Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in St Peters - Marden reveals an overall ranking slightly below national averages considering recent, and medium term trends

St Peters - Marden's population is around 14,378 as of Nov 2025. This reflects an increase of 863 people since the 2021 Census, which reported a population of 13,515 people. The change is inferred from the estimated resident population of 14,250 from the ABS as of June 2024 and an additional 77 validated new addresses since the Census date. This level of population equates to a density ratio of 2,404 persons per square kilometer. St Peters - Marden's growth rate of 6.4% since the census positions it within 0.7 percentage points of the state's growth rate of 7.1%. Population growth for the area was primarily driven by overseas migration that contributed approximately 92.0% of overall population gains during recent periods.

AreaSearch is adopting ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered and years post-2032, the SA State Government's Regional/LGA projections by age category are adopted, based on 2021 data and released in 2023. Moving forward, demographic trends suggest a population increase just below the median of national areas, with an expected expansion to 16,997 persons by 2041 based on the latest annual ERP population numbers, reflecting a gain of 10.2% over the 17 years.

Frequently Asked Questions - Population

Development

Residential development activity is slightly higher than average within St Peters - Marden when compared nationally

St Peters - Marden has seen approximately 54 new homes approved annually. Between FY-21 and FY-25, around 273 homes were approved, with an additional 33 approved so far in FY-26. On average, about 2 people moved to the area per new home constructed over those five financial years, indicating strong demand that supports property values.

New homes are being built at an average expected construction cost of $562,000, suggesting a focus on the premium segment with upmarket properties. This year has seen around $65.1 million in commercial approvals, indicating robust commercial development momentum. Compared to Greater Adelaide, St Peters - Marden has roughly two-thirds the rate of new dwelling approvals per person and ranks among the 44th percentile nationally, offering limited choices for buyers and supporting demand for existing dwellings.

Current development comprises approximately 60% detached houses and 40% attached dwellings, with an increasing blend of attached housing types offering choices across price ranges. The area has around 380 people per dwelling approval, reflecting its established nature. Future projections estimate St Peters - Marden will add approximately 1,472 residents by 2041, indicating that current development is well-matched to future needs and supports steady market conditions without extreme price pressure.

Frequently Asked Questions - Development

Infrastructure

St Peters - Marden has emerging levels of nearby infrastructure activity, ranking in the 37thth percentile nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified 14 projects likely to influence the region. Notable initiatives include Broad Street Reserve Playground Upgrade, East Park Development, Marden Connect Development, and Osmond Terrace Mixed-Use Development. The following list details those expected to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

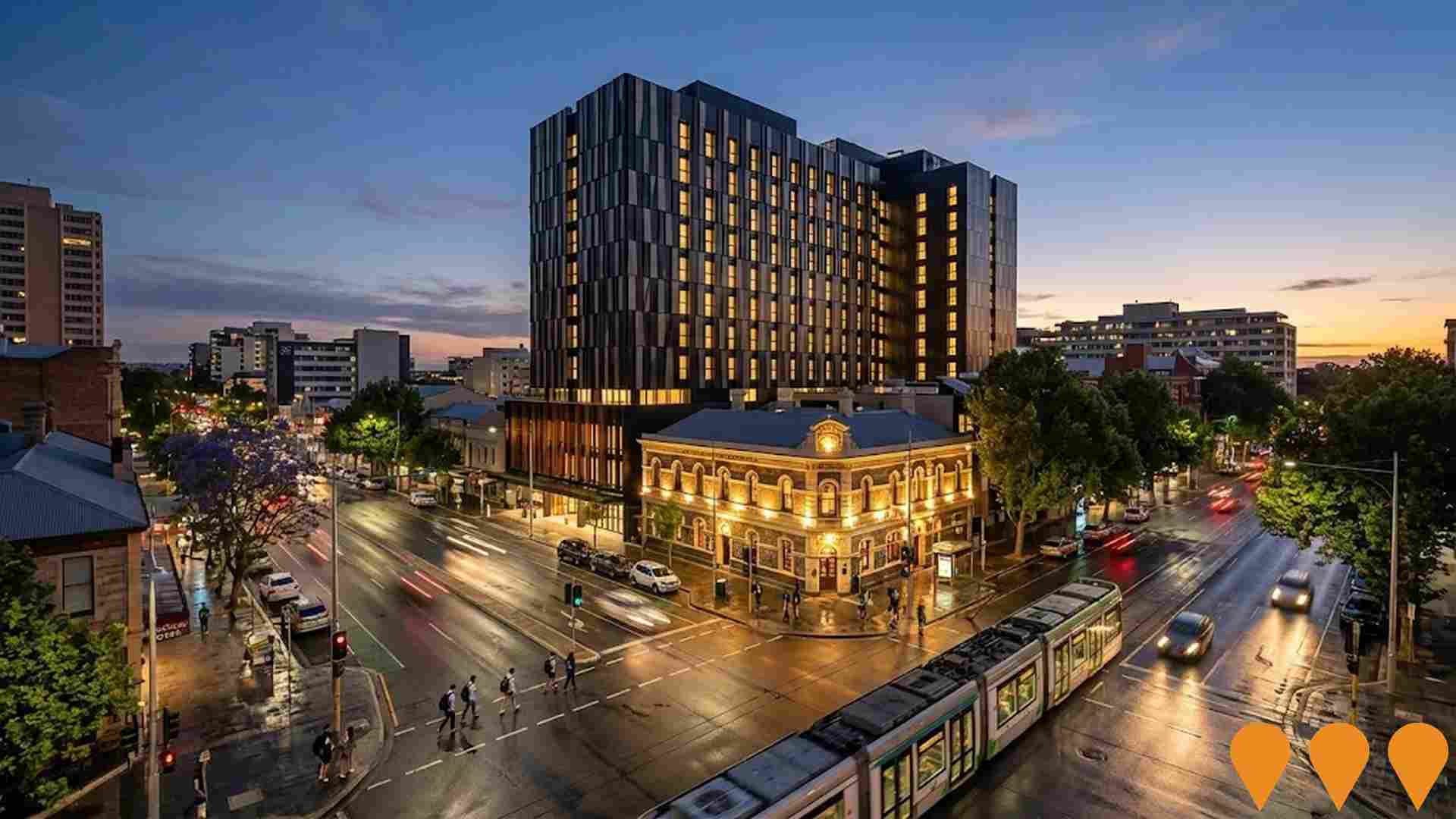

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

New Women's and Children's Hospital

A new $3.2 billion state-of-the-art hospital at the former SAPOL Barracks site with 414 overnight beds (56 more than current hospital) plus capacity for an additional 20 beds in future. Features include larger emergency department with 43 treatment spaces, Australia's first all-electric public hospital, integrated 4-bed ICU for women co-located with Paediatric ICU, on-site helipad with direct access to critical clinical areas, and all critical care services (birthing, theatres, PICU, NICU) co-located on one floor. Located in Adelaide BioMed City precinct near Royal Adelaide Hospital. Construction commenced April 2024 with $306 million Stage 1 works package (1,300-space car park and central energy facility) and $427 million Stage 2 foundational works package confirmed November 2024. New design team appointed June 2025. Expected completion 2030-31.

274-275 North Terrace Development Site

Premium 2,800sqm triple-street frontage development site opposite Lot Fourteen. Potential for Adelaide's tallest tower with mixed-use development including residential apartments, build-to-rent, hotel, student accommodation, retail and commercial space.

Norwood Oval Redevelopment

Major upgrade of the historic Norwood Oval including new grandstand, lighting, changerooms and community facilities, completed 2022-2024.

O-Bahn City Access Project

$160 million guided bus tunnel project extending O-Bahn system from Gilberton to cross-city priority bus lanes on Grenfell Street. Features 670-metre tunnel, centrally aligned priority bus lanes on Hackney Road, and improved access for 79,000 daily road users. Benefits Modbury through improved O-Bahn connectivity.

Norwood Green

A $120 million master-planned community at 100 Magill Road featuring 111 apartments, 33 townhouses, retail spaces including ALDI, and community green spaces. Built on former Caroma factory site by Buildtec Group and Catcorp.

East Park Development

A $70 million boutique residential development in Kent Town featuring 98 luxury apartments and townhouses with parkland views. The development includes one, two and three bedroom apartments with premium finishes, residents' pavilion, cafe, and gymnasium facilities. Developed by Palumbo.

The Parade Quarter

A landmark mixed-use development on The Parade featuring 120 luxury apartments above premium retail and dining tenancies, completed in 2023.

Osmond Terrace Mixed-Use Development

Contemporary mixed-use precinct delivering 85 apartments, ground-floor retail and commercial spaces directly opposite Norwood Oval.

Employment

AreaSearch analysis reveals St Peters - Marden significantly outperforming the majority of regions assessed nationwide

St Peters - Marden has a highly educated workforce with strong representation in professional services. The unemployment rate was 2.4% as of September 2025.

Employment growth over the past year was estimated at 3.0%. As of that date, 8,321 residents were employed while the unemployment rate was 1.5% lower than Greater Adelaide's rate of 3.9%. Workforce participation in St Peters - Marden was 65.2%, compared to Greater Adelaide's 61.7%. Key industries for employment among residents are health care & social assistance, professional & technical services, and education & training.

The area specializes in professional & technical services with an employment share of 1.8 times the regional level. Construction employs only 5.9% of local workers, below Greater Adelaide's 8.7%. Many residents commute elsewhere for work based on Census data analysis. In the year to September 2025, employment levels increased by 3.0%, labour force grew by 3.2%, resulting in a slight rise in unemployment (0.1 percentage points). This contrasts with Greater Adelaide where employment rose by 3.0% and unemployment fell by 0.1 percentage points. State-level data to 25-Nov shows SA employment grew by 1.19% year-on-year, with the state unemployment rate at 4.0%. National employment forecasts from May-25 suggest national employment will expand by 6.6% over five years and 14.8% over ten years. Applying these projections to St Peters - Marden's employment mix suggests local employment should increase by 7.2% over five years and 14.8% over ten years, assuming constant population projections.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

AreaSearch's latest postcode level ATO data for financial year 2022 shows that St Peters - Marden SA2 has extremely high national incomes. The median income is $58,643 and the average income stands at $88,428. This contrasts with Greater Adelaide's figures of a median income of $52,592 and an average income of $64,886. Based on Wage Price Index growth of 12.83% since financial year 2022, current estimates would be approximately $66,167 (median) and $99,773 (average) as of September 2025. Census 2021 income data shows personal income ranks at the 74th percentile ($954 weekly), while household income sits at the 57th percentile. Income brackets indicate that 28.0% of residents (4,025 people) fall into the $1,500 - 2,999 bracket, consistent with broader trends across the metropolitan region showing 31.8% in the same category. Notably, 31.1% earn above $3,000 weekly. After housing costs, residents retain 86.7% of income. The area's SEIFA income ranking places it in the 8th decile.

Frequently Asked Questions - Income

Housing

St Peters - Marden displays a diverse mix of dwelling types, with above-average rates of outright home ownership

The dwelling structure in St Peters - Marden, as per the latest Census, consisted of 61.6% houses and 38.4% other dwellings (semi-detached, apartments, 'other' dwellings), compared to Adelaide metro's 51.7% houses and 48.4% other dwellings. Home ownership in St Peters - Marden stood at 37.1%, with mortgaged dwellings at 30.0% and rented ones at 32.9%. The median monthly mortgage repayment was $2,080, higher than Adelaide metro's average of $2,000. Median weekly rent in the area was $320, lower than Adelaide metro's figure of $340. Nationally, St Peters - Marden's mortgage repayments were significantly higher than the Australian average of $1,863, while rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

St Peters - Marden features high concentrations of lone person households and group households, with a higher-than-average median household size

Family households comprise 63.8% of all households, including 28.6% couples with children, 26.3% couples without children, and 7.8% single parent families. Non-family households make up 36.2%, with lone person households at 31.8% and group households comprising 4.5%. The median household size is 2.3 people, which is larger than the Greater Adelaide average of 2.2.

Frequently Asked Questions - Households

Local Schools & Education

St Peters - Marden shows strong educational performance, ranking in the upper quartile nationally when assessed across multiple qualification and achievement indicators

Educational attainment in St Peters - Marden is notable, with 48.6% of residents aged 15+ holding university qualifications, compared to 25.7% statewide (SA) and 28.9% in the Greater Adelaide area. Bachelor degrees are most common at 30.5%, followed by postgraduate qualifications at 13.3% and graduate diplomas at 4.8%. Vocational pathways account for 21.9% of qualifications, with advanced diplomas at 9.3% and certificates at 12.6%. Educational participation is high, with 29.2% of residents currently enrolled in formal education, including 9.1% in tertiary, 8.4% in primary, and 7.2% in secondary education.

Educational participation is notably high, with 29.2% of residents currently enrolled in formal education. This includes 9.1% in tertiary education, 8.4% in primary education, and 7.2% pursuing secondary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

Transport servicing is good compared to other areas nationally based on assessment of service frequency, route connectivity and accessibility

The analysis of public transport in the St Peters - Marden area shows that there are currently 57 active transport stops operating. These stops offer a variety of bus services, with a total of 27 individual routes serving the area. Together, these routes facilitate approximately 2,660 weekly passenger trips.

The report rates the transport accessibility in this region as good, with residents typically located about 216 meters from their nearest transport stop. On average, there are around 380 trips per day across all routes, which translates to roughly 46 weekly trips per individual stop.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

The level of general health in St Peters - Marden is notably higher than the national average with both young and old age cohorts seeing low prevalence of common health conditions

St Peters - Marden demonstrates above-average health outcomes with both young and old age cohorts seeing low prevalence of common health conditions. The rate of private health cover is exceptionally high at approximately 64% of the total population (9201 people), compared to 61.4% across Greater Adelaide, and 55.3% nationally. The most common medical conditions in the area are mental health issues and arthritis, impacting 7.7% and 7.3% of residents respectively, while 71.3% declared themselves completely clear of medical ailments compared to 70.4% across Greater Adelaide.

As of 2021, the area has 19.9% of residents aged 65 and over (2864 people). Health outcomes among seniors are particularly strong, performing even better than the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

The level of cultural diversity witnessed in St Peters - Marden was found to be above average when compared nationally for a number of language and cultural background related metrics

St Peters-Marden has a higher cultural diversity than most local markets, with 28.8% of its population born overseas and 24.0% speaking a language other than English at home. Christianity is the predominant religion in St Peters-Marden, accounting for 46.3% of the population. The category 'Other' comprises 1.5% of the population, slightly higher than the Greater Adelaide average of 1.6%.

In terms of ancestry, the top three groups are English (24.7%), Australian (19.6%), and Italian (10.0%). Some ethnic groups show notable differences: Greek is overrepresented at 3.2% compared to the regional average of 2.9%, German is similarly represented at 5.1% versus 5.0%, and Polish is also slightly higher at 0.9%.

Frequently Asked Questions - Diversity

Age

St Peters - Marden's population is slightly older than the national pattern

The median age in St Peters - Marden is 40 years, similar to Greater Adelaide's average of 39 years but somewhat older than Australia's average of 38 years. The percentage of residents aged 15-24 is strong at 14.3%, compared to Greater Adelaide's figure, while the 5-14 age group is less prevalent at 9.7%. According to post-2021 Census data, the 15-24 age group has grown from 12.0% to 14.3% of the population. Conversely, the 45-54 age group has declined from 12.8% to 11.3%, and the 5-14 age group has dropped from 10.8% to 9.7%. Population forecasts for 2041 indicate significant demographic changes in St Peters - Marden. Notably, the 85+ age group is projected to grow by 89% (407 people), reaching 865 from 457. The combined 65+ age groups are expected to account for 60% of total population growth, reflecting the area's aging demographic profile. In contrast, the 0-4 age group is projected to decline by 1 person.