 5.1%. This concentration of 65-74 year-olds is well above the national average of 9.4%. Post-2021 Census data shows that the 15 to 24 age group has grown from 10.0% to 12.8%, while the 65 to 74 cohort increased from 13.2% to 15.0%. Conversely, the 55 to 64 cohort has declined from 13.6% to 10.9%, and the 85+ group dropped from 5.9% to 4.1%. Demographic modeling suggests that Redhead's age profile will change significantly by 2041, with the 75-84 age cohort projected to grow steadily, expanding by 145 people (37%) from 391 to 537. In contrast, population declines are projected for the 55-64 and 65-74 cohorts.