Chart Color Schemes

This analysis uses ABS Statistical Areas Level 2 (SA2) boundaries, which can materially differ from Suburbs and Localities (SAL) even when sharing similar names.

SA2 boundaries are defined by the Australian Bureau of Statistics and are designed to represent communities for statistical reporting (e.g., census and ERP).

Suburbs and Localities (SAL) represent commonly-used suburb/locality names (postal-style areas) and may use different geographic boundaries. For comprehensive analysis, consider reviewing both boundary types if available.

est. as @ -- *

ABS ERP | -- people | --

2021 Census | -- people

Sales Activity

Curious about local property values? Filter the chart to assess the volume and appreciation (including resales) trends and regional comparisons, or scroll to the map below view this information at an individual property level.

Find a Recent Sale

Sales Detail

Population

Central Highlands - West has shown very soft population growth performance across periods assessed by AreaSearch

Central Highlands - West's population, as of November 2025, is approximately 7,788 people. This figure represents an increase of 172 individuals since the 2021 Census, which recorded a population of 7,616 people. The change is inferred from ABS estimated resident population data of 7,668 as of June 2024 and validated new addresses totalling 201 since the Census date. This results in a density ratio of 0.20 persons per square kilometer. Natural growth contributed approximately 60.3% of overall population gains during recent periods.

AreaSearch uses ABS/Geoscience Australia projections for each SA2 area, released in 2024 with 2022 as the base year. For areas not covered and years post-2032, Queensland State Government's SA2 area projections are adopted, released in 2023 based on 2021 data. Projections indicate a decline of 505 persons by 2041, with specific age cohorts expected to grow, notably the 25 to 34 age group projected to increase by 254 people.

Frequently Asked Questions - Population

Development

The level of residential development activity in Central Highlands - West is very low in comparison to the average area assessed nationally by AreaSearch

Central Highlands - West has had approximately 10 new home approvals annually over the past five financial years, totalling around 50 homes. As of FY26, 4 approvals have been recorded so far. The area's population decline has led to adequate development activity relative to its size, benefiting buyers with an average construction cost of $351,000 per new property. This financial year has seen $6.7 million in commercial approvals, indicating limited focus on commercial development.

Compared to the rest of Queensland, Central Highlands - West maintains similar construction rates per person, preserving market equilibrium. However, recent periods have shown a moderation in development activity, which is also below average nationally. This reflects the area's maturity and possible planning constraints. All recent development has been standalone homes, maintaining the area's traditional low density character with a focus on family homes.

The estimated population per dwelling approval is 1245 people, indicating a quiet, low activity development environment. With stable or declining population forecasts, Central Highlands - West may experience less housing pressure, creating favourable conditions for buyers.

Frequently Asked Questions - Development

Infrastructure

Central Highlands - West has moderate levels of nearby infrastructure activity, ranking in the 43rdth percentile nationally

Changes in local infrastructure significantly impact an area's performance. AreaSearch has identified 27 projects that could affect the region. Notable initiatives include Codenwarra Road Mixed-Use Development Site, Emerald Regional Botanic Gardens Upgrade, Gregory-Capricorn Highway Intersection Upgrade, and 91 Gray Street Apartment Development. The following list details those expected to be most relevant.

Professional plan users can use the search below to filter and access additional projects.

INFRASTRUCTURE SEARCH

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Denotes AI-based impression for illustrative purposes only, not to be taken as definitive under any circumstances. Please follow links and conduct other investigations from the project's source for actual imagery. Developers and project owners wishing us to use original imagery please Contact Us and we will do so.

Frequently Asked Questions - Infrastructure

Valeria Coal Project

A proposed $1.5 billion open-cut thermal and metallurgical coal mine that was withdrawn by Glencore in December 2022. The project, located 27km north-west of Emerald, was expected to produce up to 20 million tonnes of coal annually over 35 years. The cancellation of the 'Coordinated Project' status was attributed to increased global uncertainty and changes to Queensland's coal royalty taxes.

Fairhill and Wilton Coal Projects

Two adjacent coking coal projects owned by Futura Resources Ltd, operational since March 2024. Located 50km northeast of Emerald in the Bowen Basin, the projects comprise large near-surface coking coal deposits with a global resource of 2.6 billion tonnes. Wilton pit became fully operational in April 2024 with a medium-term target of 1 million tonnes per annum. Fairhill pit came online in Q4 2024 and achieved first coal production in April 2025. Combined ROM production across both sites is expected to reach 2.1Mt in 2025, growing to 4Mtpa by 2030. Coal is processed at the nearby Gregory-Crinum CHPP. The projects have an expected 20+ year mine life and are supported by existing infrastructure.

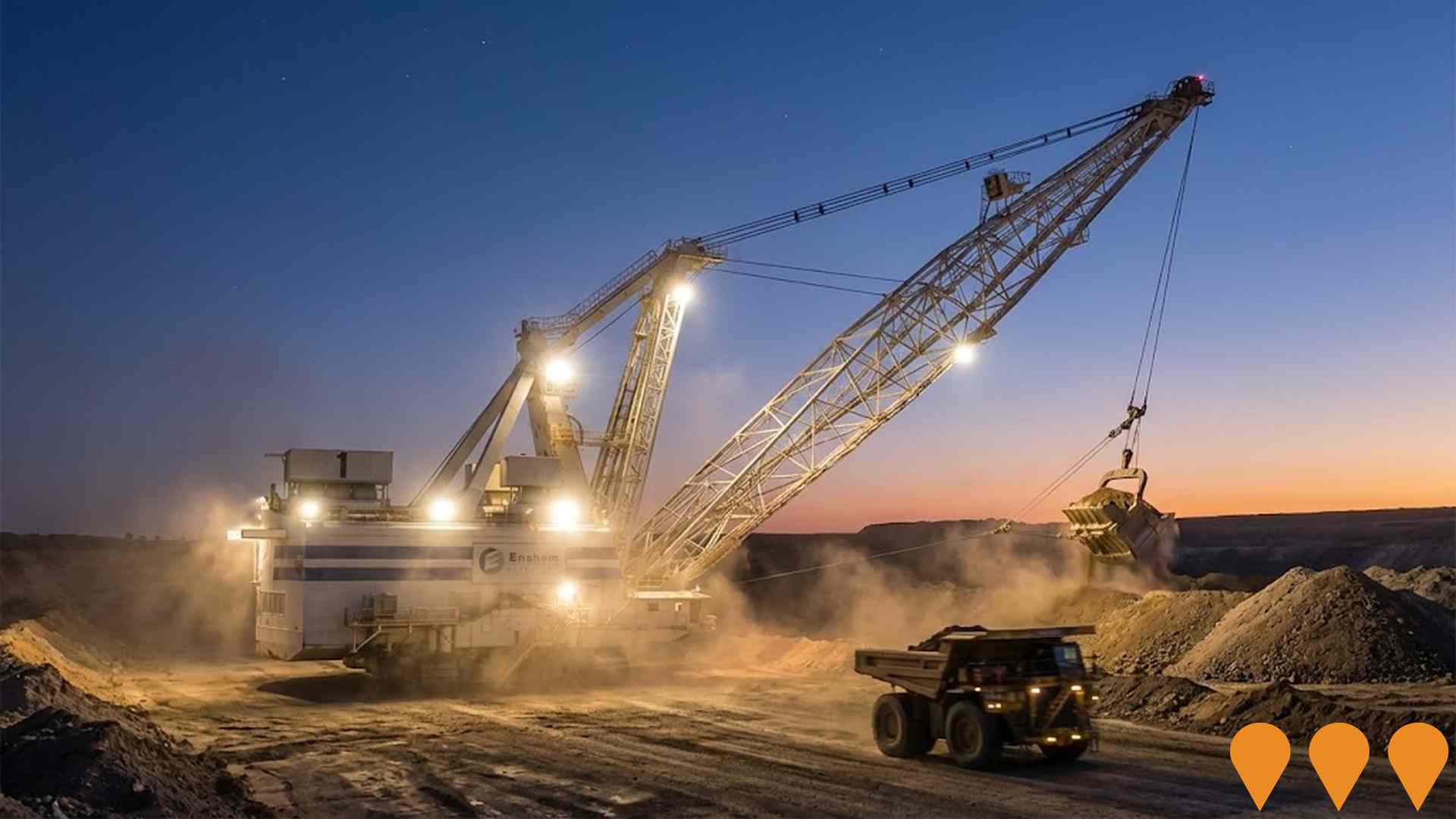

Ensham Coal Mine Extension

Extension of the Ensham Mine underground operations to approximately 2037, targeting the Aries and Castor coal seams. The project aims to maintain production of up to 4.5 million tonnes per annum using existing surface infrastructure. While the project received federal approval in 2023, the Queensland Land Court recommended against granting the mining lease extension in February 2025 due to climate change concerns. The final decision rests with the Queensland Resources Minister.

Blackwater South Coking Coal Project

Proposed greenfield open-cut metallurgical coal mine in the Bowen Basin producing up to 8 million tonnes of product coal per annum over approximately 90 years. The mine will predominantly produce metallurgical coal for steel-making, with potential secondary production of export thermal coal. The project includes mine infrastructure, coal handling and preparation plant, rail loop and train loadout facility, electricity transmission line, raw water pipeline, and temporary construction accommodation village. The project is currently in the Environmental Impact Statement (EIS) preparation phase, having been declared a 'controlled action' under the EPBC Act due to potential impacts on nationally significant environmental matters. The draft EIS is being prepared by the proponent, with the Coordinator-General extending the project declaration lapse date to September 2, 2026.

Codenwarra Road Mixed-Use Development Site

11.45 hectare prime development site positioned opposite Central Highlands Market Place. Lots 3-4 designated as Major Activity Centre under planning scheme. Lots 4-5 identified as Expansion Zone with potential for buildings up to seven storeys. Ideal for retail spaces, supermarkets, bulky goods outlets, dining, leisure facilities, and quality residential living with mixed-use developments.

Emerald Regional Botanic Gardens Upgrade

Major transformation of the 42-hectare Emerald Regional Botanic Gardens including Stage 2 pathway upgrades, wider and more accessible footpaths, improved culverts, and enhanced pathways. The project aims to create a safer, more inclusive space for all users including wheelchair access, pram-friendly paths, and enhanced visitor experiences. Features concrete path upgrades, improved accessibility, and enhanced connectivity throughout the gardens.

Blackwater Solar Farm

A 270-megawatt renewable energy facility with a 200-megawatt, 800-megawatt-hour battery energy storage system.

Bringing Blackwater Back into the Planning Scheme

Project to revoke two Priority Development Areas (Blackwater PDA declared 2010 and Blackwater East PDA declared 2013) and integrate them into the Central Highlands Regional Council Planning Scheme. This will enable consistent development assessment across the region and provide greater community influence over future zoning and land uses. Council is working with Economic Development Queensland to progress the revocation, with public notification expected late 2025 following ministerial approval.

Employment

AreaSearch analysis indicates Central Highlands - West maintains employment conditions that align with national benchmarks

Central Highlands - West has a balanced workforce with both white and blue collar jobs, prominent manufacturing and industrial sectors, and an unemployment rate of 3.5%. Over the past year, employment has remained relatively stable.

As of September 2025, 4,358 residents are employed, with an unemployment rate of 3.1%, which is 0.6% lower than Rest of Qld's rate of 4.1%. Workforce participation in Central Highlands - West is similar to Rest of Qld at 59.1%. The leading employment industries among residents include agriculture, forestry & fishing, mining, and construction. There is a strong specialization in agriculture, forestry & fishing, with an employment share 6.8 times the regional level.

Conversely, health care & social assistance is under-represented, with only 5.5% of Central Highlands - West's workforce compared to 16.1% in Rest of Qld. The ratio of 0.8 workers per resident indicates a higher than average level of local employment opportunities. Between September 2024 and September 2025, employment increased by 0.2%, while the labour force grew by 0.8%, leading to an unemployment rate rise of 0.6 percentage points. In comparison, Rest of Qld saw employment rise by 1.7% and unemployment increase by 0.3 percentage points over the same period. As of 25-Nov-25, Queensland's employment contracted by 0.01%, with a state unemployment rate of 4.2%. National employment forecasts from May-25 suggest growth of 6.6% over five years and 13.7% over ten years. Applying these projections to Central Highlands - West's employment mix indicates potential local employment increases of 4.2% over five years and 10.1% over ten years, though this is a simple extrapolation for illustrative purposes and does not account for localized population projections.

Frequently Asked Questions - Employment

Income

Income analysis reveals strong economic positioning, with the area outperforming 60% of locations assessed nationally by AreaSearch

The Central Highlands - West SA2's median income among taxpayers was $57,967 and average income stood at $70,572 in the financial year 2022, according to ATO data aggregated by AreaSearch. This compares with figures for Rest of Qld's which were $50,780 and $64,844 respectively. Based on Wage Price Index growth of 13.99% since financial year 2022, current estimates would be approximately $66,077 (median) and $80,445 (average) as of September 2025. Census 2021 income data shows personal income ranks at the 64th percentile ($882 weekly), while household income sits at the 42nd percentile. Income analysis reveals 27.5% of the population, equating to 2,141 individuals, fall within the $1,500 - 2,999 income range. This pattern is similar to the broader area where 31.7% occupy this range. After housing costs, residents retain 93.3% of their income, reflecting strong purchasing power and the area's SEIFA income ranking places it in the 4th decile.

Frequently Asked Questions - Income

Housing

Central Highlands - West is characterized by a predominantly suburban housing profile, with above-average rates of outright home ownership

In Central Highlands - West, evaluated at the latest Census, 93.4% of dwellings were houses, with the remaining 6.6% being semi-detached, apartments, or other types. This compares to Non-Metro Qld's 86.6% houses and 13.4% other dwellings. Home ownership in Central Highlands - West was 45.5%, with mortgaged dwellings at 24.2% and rented ones at 30.3%. The median monthly mortgage repayment was $1,300, below Non-Metro Qld's average of $1,500. Weekly rent in the area was $120, compared to Non-Metro Qld's $250. Nationally, Central Highlands - West's mortgage repayments were significantly lower than the Australian average of $1,863, and rents were substantially below the national figure of $375.

Frequently Asked Questions - Housing

Household Composition

Central Highlands - West has a typical household mix, with a lower-than-average median household size

Family households constitute 68.5% of all households, including 30.0% couples with children, 31.3% couples without children, and 6.6% single parent families. Non-family households comprise the remaining 31.5%, with lone person households at 29.2% and group households making up 2.3% of the total. The median household size is 2.5 people, smaller than the Rest of Qld average of 2.6.

Frequently Asked Questions - Households

Local Schools & Education

Educational outcomes in Central Highlands - West fall within the lower quartile nationally, indicating opportunities for improvement in qualification attainment

The area's university qualification rate is 13.0%, significantly lower than Australia's average of 30.4%. This disparity presents both a challenge and an opportunity for targeted educational initiatives. Bachelor degrees are the most common at 10.4%, followed by graduate diplomas (1.5%) and postgraduate qualifications (1.1%). Vocational credentials are prevalent, with 43.4% of residents aged 15+ holding them, including advanced diplomas (9.1%) and certificates (34.3%).

Educational participation is high, with 32.5% of residents currently enrolled in formal education, comprising 15.5% in primary, 9.4% in secondary, and 2.2% pursuing tertiary education.

Frequently Asked Questions - Education

Schools Detail

Nearby Services & Amenities

Transport

No public transport data available for this catchment area.

Frequently Asked Questions - Transport

Transport Stops Detail

Health

Central Highlands - West's residents are healthier than average in comparison to broader Australia with prevalence of common health conditions quite low across both younger and older age cohorts

Health data shows Central Highlands - West residents have relatively positive health outcomes. Prevalence of common conditions is low across both younger and older age groups.

Approximately 55% (~4283 people) have private health cover, compared to 58.4% in Rest of Qld. The most common medical conditions are arthritis (7.6%) and asthma (7.1%). 72.1% report no medical ailments, compared to 74.5% in Rest of Qld. 18.0% (~1400 people) are aged 65 and over, higher than the 10.7% in Rest of Qld. Health outcomes among seniors are strong, performing better than the general population.

Frequently Asked Questions - Health

Cultural Diversity

Central Highlands - West is considerably less culturally diverse than average when assessed alongside AreaSearch's national rankings for language and cultural background related metrics

Central Highlands-West had a cultural diversity below average, with 81.7% citizens, 90.1% born in Australia, and 96.3% speaking English only at home. Christianity was the main religion, at 63.7%, compared to 56.8% regionally. Ancestry showed Australian at 34.9%, English at 31.1%, and Irish at 8.8%.

Notably, German ancestry was overrepresented at 5.4% (vs regional 4.7%), Maltese at 0.5% (vs 0.3%), and Australian Aboriginal at 3.0% (vs regional 6.6%).

Frequently Asked Questions - Diversity

Age

Central Highlands - West's population is slightly older than the national pattern

The median age in Central Highlands - West is 39 years, which is lower than the Rest of Qld's average of 41 but close to the national average of 38 years. The age profile shows that those aged 25-34 are prominent at 14.2%, while the 45-54 group is smaller at 10.2% compared to Rest of Qld. Between 2021 and present, the 25-34 age group grew from 12.1% to 14.2%, and the 35-44 cohort increased from 12.7% to 13.8%. Conversely, the 45-54 cohort declined from 12.9% to 10.2%, and the 55-64 group dropped from 15.4% to 13.7%. Looking ahead to 2041, demographic projections show significant shifts in Central Highlands - West's age structure. The 25-34 age cohort is projected to increase by 170 people (16%) from 1,102 to 1,273. Conversely, both the 65-74 and 35-44 age groups are expected to decrease in numbers.