Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

An assessment of population growth drivers in Gin Gin reveals an overall ranking slightly below national averages considering recent, and medium term trends

Gin Gin's population, as of November 2025, is approximately 5,800 people. This figure represents an increase of 398 individuals since the 2021 Census, which recorded a population of 5,402. The growth is inferred from the estimated resident population of 5,745 in June 2024 and the addition of 156 validated new addresses after the Census date. This results in a population density of 2.5 persons per square kilometer. Gin Gin's 7.4% growth since the 2021 census exceeded the SA3 area average of 6.2%, indicating it as a regionally significant growth leader. Interstate migration accounted for approximately 82.3% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with a base year of 2022. For areas not covered by this data and years post-2032, Queensland State Government's SA2 area projections are adopted, which were released in 2023 using 2021 data. However, these state projections lack age category splits, so AreaSearch applies proportional growth weightings based on ABS Greater Capital Region projections for each age cohort, released in 2023 with a base year of 2022. Based on projected demographic shifts, Gin Gin is expected to grow by approximately 390 persons to 2041, reflecting a total gain of 5.8% over the 17-year period.

Frequently Asked Questions - Population

Development

Recent residential development output has been above average within Gin Gin when compared nationally

Gin Gin has seen approximately 20 new homes approved annually. Over the past five financial years, from FY-21 to FY-25102 homes were approved, with a further six approved in FY-26. On average, 4.1 new residents arrived per dwelling constructed over these five years.

This demand outpaces supply, potentially putting upward pressure on prices and increasing competition among buyers. The average construction cost of new homes is $230,000, below the regional average, suggesting more affordable housing options for buyers in Gin Gin. In FY-26, $1.9 million worth of commercial approvals have been registered, indicating the area's residential nature.

Compared to the rest of Queensland, Gin Gin has seen slightly more development, with 13.0% above the regional average per person over the five-year period, providing reasonable buyer options while sustaining existing property demand. All new construction in the area consists of detached dwellings, maintaining its traditional low-density character focused on family homes. There are approximately 228 people per dwelling approval in Gin Gin, suggesting room for growth. According to AreaSearch's latest quarterly estimate, Gin Gin's population is forecasted to grow by 335 residents by 2041. With current construction levels, housing supply should meet demand adequately, creating favourable conditions for buyers and potentially enabling growth that exceeds current forecasts.

Frequently Asked Questions - Development

Infrastructure

Gin Gin has strong levels of nearby infrastructure activity, ranking in the top 30% nationally

Changes to local infrastructure significantly impact an area's performance. AreaSearch has identified seven projects expected to influence the region. Notable initiatives are Bundaberg Solar Farm by GPG Australia, Mt Rawdon Pumped Hydro Project, Mt Perry Summit Walk, and Mount Perry Waste Facility Solar Upgrade Project. The following list details those most pertinent:.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Santos GLNG Project

Large-scale coal seam gas to LNG project comprising upstream gas field development in the Surat and Bowen Basins, gas transmission pipelines, and a liquefied natural gas (LNG) plant on Curtis Island near Gladstone. The project has been operational since 2015 with ongoing drilling and field expansion activities.

Queensland Energy and Jobs Plan

The Queensland Energy and Jobs Plan, initially a comprehensive plan for renewable energy and job creation, has been superseded by the Queensland Energy Roadmap 2025 by the new government (October 2025). The Roadmap focuses on energy affordability, reliability, and sustainability by leveraging existing coal and gas assets, increasing private sector investment in renewables and storage (targeting 6.8 GW of wind/solar and 3.8 GW of storage by 2030), and developing a new Regional Energy Hubs framework to replace Renewable Energy Zones. The initial $62 billion investment pipeline is now primarily focused on implementing the new Roadmap's priorities, including an estimated $26 billion in reduced energy system costs compared to the previous plan. The foundational legislation is the Energy Roadmap Amendment Bill 2025, which is currently before Parliament and expected to pass by December 2025, formally repealing the previous renewable energy targets. Key infrastructure projects like CopperString's Eastern Link are still progressing. The overall project is in the planning and legislative amendment phase under the new policy.

New Paradise Dam Wall

Construction of a new 12.6 m high roller-compacted concrete dam wall immediately downstream of the existing Paradise Dam on the Burnett River. The new wall will restore full water supply capacity (approximately 300,000 ML) and bring the dam up to modern safety standards after the existing structure was deemed irreparable due to foundation and concrete durability issues. Works include demolition/removal of the existing primary spillway, construction of a new secondary spillway, and associated river diversion works. Essential water security and flood mitigation infrastructure for the Bundaberg and Wide Bay region.

Building Future Hospitals Program

Queensland's flagship hospital infrastructure program delivering over 2,600 new and refurbished public hospital beds by 2031-32. Includes major expansions at Ipswich Hospital (Stage 2), Logan Hospital, Princess Alexandra Hospital, Townsville University Hospital, Gold Coast University Hospital and multiple new satellite hospitals and community health centres.

Mt Rawdon Pumped Hydro Project

The Mt Rawdon Pumped Hydro Project is a proposed 2 GW / 20 GWh off-river pumped hydro energy storage project that will repurpose the existing void of the Mount Rawdon gold mine as the lower reservoir and construct a new upper reservoir on adjacent land. The project is currently preparing an Environmental Impact Statement (EIS) for submission.

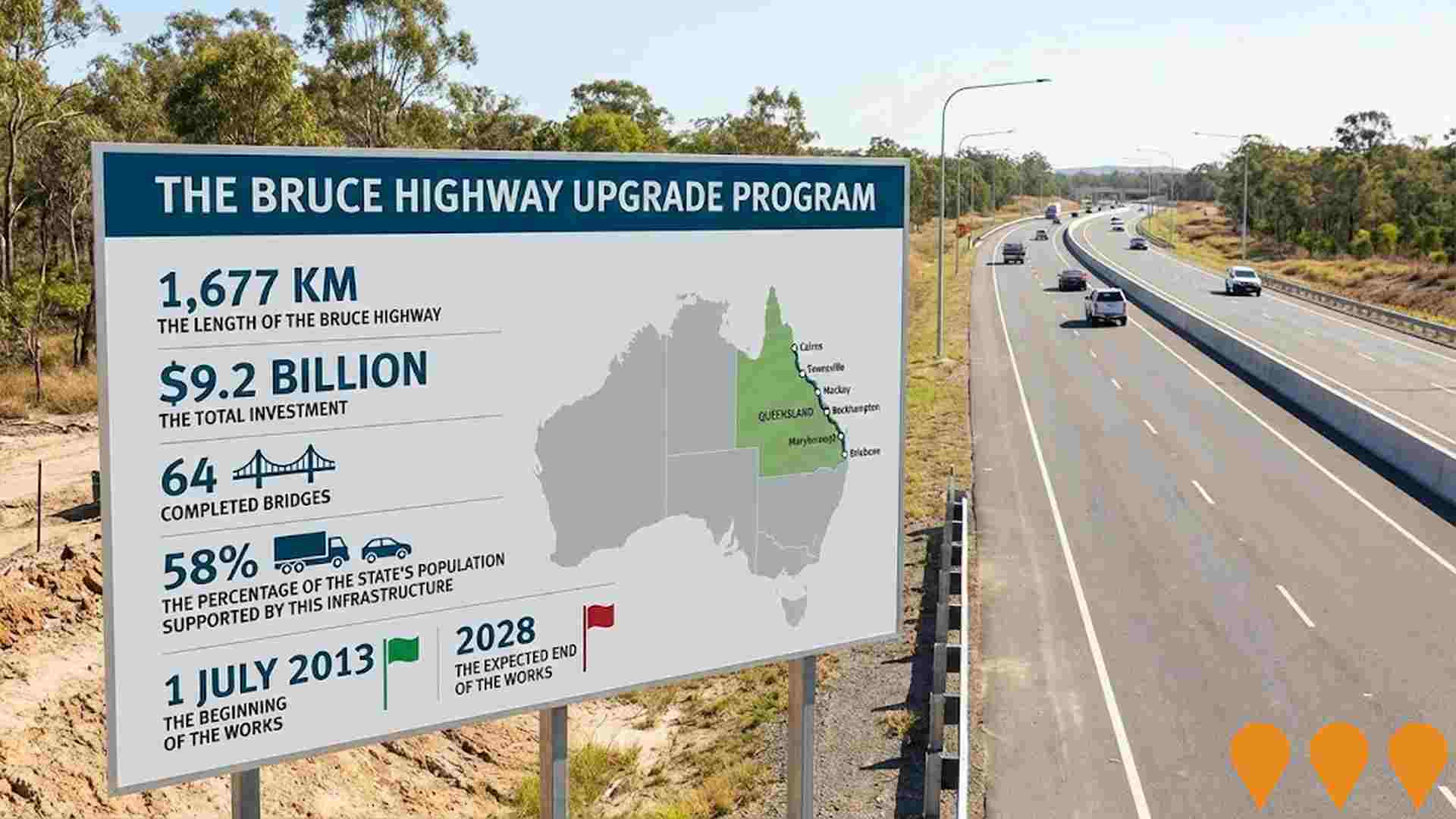

Bruce Highway Upgrade Program

The Bruce Highway Upgrade Program is Queensland's largest road infrastructure initiative, delivering safety, flood resilience, and capacity improvements along the 1,677km corridor from Brisbane to Cairns. The massive investment program includes the $9 billion Targeted Safety Program, major bypass projects (including Gympie, Rockhampton, and Tiaro), bridge replacements, and wide centre line treatments. Jointly funded by the Australian and Queensland governments, works are progressing across multiple sections simultaneously.

Gladstone Project

Powerlink Queensland's Gladstone Project (also known as the Gladstone grid reinforcement) is a multi-stage transmission network reinforcement to maintain reliability and security of electricity supply in the Gladstone region following the anticipated retirement of Gladstone Power Station. It supports industrial decarbonisation, electrification of major industries, and integration of renewables from the Central Queensland REZ. Key stages include new 275kV double-circuit lines (Calvale-Calliope River and Bouldercombe-Larcom Creek via new Gladstone West Substation), synchronous condensers, and reactive support equipment. Final Assessment Report submitted June 2025; government review ongoing with construction of Stage 1 expected mid-2026.

Stony Creek Wind Farm

Approved wind farm in North Burnett, QLD by Greenleaf Renewables and Enerfin. Up to 27 turbines (tip height up to 260m) and around 166-200 MW capacity. Federal EPBC and Queensland state approvals are in place for the wind farm. Transmission line route to connect to the Powerlink network has been finalised, with a development application to North Burnett Regional Council expected in the second half of 2025. Estimated construction start late 2026 with an 18-month build program.

Employment

Employment drivers in Gin Gin are experiencing difficulties, placing it among the bottom 20% of areas assessed across Australia

Gin Gin's workforce is balanced across white and blue-collar jobs with varied sector representation. The unemployment rate was 8.1% in the past year, with an estimated employment growth of 9.0%.

As of September 2025, 2,397 residents are employed, but the unemployment rate is higher than Rest of Qld's by 4.0%, indicating room for improvement. Workforce participation lags significantly at 41.9% compared to Rest of Qld's 59.1%. Key industries include agriculture, forestry & fishing, health care & social assistance, and education & training. Gin Gin specializes in agriculture, forestry & fishing with an employment share 5.4 times the regional level.

However, health care & social assistance is under-represented at 12.4% compared to Rest of Qld's 16.1%. Employment opportunities locally appear limited based on Census data analysis. Between September 2024 and September 2025, employment levels increased by 9.0%, labour force by 10.5%, leading to a 1.2 percentage point rise in unemployment. In contrast, Rest of Qld saw employment growth of 1.7% and unemployment rising by 0.3 percentage points. State-level data from 25-Nov-25 shows Queensland's employment contracted by 0.01%, with an unemployment rate of 4.2%. National employment forecasts from May-25 suggest a 6.6% increase over five years and 13.7% over ten years, but growth rates vary significantly between sectors. Applying these projections to Gin Gin's employment mix indicates local employment should rise by 5.1% over five years and 11.6% over ten years.

Frequently Asked Questions - Employment

Income

Income metrics place the area in the bottom 10% of locations nationally according to AreaSearch analysis

The Gin Gin SA2 had a median taxpayer income of $33,870 and an average income of $43,922 in the financial year 2022, according to postcode level ATO data aggregated by AreaSearch. This was lower than the national average, with Rest of Qld's median income being $50,780 and average income $64,844. By September 2025, based on Wage Price Index growth of 13.99%, estimated incomes would be approximately $38,608 (median) and $50,067 (average). Gin Gin's household, family, and personal incomes all fell within the 2nd to 2nd percentiles nationally in the census data. The income bracket of $400 - $799 covered 31.1% of the community (1,803 individuals), contrasting with metropolitan regions where the $1,500 - $2,999 bracket was highest at 31.7%. Economic circumstances showed widespread financial pressure, with 41.6% of households having weekly budgets below $800. Despite modest housing costs, with 88.1% of income retained, total disposable income ranked at just the 5th percentile nationally.

Frequently Asked Questions - Income

Housing

Gin Gin is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Gin Gin, as evaluated at the latest Census held in 2016, dwelling structures consisted of 96.1% houses and 3.9% other dwellings such as semi-detached homes, apartments, and 'other' dwellings. This is compared to Non-Metro Queensland's figures of 93.4% houses and 6.6% other dwellings. Home ownership in Gin Gin was recorded at 51.9%, with mortgaged dwellings accounting for 31.9% and rented dwellings making up the remaining 16.2%. The median monthly mortgage repayment in the area, as of 2016, was $1,000, which is below Non-Metro Queensland's average of $1,083. The median weekly rent figure for Gin Gin stood at $250, compared to Non-Metro Queensland's $230 and the national average of $375. Nationally, Gin Gin's mortgage repayments were significantly lower than the Australian average of $1,863, recorded in 2016.

Frequently Asked Questions - Housing

Household Composition

Gin Gin features high concentrations of group households, with a fairly typical median household size

Family households constitute 67.3% of all households, including 19.7% couples with children, 35.9% couples without children, and 10.7% single parent families. Non-family households account for the remaining 32.7%, with lone person households at 27.8% and group households comprising 5.0%. The median household size is 2.3 people, which aligns with the average in the Rest of Qld.

Frequently Asked Questions - Households

Local Schools & Education

Gin Gin faces educational challenges, with performance metrics placing it in the bottom quartile of areas assessed nationally

The area's university qualification rate is 9.3%, significantly lower than Australia's average of 30.4%. This presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 7.3%, followed by postgraduate qualifications (1.0%) and graduate diplomas (1.0%). Vocational credentials are prominent, with 42.9% of residents aged 15+ holding them, including advanced diplomas (8.8%) and certificates (34.1%).

Educational participation is high, with 26.8% of residents currently enrolled in formal education. This includes secondary education (10.4%), primary education (9.6%), and tertiary education (2.5%).

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Health performance in Gin Gin is a key challenge with a range of health conditions having marked impacts on both younger and older age cohorts

Gin Gin faces significant health challenges, with various conditions affecting both younger and older age groups. Private health cover stands at approximately 48%, covering around 2,772 people, which is lower than the national average of 55.3%.

The most prevalent medical conditions are arthritis (affecting 14.1% of residents) and mental health issues (9.7%). Conversely, 55.7% of residents report no medical ailments, compared to 59.4% in the rest of Queensland. Gin Gin has a higher proportion of seniors aged 65 and over, with 27.8%, or approximately 1,613 people, compared to the state average of 26.8%. Despite this, health outcomes among seniors are promising, performing well relative to the general population in health metrics.

Frequently Asked Questions - Health

Cultural Diversity

Gin Gin is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Gin Gin, surveyed in June 2016, had a population with 85.7% being citizens, 85.4% born in Australia, and 96.1% speaking English only at home. Christianity was the predominant religion, accounting for 54.1%, compared to 56.4% regionally. The top three ancestry groups were English (32.7%), Australian (30.6%), and Irish (7.6%).

Notably, German ancestry was overrepresented at 7.0% (regional: 7.8%), Hungarian at 0.5% (regional: 0.2%), and Australian Aboriginal at 3.1% (regional: 6.0%).

Frequently Asked Questions - Diversity

Age

Gin Gin ranks among the oldest 10% of areas nationwide

Gin Gin has a median age of 52, which is higher than Rest of Qld's figure of 41 and well above the national average of 38. The age group of 55-64 shows strong representation in Gin Gin at 19.3%, compared to Rest of Qld, while the 25-34 cohort is less prevalent at 7.7%. This 55-64 concentration is well above the national figure of 11.2%. According to the 2021 Census, the 75 to 84 age group has grown from 8.1% to 9.2%, while the 65 to 74 cohort has declined from 17.5% to 16.3% and the 45 to 54 group has dropped from 13.8% to 12.6%. Demographic modeling suggests that Gin Gin's age profile will evolve significantly by 2041. The 85+ age cohort is projected to more than double, expanding by 153 people (115%) from 133 to 287. Notably, the combined 65+ age groups are expected to account for 68% of total population growth, reflecting the area's aging demographic profile. Conversely, population declines are projected for the 5 to 14 and 15 to 24 cohorts.