Chart Color Schemes

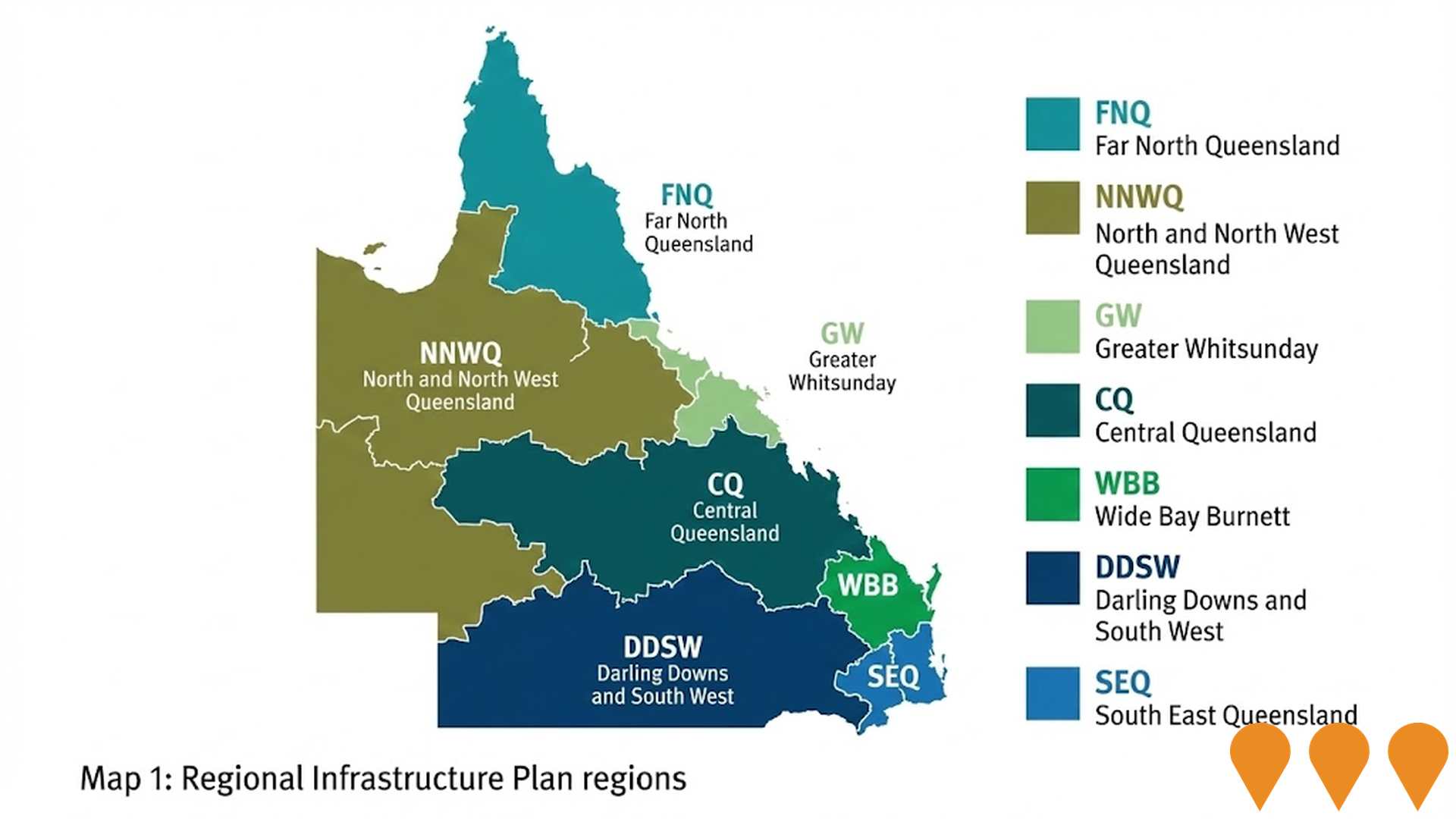

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Mount Isa has shown very soft population growth performance across periods assessed by AreaSearch

Mount Isa's population was approximately 18,333 as of November 2025. This figure represents an increase of 16 people since the 2021 Census, which recorded a population of 18,317. The change is inferred from the estimated resident population of 18,356 in June 2024 and the addition of 15 validated new addresses since the Census date. This results in a density ratio of 266 persons per square kilometer. Mount Isa's growth rate of 0.1% since the census is within 2.5 percentage points of the SA3 area's growth rate of 2.6%. Natural growth contributed approximately 64.7% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections from 2023, based on 2021 data, are adopted. However, these state projections do not provide age category splits, so AreaSearch applies proportional growth weightings in line with ABS Greater Capital Region projections released in 2023, based on 2022 data, for each age cohort. Projections indicate a decline in overall population by 619 persons by 2041. However, the 25 to 34 age group is projected to increase by 446 people during this period.

Frequently Asked Questions - Population

Development

The level of residential development activity in Mount Isa is very low in comparison to the average area assessed nationally by AreaSearch

Mount Isa has received approximately 10 dwelling approvals annually. Over the past five financial years, from FY21 to FY25, 53 homes were approved, with none yet in FY26. The population decline in recent years suggests adequate development activity relative to population size, benefiting buyers.

New dwellings are developed at an average cost of $595,000, indicating a focus on the premium market segment. This year, $17.4 million in commercial development approvals have been recorded, suggesting balanced commercial development activity. Compared to the rest of Queensland and nationally, Mount Isa has about half the construction activity per person, placing it around the 14th percentile of areas assessed, which limits buyer options but strengthens demand for established homes. Recent construction activity has intensified, reflecting market maturity and possible development constraints. New building activity consists of 11.0% detached houses and 89.0% townhouses or apartments, creating more affordable entry points for downsizers, investors, and first-home buyers. This shift from the current housing mix (76.0% houses) is due to reduced availability of development sites and changing lifestyle demands and affordability requirements.

The area has an estimated 4898 people per dwelling approval, indicating a quiet, low activity development environment. With population expected to remain stable or decline, Mount Isa should see reduced pressure on housing, potentially creating opportunities for buyers.

Frequently Asked Questions - Development

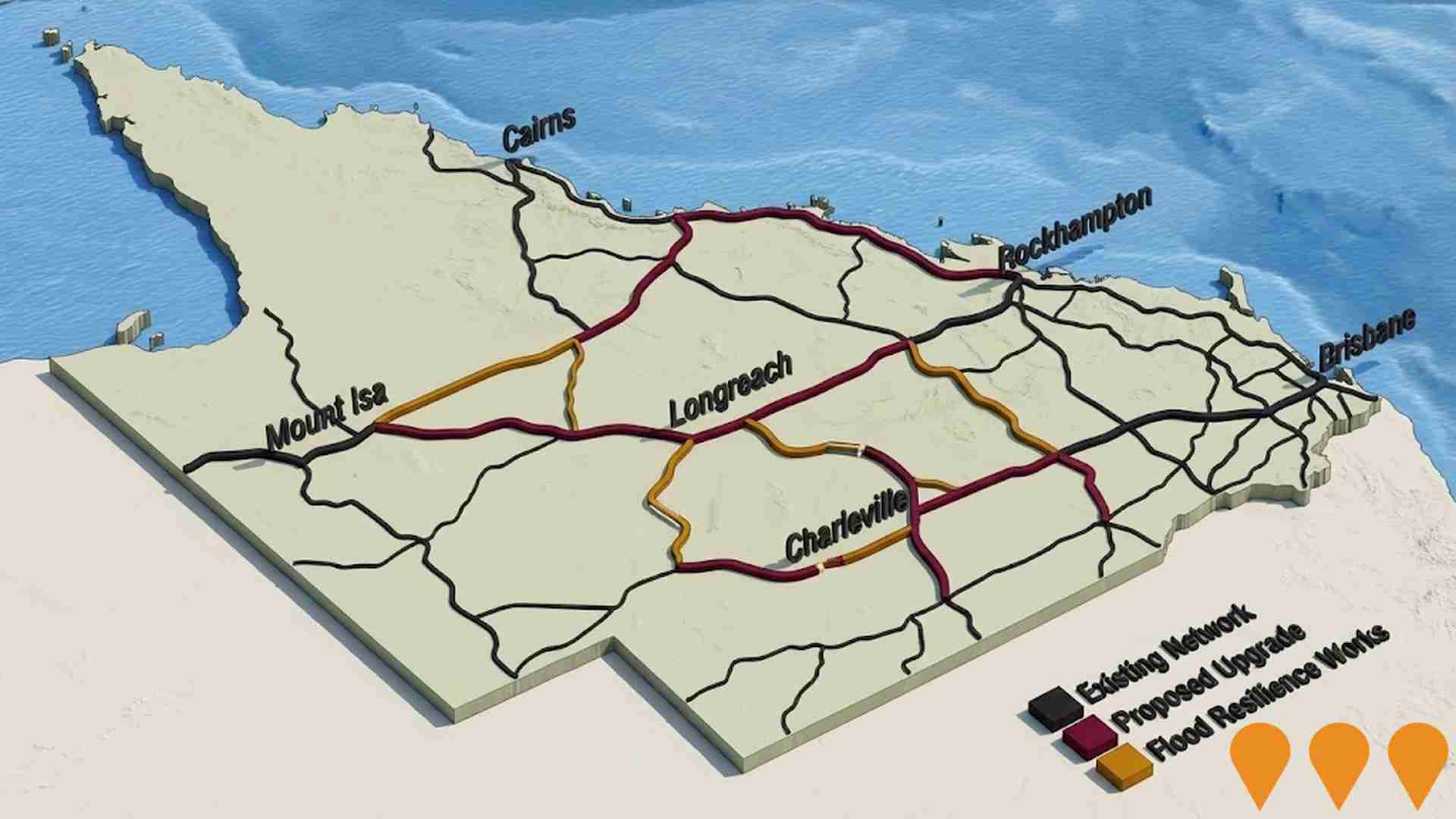

Infrastructure

Mount Isa has very high levels of nearby infrastructure activity, ranking in the top 20% nationally

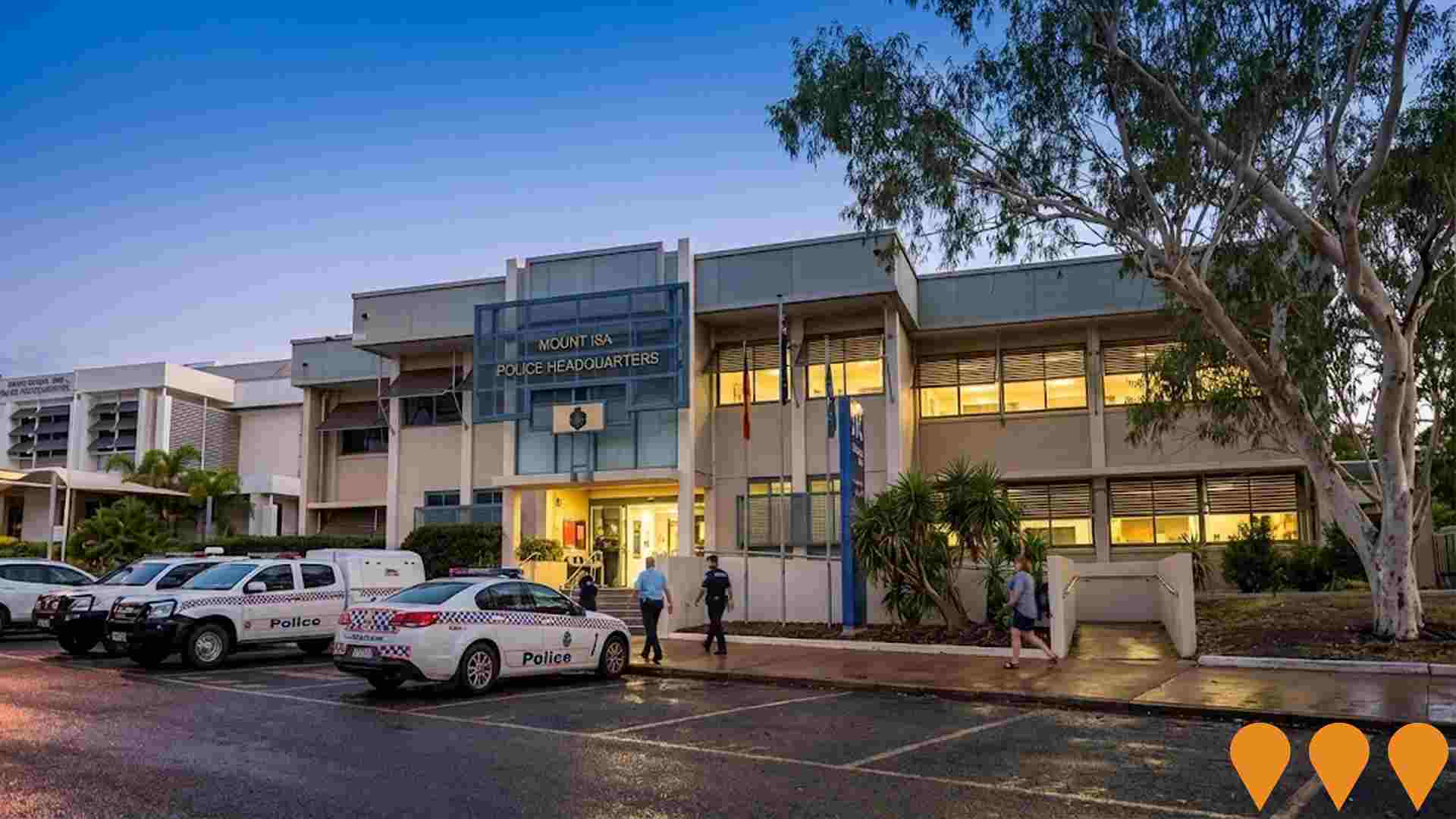

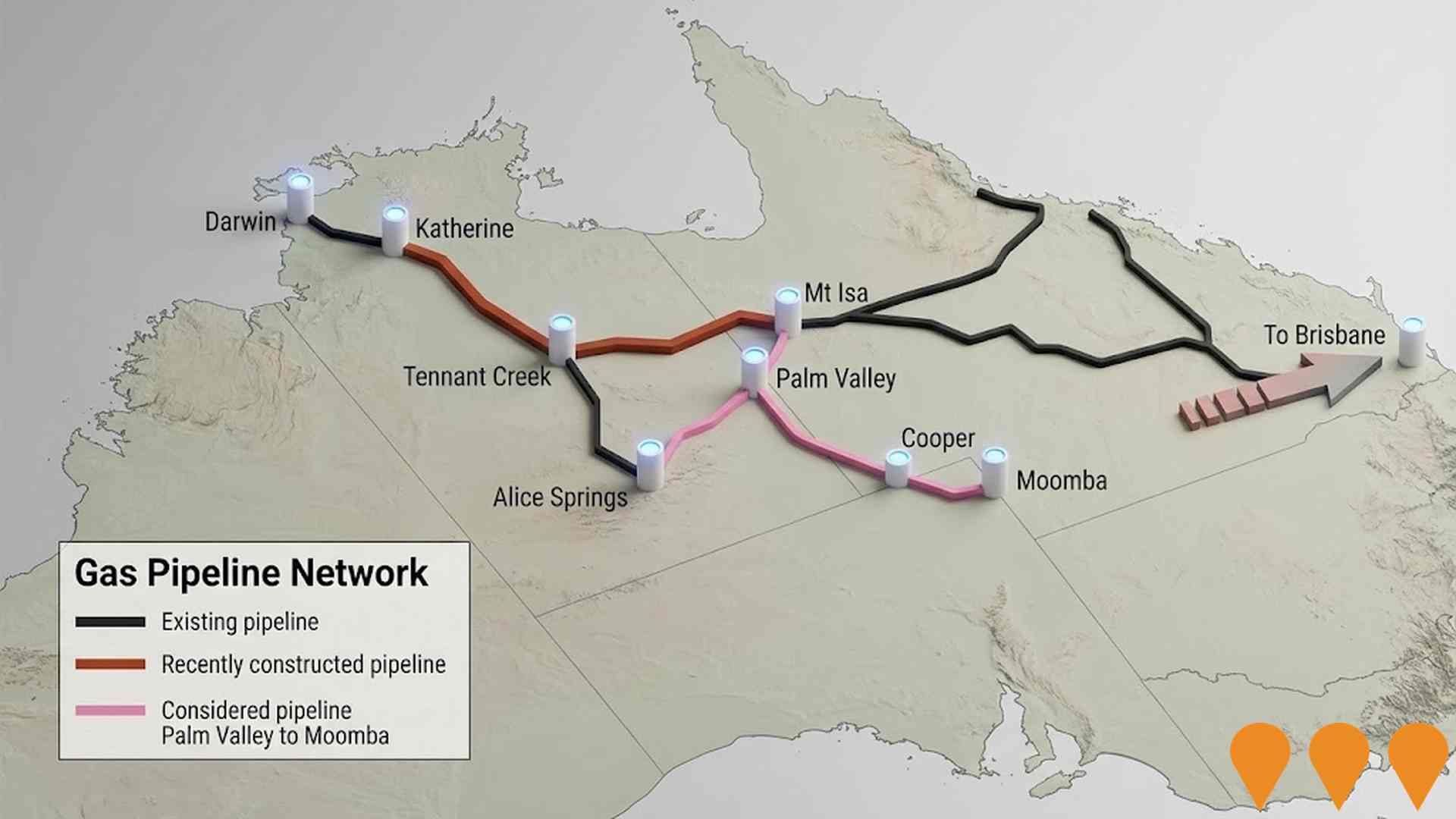

Five projects have been identified by AreaSearch as potentially impacting the area. These include: Mount Isa Mines' Black Star Open Cut Project, Mount Isa Future Ready Economy Plan, Mount Isa Police Accommodation and Justice System Resourcing, and Essential Pipeline Works - City Low and high Systems. The following list details those considered most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

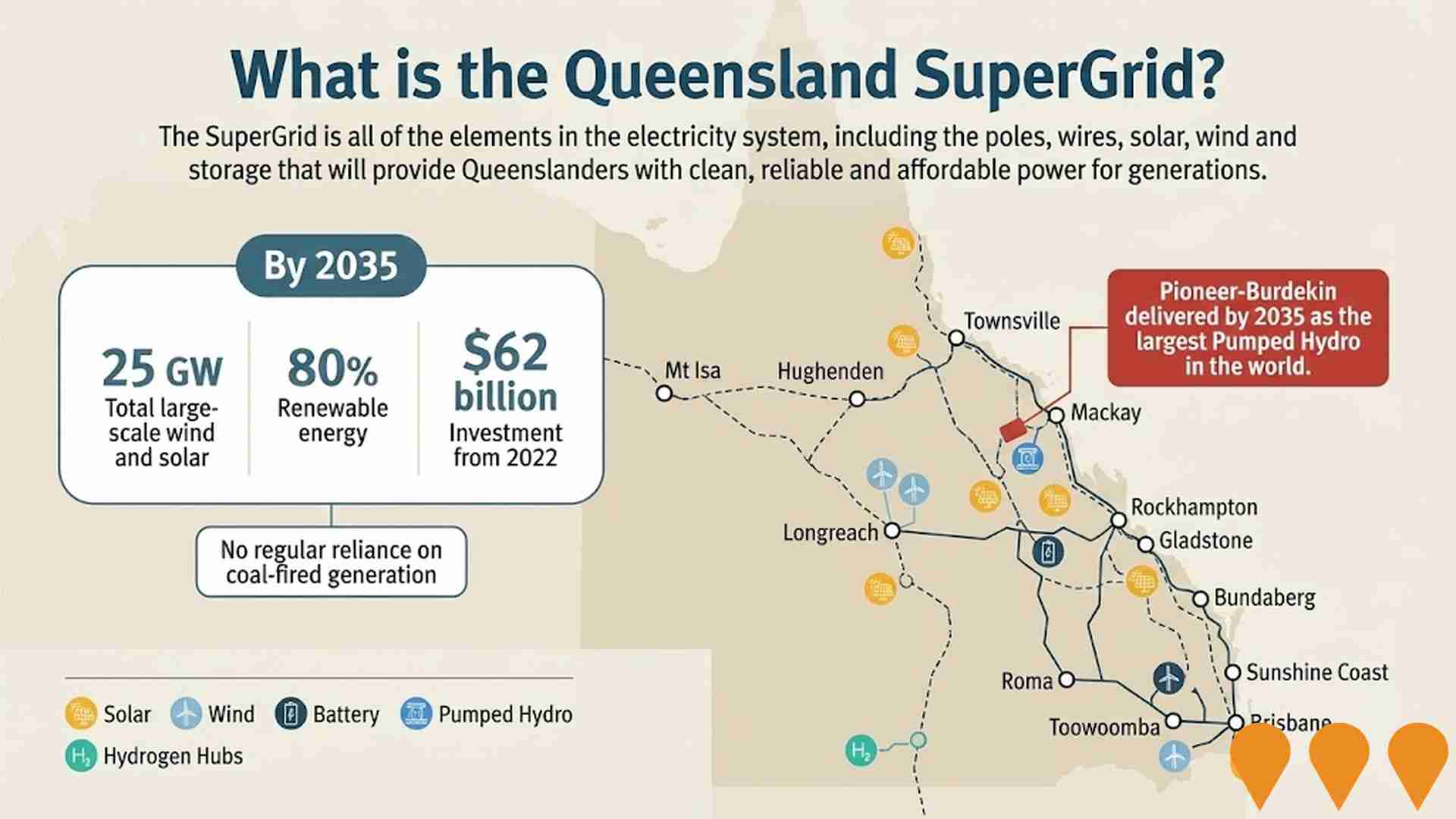

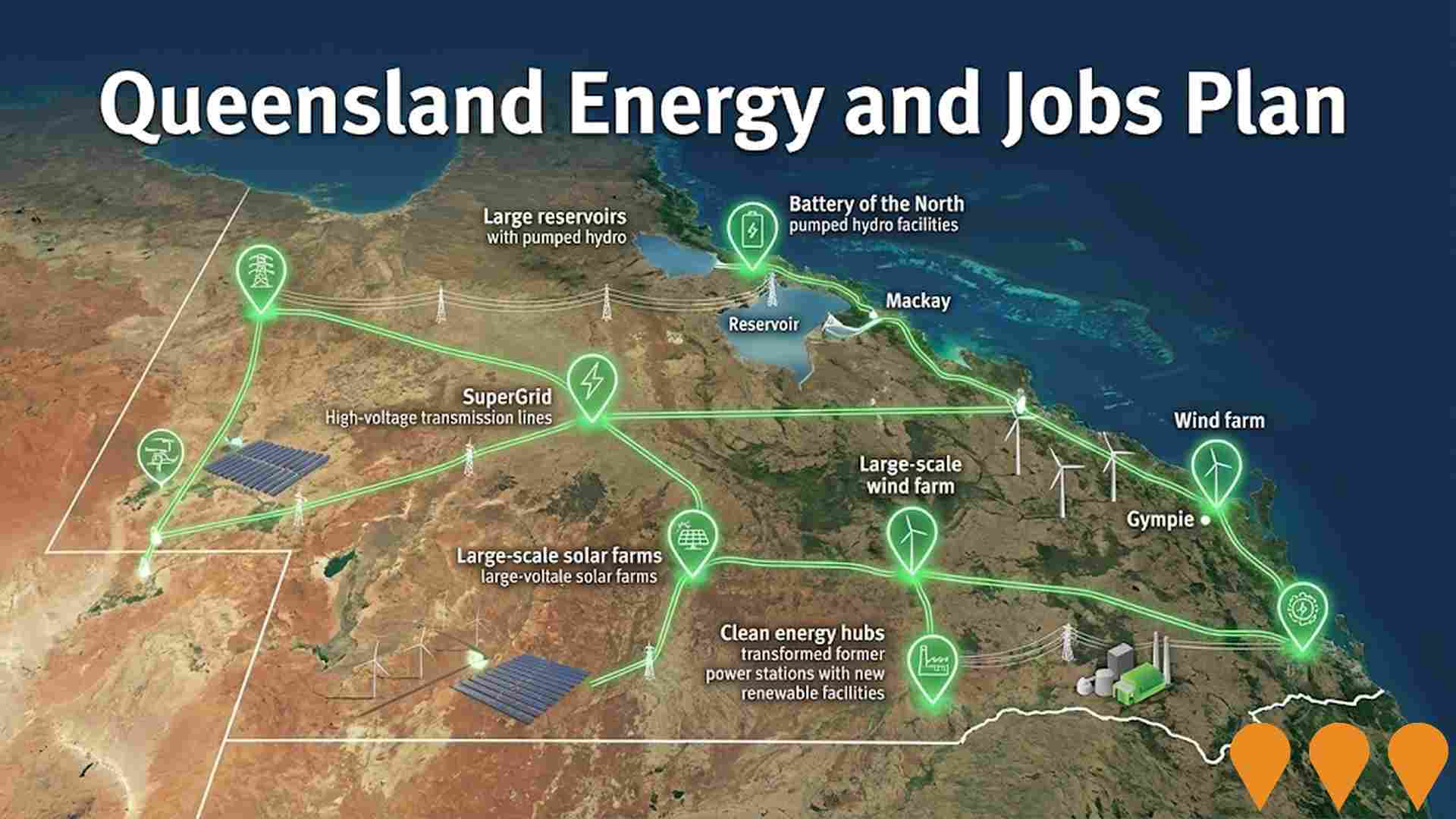

Queensland Energy and Jobs Plan

State-wide renewable energy transformation program delivering large-scale wind, solar, pumped hydro, battery storage and transmission infrastructure. Aims for 70% renewable energy by 2032 and 80% by 2035, supporting 100,000 jobs by 2040 across regional Queensland. Largest clean energy investment program in Australia.

Queensland Energy and Jobs Plan - Northern Queensland SuperGrid (CopperString 2032 & Northern REZ)

Flagship component of the Queensland Energy and Jobs Plan delivering the 1,100 km CopperString 2032 high-voltage transmission project, establishment of the Northern Renewable Energy Zone, and supporting SuperGrid infrastructure to unlock large-scale renewable energy and critical minerals processing in North and North-West Queensland.

Queensland Energy and Jobs Plan SuperGrid

The Queensland Energy and Jobs Plan is delivering the Queensland SuperGrid and 22 GW of new renewable energy capacity through Renewable Energy Zones (REZs) across the state. Legislated targets are 50% renewables by 2030, 70% by 2032 and 80% by 2035. Key delivery mechanisms include the Energy (Renewable Transformation and Jobs) Act 2024, the SuperGrid Infrastructure Blueprint, the Queensland REZ Roadmap and the Priority Transmission Investments (PTI) framework. Multiple transmission projects are now in construction including CopperString 2032, Gladstone PTI (Central Queensland SuperGrid), Southern Queensland SuperGrid reinforcements, and numerous grid-scale batteries and pumped hydro projects under active development.

Queensland Energy and Jobs Plan

The Queensland Energy and Jobs Plan is a $62 billion+ statewide program to deliver publicly owned renewable energy generation, large-scale battery and pumped hydro storage, and the Queensland SuperGrid transmission backbone. Targets: 50% renewables by 2030, 70% by 2032, 80% by 2035. Multiple projects are now under construction including CopperString 2032, Pioneer-Burdekin Pumped Hydro, and numerous Renewable Energy Zones.

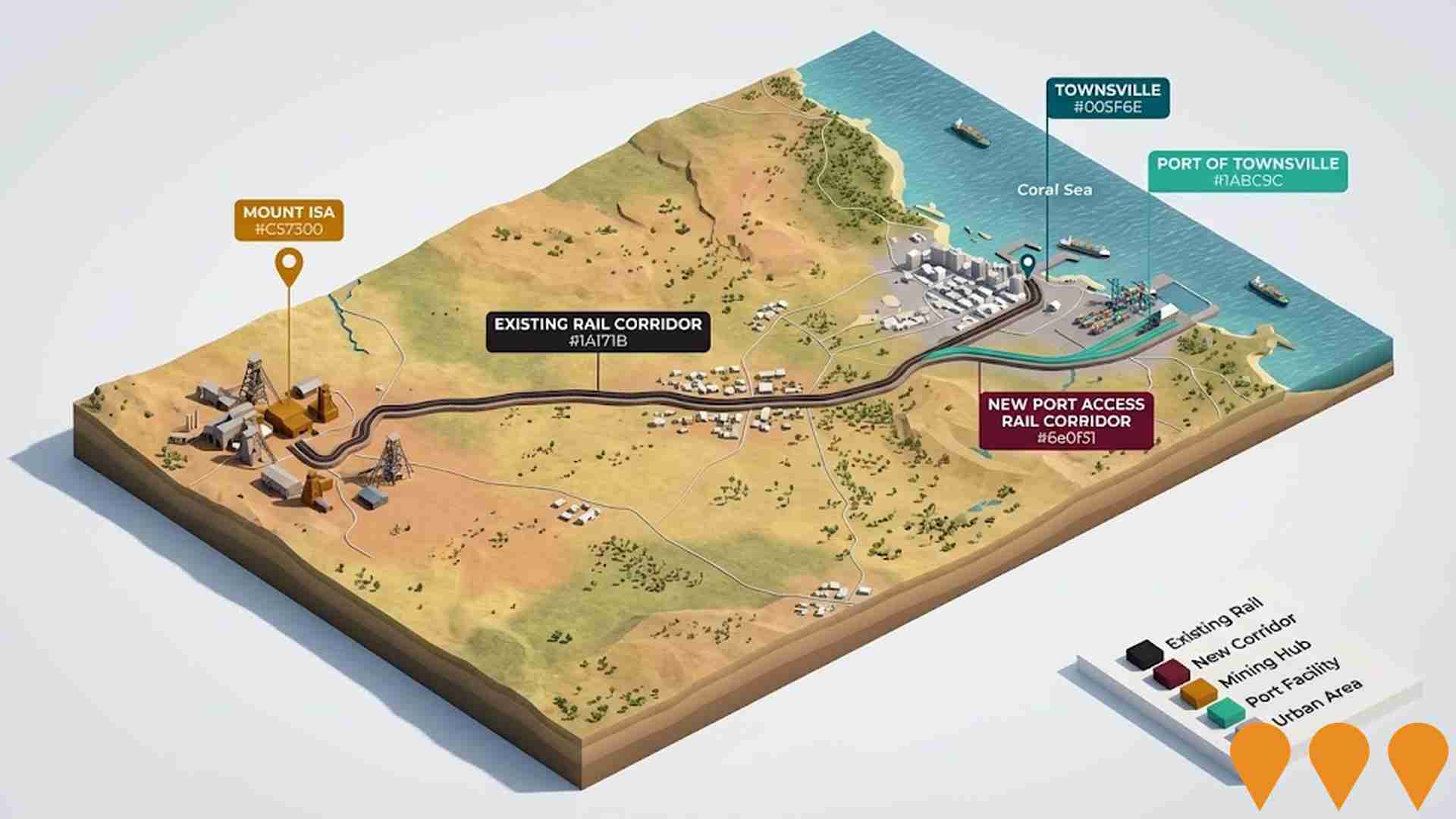

CopperString 2032

CopperString 2032 is a 1,100 km high-voltage transmission project (including spurs) connecting the North West Minerals Province to the National Electricity Market for the first time. The 500 kV line runs from just south of Townsville to Mount Isa, with construction underway since mid-2024. Fully funded with Queensland Government ownership, it will unlock large-scale renewable generation and critical minerals projects in north-west Queensland. Expected energisation by late 2029.

Mount Isa Future Ready Economy Plan

A strategic roadmap led by Mount Isa City Council to transition Mount Isa into a renewable energy and critical minerals hub as traditional mining declines. The plan focuses on large-scale wind and solar generation, repurposing closed underground mines for pumped hydro/gravity energy storage, and establishing green hydrogen and critical minerals processing facilities.

CopperString 2032

The CopperString 2032 project involves constructing approximately 840 km of high-voltage electricity transmission lines to connect Queensland's North West Minerals Province to the National Electricity Market. It includes a 500 kV line from Townsville to Hughenden, a 330 kV line from Hughenden to Cloncurry, a 220 kV line from Cloncurry to Mount Isa, along with substations and supporting facilities. The project is prioritizing the Eastern Link with private investment sought for the Western Link.

Mount Isa Mines - Black Star Open Cut Project

Glencore is advancing a pre-feasibility study to reopen and extend the Black Star Open Cut mine at Mount Isa. Subject to approvals and investment decision, the large-scale operation would supply zinc, lead and copper ores to Mount Isa's processing facilities, create around 300-400 jobs, and operate for about 10-20 years starting from late 2027 or 2028.

Employment

AreaSearch analysis indicates Mount Isa maintains employment conditions that align with national benchmarks

Mount Isa has a skilled workforce with manufacturing and industrial sectors well-represented. As of September 2025, the unemployment rate is 3.7%.

By this date, 10,439 residents are employed while the unemployment rate is 0.4% below Rest of Qld's rate of 4.1%. Workforce participation in Mount Isa stands at 68.5%, higher than Rest of Qld's 59.1%. Key industries for employment among residents include mining, health care & social assistance, and education & training. Mining is particularly strong with an employment share 8.8 times the regional level.

Conversely, construction shows lower representation at 4.3% compared to the regional average of 10.1%. While local employment opportunities exist, many residents commute elsewhere for work based on Census data. Between September 2024 and September 2025, Mount Isa's labour force decreased by 0.8%, with a 0.7% decline in employment, keeping the unemployment rate relatively stable. In contrast, Rest of Qld saw employment growth of 1.7% and labour force growth of 2.1%. As of 25-Nov-25, Queensland's employment contracted by 0.01%, with a state unemployment rate of 4.2%, closely aligned with the national rate of 4.3%. Jobs and Skills Australia forecasts national employment to expand by 6.6% over five years and 13.7% over ten years. Applying these projections to Mount Isa's employment mix suggests local employment should increase by 5.1% over five years and 12.0% over ten years, though this is a simplified extrapolation for illustrative purposes.

Frequently Asked Questions - Employment

Income

The economic profile demonstrates exceptional strength, placing the area among the top 10% nationally based on comprehensive AreaSearch income analysis

AreaSearch aggregated latest postcode level ATO data released for financial year 2022 indicates Mount Isa SA2 had a median income among taxpayers of $71,448 and an average level of $81,957. These figures are among the highest in Australia, compared to $50,780 and $64,844 across Rest of Qld respectively. Based on Wage Price Index growth of 13.99% since financial year 2022, current estimates for Mount Isa would be approximately $81,444 (median) and $93,423 (average) as of September 2025. Census 2021 income data shows household, family and personal incomes in Mount Isa rank highly nationally, between the 80th and 88th percentiles. Distribution data indicates the $1,500 - 2,999 earnings band captures 35.4% of the community (6,489 individuals), similar to the broader area where this cohort represents 31.7%. Economic strength is evident with 33.2% of households achieving high weekly earnings exceeding $3,000, supporting elevated consumer spending. After housing costs, residents retain 88.7% of income, reflecting strong purchasing power and the area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Mount Isa is characterized by a predominantly suburban housing profile, with ownership patterns similar to the broader region

Mount Isa's dwelling structures, as per the latest Census, were 75.6% houses and 24.4% other dwellings (semi-detached, apartments, 'other' dwellings). In comparison, Non-Metro Qld had 77.3% houses and 22.7% other dwellings. Home ownership in Mount Isa was at 17.6%, with mortgaged dwellings at 32.8% and rented ones at 49.6%. The median monthly mortgage repayment in Mount Isa was $1,546, higher than Non-Metro Qld's average of $1,500. The median weekly rent figure in Mount Isa was $275, compared to Non-Metro Qld's $220. Nationally, Mount Isa's mortgage repayments were lower at $1,546 versus the Australian average of $1,863. Rents in Mount Isa were substantially below the national figure of $375 at $275.

Frequently Asked Questions - Housing

Household Composition

Mount Isa features high concentrations of group households, with a fairly typical median household size

Family households constitute 67.9% of all households, including 30.6% couples with children, 22.9% couples without children, and 13.2% single parent families. Non-family households account for the remaining 32.1%, with lone person households making up 28.1% and group households comprising 3.9%. The median household size is 2.6 people, which aligns with the average in the Rest of Qld.

Frequently Asked Questions - Households

Local Schools & Education

Mount Isa faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area has university qualification rates of 18.6%, significantly lower than the Australian average of 30.4%. Bachelor degrees are the most common at 13.3%, followed by postgraduate qualifications (3.3%) and graduate diplomas (2.0%). Vocational credentials are prominent, with 40.9% of residents aged 15+ holding them - advanced diplomas account for 7.6% and certificates for 33.3%. Educational participation is high, with 33.0% of residents currently enrolled in formal education.

This includes 13.7% in primary education, 9.5% in secondary education, and 3.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Mount Isa's residents boast exceedingly positive health performance metrics with younger cohorts in particular seeing very low prevalence of common health conditions

Mount Isa's health outcomes show notable results, with younger age groups having a low prevalence of common conditions. Private health cover stands at approximately 61% (11,146 people), higher than Queensland's average of 57.6%. Nationally, it is 55.3%.

Asthma and mental health issues are the most prevalent conditions, affecting 7.2 and 5.6% respectively. Overall, 76.3% report no medical ailments, similar to Rest of Qld's 76.2%. Mount Isa has a lower proportion of residents aged 65 and over at 8.5% (1,556 people), compared to Queensland's average of 10.0%.

Frequently Asked Questions - Health

Cultural Diversity

In terms of cultural diversity, Mount Isa records figures broadly comparable to the national average, as found in AreaSearch's assessment of a number of language and cultural background related metrics

Mount Isa's cultural diversity aligns with the broader region, as 80.9% of its residents are citizens, 81.8% were born in Australia, and 89.1% speak English only at home. Christianity is the predominant religion in Mount Isa, accounting for 51.6%, similar to the regional average of 52.2%. The top three ancestry groups in Mount Isa are Australian (25.6%), English (21.8%), and Australian Aboriginal (14.6%), the latter being lower than the regional average of 20.0%.

Notably, Maori (1.8% vs 1.3%), Filipino (3.0% vs 2.0%), and Samoan (0.5% vs 0.4%) groups are overrepresented in Mount Isa compared to the wider region.

Frequently Asked Questions - Diversity

Age

Mount Isa hosts a very young demographic, ranking in the bottom 10% of areas nationwide

Mount Isa's median age in 2021 was 31 years, which is younger than Rest of Qld's median age of 41 and considerably younger than the national average of 38 years. The age group of 25-34 years had a strong representation at 18.9% compared to Rest of Qld, while the 65-74 cohort was less prevalent at 4.9%. Between 2021 and the present, the percentage of the population aged 25 to 34 has increased from 17.9% to 18.9%, while the percentage of those aged 45 to 54 has declined from 12.1% to 10.7%. Population forecasts for Mount Isa indicate substantial demographic changes by 2041. The age cohort of 25 to 34 is projected to increase significantly, with an expected rise of 358 people (10%) from 3,468 to 3,827. Conversely, population declines are projected for the age cohorts of 45 to 54 and 5 to 14 years.